From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Downward Pressure: Rebar Prices Fluctuate Amid Plant Activity Shifts

The European steel market, particularly in Italy, is experiencing downward pressure on rebar prices as highlighted in “Rebar prices in Northern Italy are under pressure, the domestic market is expanding downward” and “European longs market stable to lower amid pessimistic mood“. These articles suggest regional disparities and a general wait-and-see approach among traders. While “Rebar prices in Italy are rising amid reports of new deals and declining supply; traders are taking a wait-and-see attitude” initially reported increases, subsequent reports indicate a weakening market. This dynamic does not appear to have a direct link to the satellite-observed plant activity changes, as those changes have been far less reactive and sensitive to the market fluctuations.

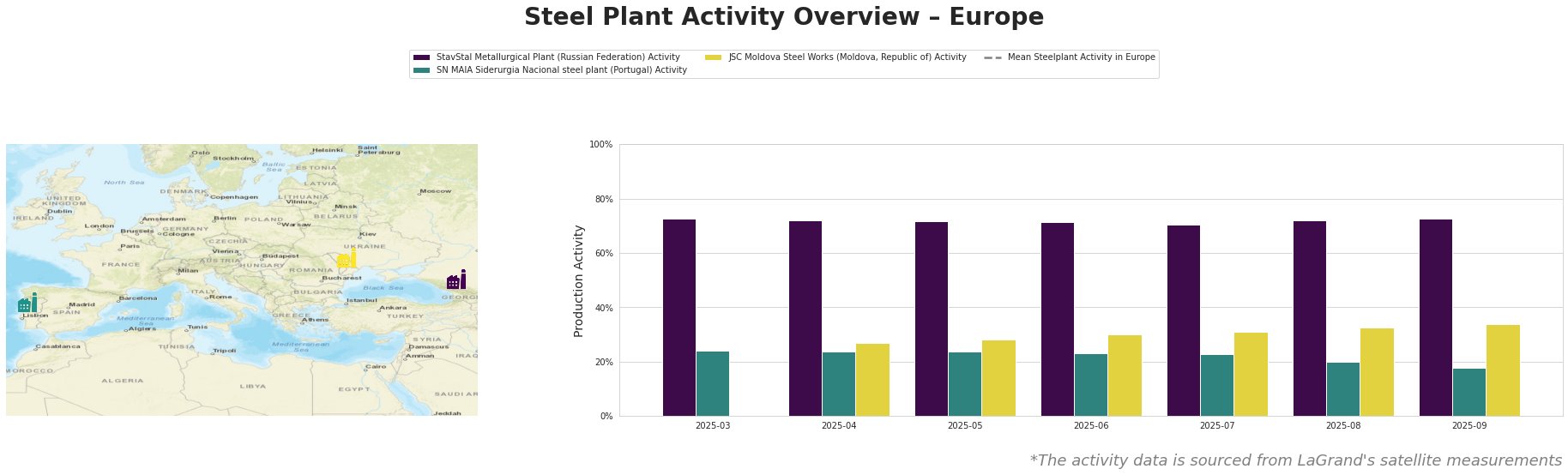

The mean steel plant activity in Europe shows inconsistent data, rendering comparisons difficult. StavStal Metallurgical Plant in Russia, an EAF-based mill producing rebar and wire rod, shows relatively stable activity around 70-73% throughout the period, with a slight dip in July followed by a return to previous levels. SN MAIA Siderurgia Nacional in Portugal, another EAF-based rebar producer, shows a gradual decline in activity from 24% in March-May to 18% in September. JSC Moldova Steel Works, also EAF-based and producing rebar and wire rod, shows a steady increase in activity from 27% in April to 34% in September. No direct connection can be established between the stable activity at StavStal and the market fluctuations reported in the news articles. The decline in activity at SN MAIA may reflect the general market weakness, but this cannot be stated definitively based solely on the provided information. The increase in JSC Moldova Steel Works may be explained by the reports but there isn’t a clear connection.

StavStal Metallurgical Plant, located in Russia and boasting a 500ktpa EAF capacity, maintained a relatively stable production level, fluctuating only slightly between 70% and 73% activity. Despite the fluctuations and overall very negative market sentiment in Europe as a whole, no correlation can be established between the plant’s activity levels and market dynamics of the European Rebar market.

SN MAIA Siderurgia Nacional, a Portuguese steel plant with a 600ktpa EAF capacity dedicated to rebar production, experienced a noticeable decrease in activity, dropping from 24% in March-May to 18% in September. Considering the reported downward pressure on rebar prices, most notably in Northern Europe, the observed activity drop at SN MAIA might be a supply side response to the overall weak market. However, without further data or clear market commentary, no conclusive relation can be drawn and this remains a high-confidence assumption based on the facts.

JSC Moldova Steel Works, equipped with a 120-tonne EAF and a 1,000ktpa crude steel capacity, shows a steadily increasing activity level from 27% in April to 34% in September. The main products are rebar, wire rod and billet, while no clear connection to the main European market can be derived from the news articles, nor from the overall market sentiment.

Given the reports of regional disparities and a wait-and-see approach, alongside the declining activity at SN MAIA, steel buyers should proceed with caution. The news articles show that Southern European prices have held better, while Northern European prices are showing weakness.

Recommended Procurement Actions:

* Prioritize Southern European Suppliers: Given the relative stability in Southern Italy and Spain, focus procurement efforts on suppliers in these regions to mitigate price volatility.

* Negotiate Contracts with built-in flexibility: Given the overall uncertain market conditions, negotiate contracts with built-in optionality to capture potential price declines. Explicitly, steel buyers can negotiate smaller delivery volumes, more frequent deliveries, and shortened contract durations.

* Closely Monitor SN MAIA Activity: Closely monitor the activity of SN MAIA Siderurgia Nacional steel plant in Portugal, in order to derive insights into the overall supply side reaction to the European Rebar market.