From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Ferroalloy Export Surge Offsets Semi-Finished Downturn Amidst Turkish Competition

Ukraine’s steel sector presents a mixed landscape. While ferroalloy exports have increased substantially, as highlighted in “Ukraine’s ferroalloy industry exported 73.8 thousand tons of products in January-August,” semi-finished product exports have declined, with a corresponding increase in imports detailed in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons.” This import surge, particularly from Turkey, is placing pressure on domestic producers, coinciding with observed activity fluctuations at key steel plants.

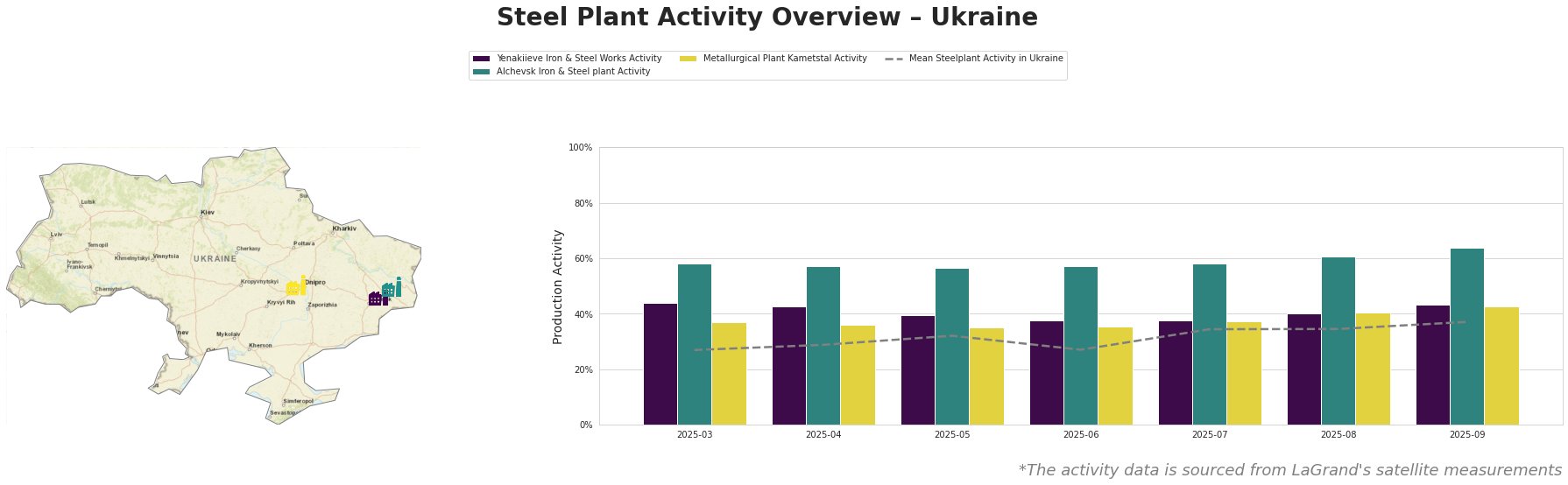

Measured Activity Overview

The mean steel plant activity in Ukraine shows a general upward trend from March (27.0%) to September (37.0%). Alchevsk Iron & Steel plant consistently operates above the mean, peaking at 64.0% in September. Yenakiieve Iron & Steel Works activity has fluctuated, reaching 44.0% in March before dropping to 38.0% in June and July, and subsequently recovering to 43.0% in September. Metallurgical Plant Kametstal shows more stable activity, with a low of 35.0% in May and a high of 43.0% in September. No direct connection can be established between these fluctuations and specific events mentioned in the news articles.

Yenakiieve Iron & Steel Works, located in Donetsk and with a crude steel capacity of 3.3 million tonnes per annum (ttpa) via BOF, produces semi-finished and finished rolled products. The plant’s activity dropped to 38.0% in June and July. No direct correlation between the fluctuations in activity levels and the news articles could be established.

Alchevsk Iron & Steel plant, situated in Luhansk, boasts a larger crude steel capacity of 5.472 million ttpa, also utilizing BOF technology. The plant’s activity consistently remained above the national average, reaching 64.0% in September, signaling robust production despite overall market shifts. No direct link to news articles.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, has a crude steel capacity of 4.2 million ttpa via BOF. Kametstal displays relatively stable operations compared to other plants. Its output is primarily semi-finished and finished rolled products targeting the energy and transport sectors. No direct link to news articles.

Evaluated Market Implications

The article “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August” highlights a significant increase in Turkish steel imports. This, coupled with the increase in semi-finished imports reported in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons.“, suggests heightened competition for domestic producers like Yenakiieve Iron & Steel Works and Metallurgical Plant Kametstal, potentially impacting their production levels if they cannot compete on price or product mix. While Alchevsk Iron & Steel plant demonstrates strong performance, the overall increase in imports poses a risk to the broader Ukrainian steel industry.

Recommended Procurement Actions:

- Steel Buyers: Diversify your supply base to include Turkish steel, leveraging potentially lower prices. Negotiate contracts with Ukrainian suppliers, emphasizing quality and delivery reliability to mitigate the import pressure.

- Market Analysts: Closely monitor import volumes from Turkey and other nations. Analyze the product mix of imported steel to identify direct competition with domestic production. Assess the potential for state intervention, as suggested by Ukrmetprom, to influence import dynamics. Further analysis of ferroalloy export destinations is recommended to secure competitive offtake conditions.