From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Political Uncertainty & Plant Activity Downturn Signal Weak Demand

In Europe, the steel market faces growing headwinds. Political uncertainties reflected in news articles like „Maischberger“: „Seine Bilanz waren drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor and Liveticker Bundespolitik: Spahn wirft AfD „Verrat am Vaterland“ vor | FAZ, are coinciding with fluctuations in observed steel plant activity, signaling potential disruptions. While the news articles point to internal political challenges in Germany, no direct relationship to the observed fluctuations in plant activity can be explicitly established.

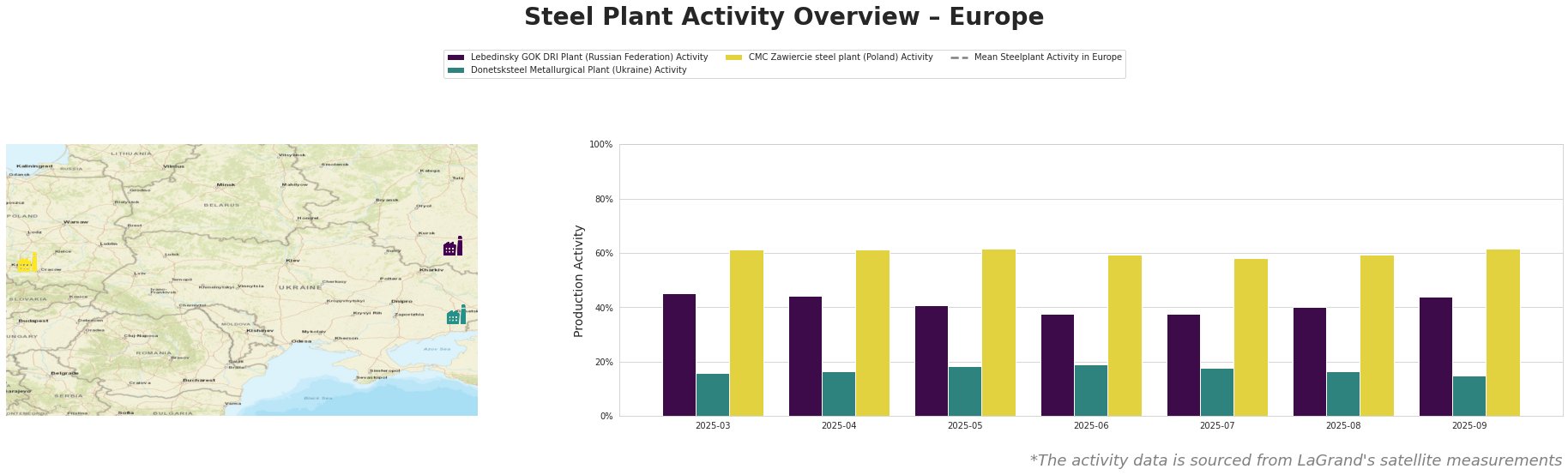

Overall, the mean steel plant activity in Europe shows significant volatility. From March to September, the mean oscillated from highs near 3.6 billion to a low of about 2.4 billion in September.

The Lebedinsky GOK DRI Plant, a Russian producer with a DRI capacity of 4.5 MTPA, experienced fluctuations in activity, dropping from 45% in March to 38% in June and July, before rising again to 44% in September. This volatility, in the absence of any news link, does not suggest any immediate disruptions, but warrants close monitoring.

Donetsksteel Metallurgical Plant, a Ukrainian producer focused on pig iron with a BF capacity of 1.5 MTPA, shows a gradual, but volatile decline in plant activity. Activity decreased from 16% in March to 15% in September, with a high of 19% in June. Given the ongoing geopolitical situation, no direct link to the above named news articles can be established, these activity levels suggest continued operational challenges.

The CMC Zawiercie steel plant in Poland, an EAF-based producer with a crude steel capacity of 1.7 MTPA serving diverse sectors, has demonstrated relatively stable activity, fluctuating between 58% and 62%. The lowest plant activity was recorded in July, with 58%, and the highest in May and September, with 62%. No explicit link to named news articles can be established.

The current market sentiment is negative. Given the volatility in overall European steel plant activity, alongside broader political and economic uncertainties, steel buyers should prioritize the following:

- Diversify Sourcing: Mitigate potential disruptions from specific regions or plants (e.g. Russian Federation, Ukraine). While Lebedinsky GOK DRI Plant is experiencing fluctuating activity, explore alternative DRI sources.

- Short-Term Contracts: Given the high volatility, favor shorter-term contracts with built-in price adjustment mechanisms to navigate rapid market changes.

- Monitor Polish Market: Considering the relative stability of the CMC Zawiercie steel plant, closely monitor Polish steel prices and availability as a potential reliable supply source within the EU.