From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Reacts to Nvidia Chip Ban, Plant Activity Dips

China’s steel market is facing headwinds as Nvidia’s struggles in the region coincide with a noticeable dip in steel plant activity. The situation is further complicated by reports of a ban on top tech firms from purchasing Nvidia AI chips, as reported in “China Bans Top Tech Firms From Buying Nvidia Chips, Report Says.” This development coincides with a significant drop in overall Chinese steel plant activity, though a direct causal relationship cannot be definitively established based solely on the available data.

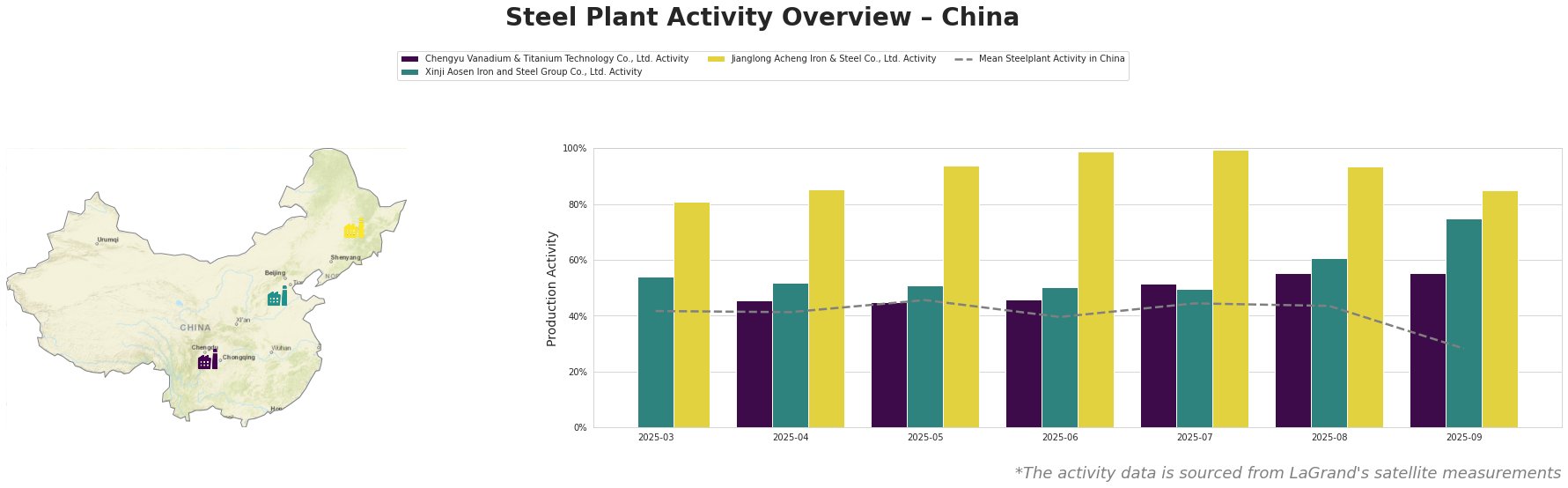

The average steel plant activity in China saw a significant decrease in September, dropping to 28% from a stable 44% in the preceding months. This overall downturn is likely influenced by a multitude of factors beyond the Nvidia situation, but the timing is noteworthy. It is important to note that “China schlägt zu: Schock‑Vorwurf gegen Nvidia” may play a role, but its effect would be indirect and very difficult to quantify.

Chengyu Vanadium & Titanium Technology Co., Ltd., a Sichuan-based integrated steel plant with a crude steel capacity of 6000 ttpa, showed relatively stable activity between April and September. Its activity in September remained at 55%, above the national average, and seemingly unaffected by the Nvidia-related news. No direct connection can be established between the plant’s activity and the cited news articles.

Xinji Aosen Iron and Steel Group Co., Ltd., a Hebei-based integrated plant with a crude steel capacity of 3600 ttpa, experienced an increase in activity, reaching 75% in September. This increase contrasts the overall market downturn, suggesting regional or plant-specific factors are at play. Its activity is considerably above the national mean. The increase in activity shows no direct link to the issues with Nvidia.

Jianglong Acheng Iron & Steel Co., Ltd., a Heilongjiang-based integrated steel plant with a smaller crude steel capacity of 1100 ttpa, showed high activity levels throughout the observed period. It peaked at 100% in July and remained relatively high at 85% in September, despite a moderate decline from August. Like Chengyu and Xinji Aosen, no direct correlation between its activity and the Nvidia situation can be established based on the available information.

The reported ban on Nvidia chips and the lukewarm reception of the RTX6000D chip (“Exclusive-Nvidia’s new RTX6000D chip for China finds little favour with major firms, sources say“) highlight potential weakening demand from key sectors that rely on advanced computing. While the satellite data doesn’t directly reflect an immediate impact on steel production, the potential for a broader economic slowdown stemming from these tech sector challenges poses a risk to future steel demand, particularly for high-end applications such as automotive and energy, which are sectors served by Jianglong Acheng Iron & Steel Co., Ltd.. The reliance on Nvidia chips of the before mentioned sector makes them especially vulnerable in the current market situation.

Evaluated Market Implications:

Given the general downward trend in activity, and the specific pressures on the tech industry, it is advisable for steel buyers to negotiate favorable pricing terms where possible. While no specific supply disruption can be attributed directly to the Nvidia situation, steel buyers should monitor closely the potential impact on end-user demand, particularly from sectors exposed to the tech industry downturn. Buyers sourcing coated steel products from Jianglong Acheng Iron & Steel Co., Ltd. should monitor this plant’s activity closely as its exposure to the automotive and energy sectors makes it especially vulnerable in the current market situation.