From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Uncertainty Amidst Geopolitical Tensions and Production Fluctuations

Europe’s steel market faces increasing uncertainty due to geopolitical tensions and fluctuating plant activity. Concerns regarding escalating tensions stemming from the Ukraine war, as highlighted in news articles like “Ukraine-Krieg: ++ Slowakei fordert von der EU eine Gegenleistung für neue Russland-Sanktionen ++ Liveticker” and “Ukraine-Krieg: ++Polen schickt laut Bericht 40.000 Soldaten an die Ostgrenze – Russland beginnt Großmanöver ++ Liveticker,” are creating a volatile environment. While some plant activity shows stability, broader geopolitical concerns are contributing to a negative market sentiment, further fueled by the article “Merz warnt vor Putins „imperialistischem Plan“ – und gibt Diplomaten eine Botschaft mit“. No direct link between specific plant activity changes and these news articles can be established based on the provided data.

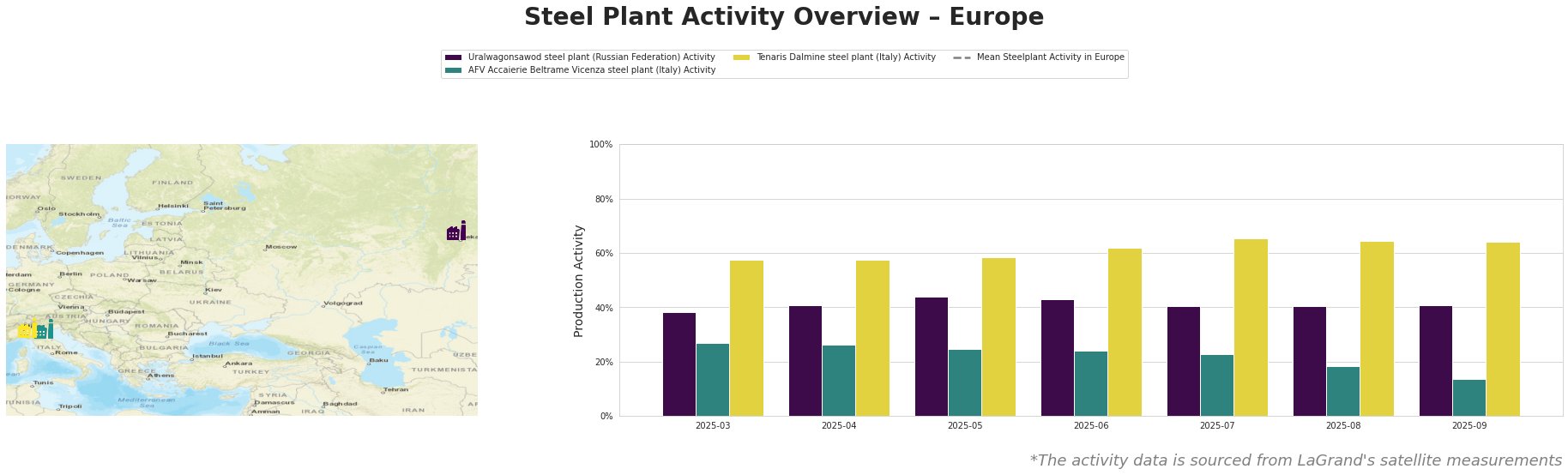

The mean steel plant activity in Europe fluctuates significantly throughout the period, with no clear trend. Uralwagonsawod, a Russian steel plant serving the defense sector, shows relatively stable activity, ranging from 38% to 44%. AFV Accaierie Beltrame Vicenza, an EAF steel plant in Italy producing steel for building, infrastructure, tools, machinery, and transport, experienced a notable activity drop from 27% in March to 14% in September. Tenaris Dalmine, another Italian EAF steel plant producing semi-finished and finished rolled products for automotive, energy, and machinery sectors, exhibits relatively stable activity, ranging from 57% to 65%. No direct connection between the news articles and the plant activities can be established.

Uralwagonsawod, located in Russia and primarily serving the defense sector, maintained a relatively stable activity level throughout the observed period. The plant’s activity hovered around the 40% mark, showing resilience despite geopolitical tensions highlighted in articles like “Ukraine-Krieg: ++ Kreml verkündet „Pause“ in Ukraine-Gesprächen – Nato äußert sich zu russischem Militärmanöver ++ Liveticker“.

AFV Accaierie Beltrame Vicenza, an Italian EAF steel plant with a crude steel capacity of 1200 tonnes, experienced a significant decrease in activity, dropping from 27% in March to 14% in September. This reduction could reflect weakening demand or supply chain disruptions, though no direct link to the provided news articles can be established.

Tenaris Dalmine, an Italian EAF steel plant with a 700-tonne crude steel capacity, demonstrated stable activity, fluctuating between 57% and 65%. This plant, producing tubes and pipes for the energy and automotive sectors, appears more resilient than AFV Accaierie Beltrame Vicenza. No direct connection between the news articles and the plant’s activity could be established.

Given the geopolitical instability reflected in news articles such as “Ukraine-Krieg: ++ „Geschlossene Grenzen, konfrontative Schritte“ – Moskau wirft Polen Eskalation vor ++ Liveticker” and the observed decrease in activity at AFV Accaierie Beltrame Vicenza, steel buyers should consider the potential for localized supply disruptions within Europe. It is recommended that steel buyers dependent on AFV Accaierie Beltrame Vicenza for steel used in building, infrastructure, tools, machinery, and transport consider diversifying their supply sources to mitigate risks associated with potential further production declines at this specific plant. Due to the general instability, analysts should carefully monitor Eastern European border activity.