From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Cuts & Rising Inventories Impact Regional Supply

Asia’s steel market shows signs of stabilization amidst production cuts in China and rising inventories. “China cut steel production to a 9-month low in August” due to production limits and weak construction demand, correlating with observed dips in regional steel plant activity. “Stocks of main finished steel products in China up 4.2 percent in early Sept 2025” indicates a potential supply glut despite the production slowdown, while no direct connections to the ArcelorMittal article can be established, implying that US tariff issues do not propagate directly into Asian Markets.

China’s crude steel output declined for the third consecutive month, as highlighted in the articles “China cut steel production to a 9-month low in August” and “China’s crude steel output below 80 million mt again in August, down 2.8% in Jan-Aug 2025”. While domestic output decreases, inventory levels increased.

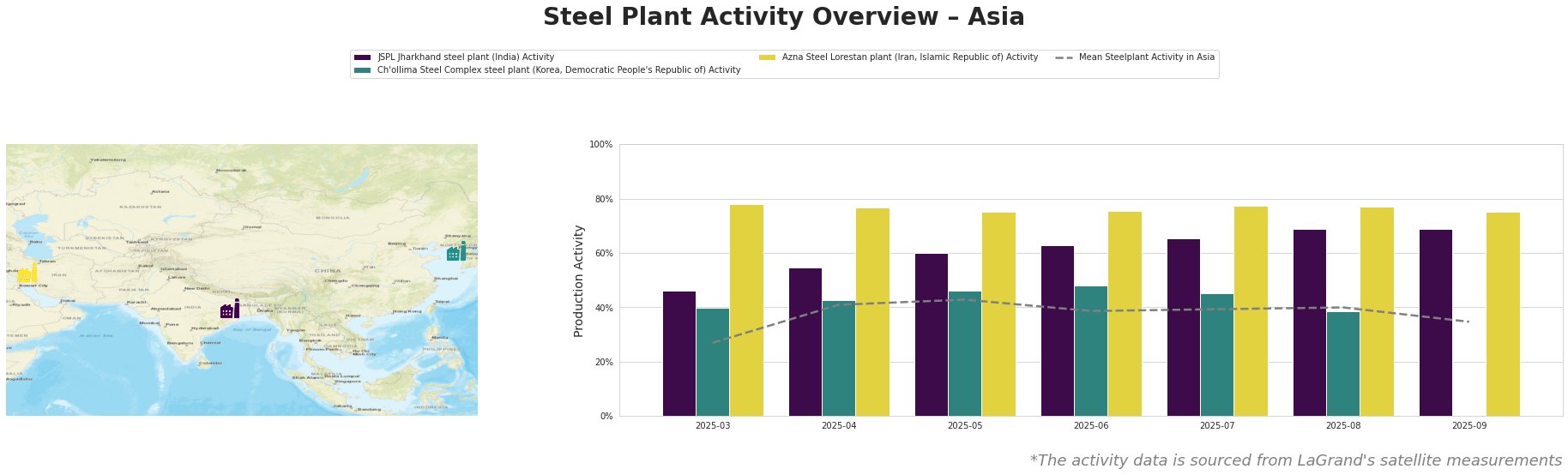

The mean steel plant activity in Asia reached a peak in May at 43% and has declined to 35% in September. JSPL Jharkhand consistently operated above the Asian average, peaking at 69% in August and September. Azna Steel Lorestan also showed consistently high activity levels, fluctuating between 75% and 78%. Ch’ollima Steel Complex activity fluctuated and the plant has no data for September.

JSPL Jharkhand is an Indian steel plant with a 1.6 million tonnes per annum (ttpa) crude steel capacity focused on semi-finished products like wire rod and bars, utilizing electric arc furnaces (EAF). Its activity has steadily risen from 46% in March to 69% in August and remained stable through September, consistently outperforming the regional average. No direct link to the provided news articles could be established.

The Ch’ollima Steel Complex in North Korea, with a 760 ttpa capacity, produces semi-finished and finished rolled products like plates and wire rod. Its activity fluctuated between 40% and 48% from March to June, dropping to 39% in August, with no data available for September. No direct connection to the provided news articles could be established.

Azna Steel Lorestan, located in Iran, has a 1.2 million ttpa crude steel capacity, relying on EAF technology to produce semi-finished products such as sheets and slabs. Its activity remained consistently high, fluctuating narrowly between 75% and 78% from March to August, settling at 75% in September. No direct connection to the provided news articles could be established.

The decrease in Chinese steel production, as highlighted in “China cut steel production to a 9-month low in August“, is somewhat offset by the rise in inventories reported in “Stocks of main finished steel products in China up 4.2 percent in early Sept 2025“, potentially creating downward pressure on steel prices in the short term, despite reduced output. For steel buyers this means:

- Monitor Chinese Inventory Levels: Closely track inventory data released by CISA for continued increases, which could signal opportunities to negotiate more favorable pricing.

- Diversify Sourcing: Given the production cuts in China, explore alternative suppliers outside of China to mitigate potential supply disruptions. Plants in India and Iran are operating at significantly higher levels. However, logistical challenges from these alternative markets should be priced in.

- Short Term Buying Strategy: Given the inventory increases, procurement professionals should focus on short-term contracts or spot market purchases to capitalize on potential price dips. Longer-term commitments should be approached cautiously until the impact of production cuts becomes clearer.