From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Signals Resilience Despite Fluctuations, Cautious Optimism Advised

Ukraine’s steel market presents a complex picture of resilience amidst fluctuations. Recent satellite data reveals shifts in activity levels across key steel plants, demanding close monitoring. The “British defense strategy emphasizes priority for domestic steel“ and “UK’s new defense industrial strategy puts UK steel at core of national security“ articles highlight a potential shift in global steel demand, although no direct connection to Ukrainian plant activity can be established from the available data. “The UK government is considering a plan for the development of domestic steel production“ further underscores potential shifts in international steel market dynamics, further emphasizing the need for careful analysis of steel supply.

Here’s a summary of recent activity:

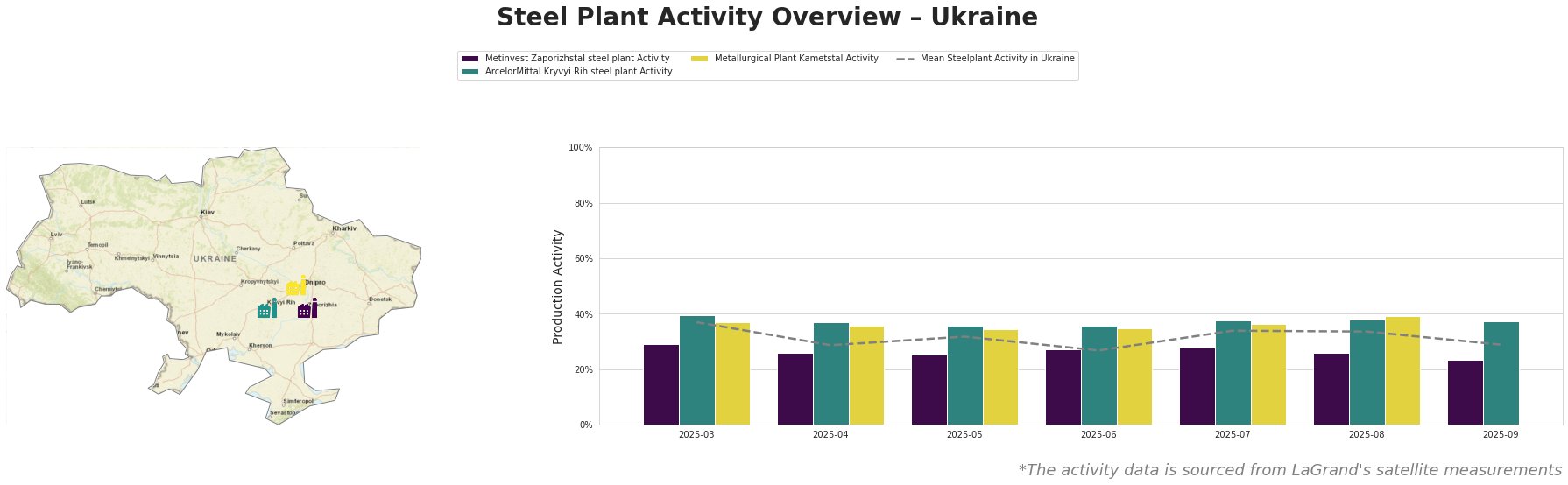

The average steel plant activity in Ukraine experienced fluctuations, peaking at 37% in March and dipping to 27% in June, before settling at 29% in September. The data suggests a general trend of instability across the observed period.

Metinvest Zaporizhstal, an integrated BF-OHF plant with a crude steel capacity of 4,100 ttpa and known for its finished rolled products, experienced a consistent decline in activity from 29% in March to 24% in September. This is a significant reduction. No direct link between this decline and the provided news articles can be established.

ArcelorMittal Kryvyi Rih, a major integrated BF-BOF-OHF plant with a substantial 8,000 ttpa crude steel capacity and diverse product range (semi-finished and finished rolled), maintained relatively stable activity levels, fluctuating between 36% and 40%. This suggests greater resilience compared to Metinvest Zaporizhstal. There is no direct indication from the provided news to explain the plants resistance to the overall activity decreases in Ukraine.

Metallurgical Plant Kametstal, an integrated BF-BOF plant producing semi-finished and finished rolled products, showed the highest activity in August at 39%, starting from 37% in March, then followed by a decline in September at 37%. This increase, followed by a minor decline is inconsistent with the trend of Ukrainian steel industry. No direct connection between this activity and the provided news articles can be established.

The observed fluctuations in steel plant activity, alongside the potential for increased demand in the UK (indicated by the news articles), suggest possible supply disruptions within Ukraine. Procurement professionals should:

- Prioritize securing supply contracts with ArcelorMittal Kryvyi Rih: Given its stable activity, it represents a more reliable source of steel.

- Exercise caution with Metinvest Zaporizhstal: The consistent decline in activity suggests potential delivery delays or reduced supply. Closely monitor their production updates.

- Carefully monitor Metallurgical Plant Kametstal activity: Because the plant experienced activity out of sync with the rest of Ukraine, further investigation into this plant should be conducted to clarify the plant’s operation status.

- Diversify sourcing: The UK’s shift towards domestic steel, highlighted in the news articles, could indirectly impact global steel availability and pricing. Explore alternative suppliers.

- Factor in potential price volatility: Increased demand in specific regions (like the UK) due to policy shifts could lead to price increases. Hedge procurement strategies accordingly.