From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Production Rebounds Amidst Export Shifts: An Increasing Market for Steel Buyers

Europe’s steel market presents a mixed picture, particularly within Ukraine where, despite challenges, production shows signs of recovery alongside shifting export dynamics. The “Ukraine increased its pig iron exports by 65% y/y in January-August“ driven by US demand, and “Ukraine reports eight percent rise in pig iron output for January-August 2025“ signals a rebound in pig iron production, even as “Ukraine reduced iron ore exports by 7% y/y in January-August“ highlights a squeeze on raw material availability. These developments occur as reported in “Domestic prices for construction steel products rose slightly in August“ due to low demand, while the industry grapples with an anticipated global steel market crisis, described in the article “Ukraine produced 4.25 million tons of rolled steel in January-August“. No direct relationship between these news items and the satellite-observed changes in activity at all plants could be established.

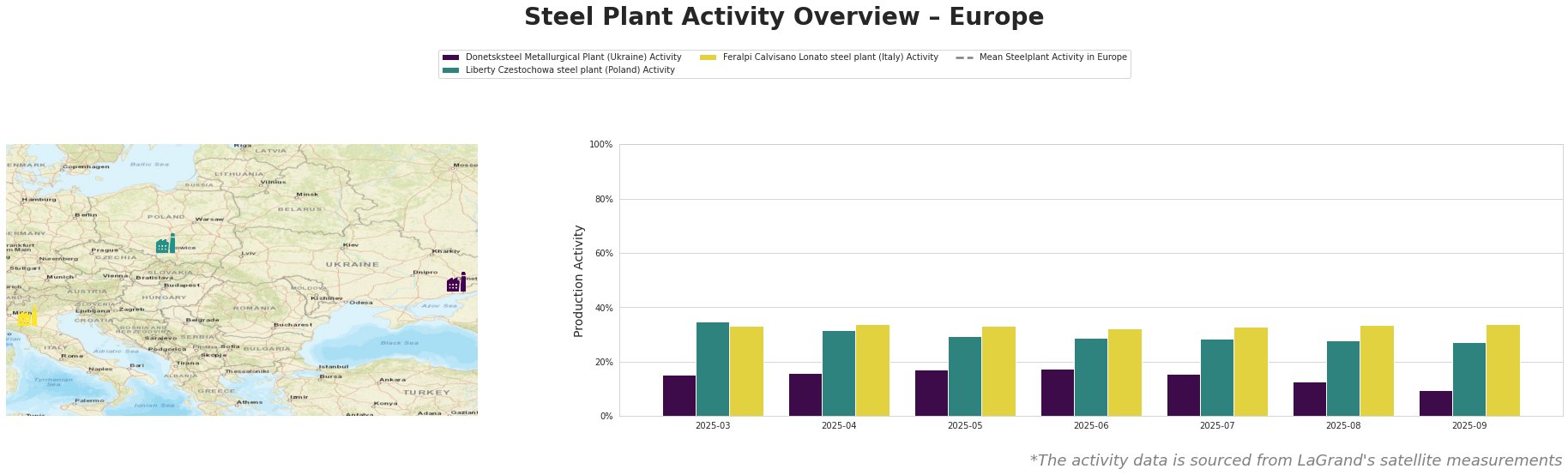

The provided data reveals diverging trends. The mean steel plant activity in Europe remained strongly negative, but the Donetsksteel Metallurgical Plant in Ukraine saw a decrease, starting at 15.0% in March and decreasing to 9.0% by September. The Liberty Czestochowa steel plant in Poland shows a consistent decline from 35% to 27% across the observation period. The Feralpi Calvisano Lonato steel plant in Italy shows relative consistent activity levels around 33%-34%.

Donetsksteel Metallurgical Plant, primarily focused on pig iron production using integrated BF-BOF processes, experienced a decrease in activity, with the percentage dropping to 9% in September. Given the plant’s focus on pig iron and the news of increased pig iron exports, this decrease is notable but no direct connection can be established from the provided data. The plant has a crude Iron capacity of 1500 ttpa.

Liberty Czestochowa, an EAF-based plant in Poland producing semi-finished plate products with a crude steel capacity of 840 ttpa, displayed a steady decline in activity, decreasing from 35% in March to 27% in September. No direct connection between the news articles provided and this activity decrease can be established, despite its Responsible Steel Certification.

Feralpi Calvisano Lonato, an EAF-based plant in Italy focused on billet production with a crude steel capacity of 600 ttpa, maintained a stable activity level around 33-34% throughout the period. This stability suggests consistent demand and operational efficiency, but no direct connection to the Ukrainian-focused news articles can be established.

Reduced activity at the Donetsksteel Metallurgical Plant despite overall pig iron production increases in Ukraine, coupled with decreasing semi-finished exports (“Ukrainian steel companies reduced exports of semi-finished products by 39% y/y in January-August“), indicate a potential shift in market focus and supply chain dynamics. Given that “Consumption of steel products in Ukraine grew by 22.6% y/y in January-August” with Ukrainian steelmakers producing 4.26 million tons of rolled products, a slight decline of 1.4% from 2024, procurement teams should evaluate diversifying their pig iron suppliers to mitigate risks associated with relying solely on Ukrainian sources, especially if domestic demand continues to rise. Also, consider negotiating contracts with built-in flexibility to account for potential price fluctuations, given the slightly increasing domestic prices for construction steel products in Ukraine, especially if they plan on importing construction steel products, as indicated in the report “Domestic prices for construction steel products rose slightly in August“.