From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Shows Resilience Despite Mexican Industrial Slowdown, US Plants Maintain High Activity

North America’s steel market demonstrates resilience, evidenced by strong US plant activity amid Mexico’s industrial struggles. According to “Mexico’s industrial output extends declines in July,” Mexico’s industrial production decreased, impacting the steel-consuming manufacturing sector. However, satellite data indicates that this decline has not yet translated into a significant drop in activity at the Ternium Guerrero plant, although a drop in activity is observed for September.

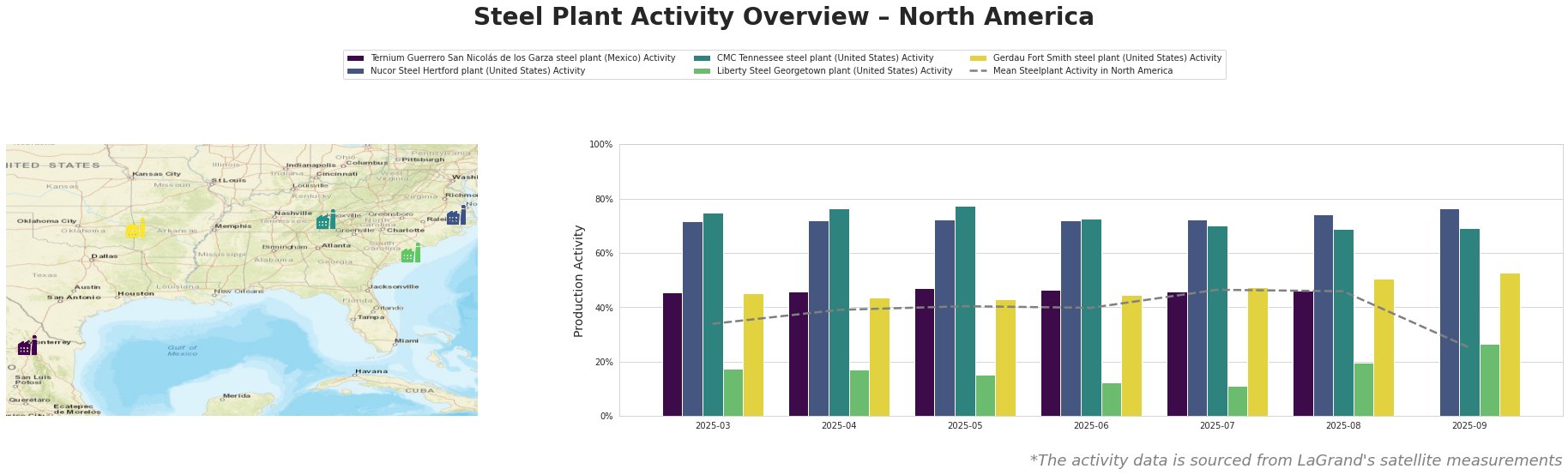

Observed steel plant activity levels across North America are detailed below:

The mean steel plant activity in North America shows a significant drop in September to 25.0%. This is primarily driven by missing data from the Ternium Guerrero plant. Until August, the average activity has been steadily increasing, suggesting robust demand.

Ternium Guerrero San Nicolás de los Garza steel plant: This plant, located in Nuevo León, Mexico, has a crude steel capacity of 2400 ttpa, utilizing DRI and EAF technologies. Its product portfolio includes semi-finished and finished rolled products for the building, infrastructure, tools, and machinery sectors. The plant maintained a relatively stable activity level between 45% and 47% from March to August. September data is missing. Given the report “Mexico’s industrial output extends declines in July,” procurement professionals should monitor Ternium Guerrero’s output closely for potential future disruptions due to reduced domestic demand. The new import tariffs announced in “Mexico slaps import tariffs on 1,371 products starting in 2026” could positively influence activity at Ternium, but the effect will only start in 2026.

Nucor Steel Hertford plant: Located in North Carolina, this EAF-based plant has a crude steel capacity of 1542 ttpa, primarily producing plate for automotive, building, energy, and other sectors. This plant consistently operated at high activity levels, ranging from 72% to 76% between March and September, significantly above the North American average. No direct connection to the provided news articles can be established.

CMC Tennessee steel plant: This plant in Tennessee uses EAF technology to produce rebar, mainly for building and infrastructure. Its activity decreased from 75% in March and April to 69% in August and September. No direct connection to the provided news articles can be established.

Liberty Steel Georgetown plant: Operating in South Carolina, this EAF-based plant produces various products including billet, wire, and mesh. Its activity level fluctuated, reaching a low of 11% in July and peaking at 27% in September. No direct connection to the provided news articles can be established.

Gerdau Fort Smith steel plant: Situated in Arkansas, this EAF-based plant has a crude steel capacity of 550 ttpa. The plant’s activity increased steadily from 45% in March to 53% in September. No direct connection to the provided news articles can be established.

Given the “Mexico’s industrial output extends declines in July” and the missing September activity data for Ternium Guerrero, steel buyers should:

- Diversify Sourcing: Actively explore alternative steel suppliers outside of Mexico to mitigate potential supply chain disruptions.

- Monitor Ternium Guerrero: Closely track the plant’s production updates and communicate with Ternium to assess potential impacts on existing contracts.

- Assess Inventory Levels: Review current steel inventory levels and adjust procurement strategies as needed to ensure adequate supply.

- Factor in Tariffs: Consider the impact of Mexico’s new import tariffs starting in 2026 when planning long-term sourcing strategies.