From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Output Dips, Taiwan Exports Fall: Asia Market Overview September 2025

Steel market activity in Asia presents a neutral outlook, marked by production cuts in China and export declines in Taiwan. China’s reduced steel production may impact regional supply dynamics, while Taiwanese export figures suggest softening demand. “China cut steel production to a 9-month low in August” and “China’s crude steel output below 80 million mt again in August, down 2.8% in Jan-Aug 2025” directly explain observed drops in production at some steel plants. Taiwan’s iron and steel export value down 8.4 percent in January-August 2025” does not have a direct relationship to the plant activity levels.

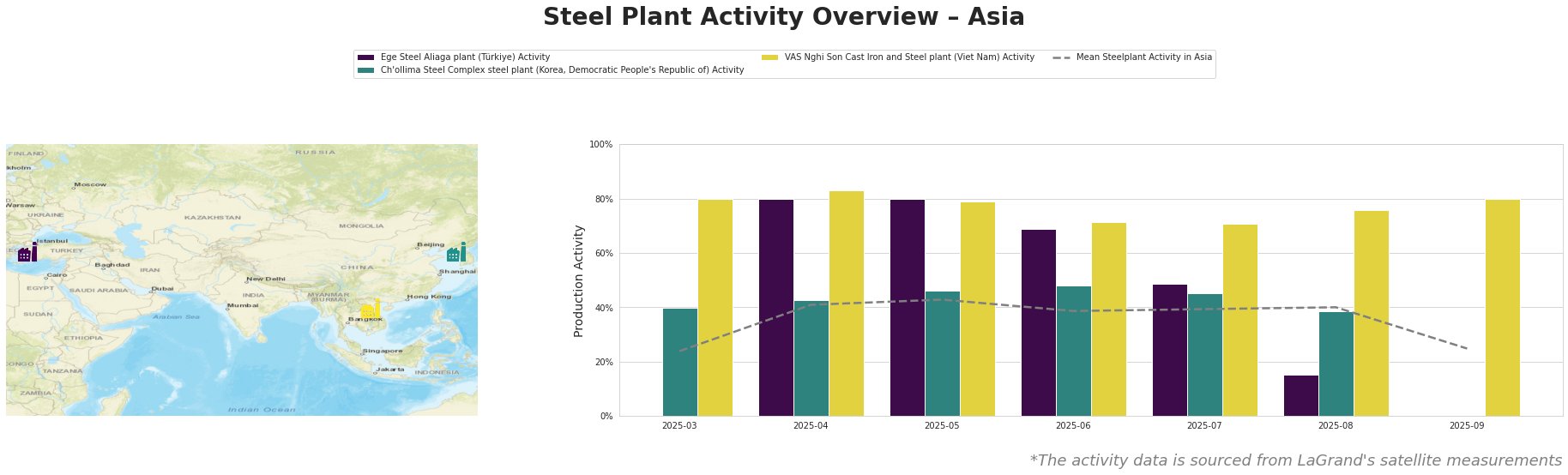

The mean steel plant activity in Asia saw a peak in May at 43%, then declined to 25% in September.

Ege Steel Aliaga plant, located in İzmir, Türkiye, has a crude steel capacity of 2000 ttpa, utilizing EAF technology to produce rebar and wire rod. The plant’s activity experienced a significant drop to 15% in August from 49% in July and a peak of 80% in April and May. There is no direct link to the provided news articles can be established.

Ch’ollima Steel Complex steel plant, situated in South Pyongan, Democratic People’s Republic of Korea, has a crude steel capacity of 760 ttpa and produces plates and wire rod. The plant’s activity has shown fluctuations, peaking at 48% in June and falling to 39% in August. The plant activity data does not correlate with any of the news articles about China or Taiwan.

VAS Nghi Son Cast Iron and Steel plant, located in Thanh Hoa, Viet Nam, has a crude steel capacity of 3150 ttpa and uses EAF technology to produce billet, rebar, and wire rod. This plant demonstrated a relatively stable activity level, ranging from 71% to 83% between March and September, with a slight increase to 80% in September. There is no direct link to the provided news articles can be established.

Evaluated Market Implications

The news article “China cut steel production to a 9-month low in August,” coupled with the satellite data showing a decline in mean steel plant activity across Asia, including a significant drop at the Ege Steel Aliaga plant (although no link between the news and the plant can be established), suggests potential supply constraints in the region. The “Stocks of main finished steel products in China up 4.2 percent in early Sept 2025” combined with declining production rates suggests domestic demand is weakening, and prices may decline further, in the short-term. The rise of Chinese rebar output in the article “China’s rebar output up 0.3 percent in January-August 2025” combined with a simultaneous price decrease suggests that rebar market participants will be under increased pressure.

Procurement Actions:

- Steel Buyers: Given the Chinese production cuts, consider diversifying rebar and wire rod sourcing options to mitigate potential supply disruptions or price increases in the short term if demand recovers. Closely monitor inventory levels from domestic suppliers and ensure appropriate safety stocks.

- Market Analysts: Closely monitor Chinese domestic steel prices and inventory levels. Analyze if declining prices will spur an increase in export volumes of sheet and plate from China, following the “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” report.