From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Exports Surge Amidst Fluctuating Iron Ore and Coal Imports, Indian Plants Show Divergent Activity

Asia’s steel market presents a mixed picture. Chinese steel exports are up significantly, impacting global supply, while import trends for key raw materials like iron ore and coal are fluctuating. According to “China increased steel exports by 10% y/y in January-August,” Chinese steel exports have risen sharply, while “China’s iron ore imports down 1.6 percent in January-August” and “China’s coal imports decrease by 12.2 percent in January-August 2025” detail shifts in raw material procurement. While a correlation between coal and iron ore import decreases and steel export increases cannot be definitively established through these articles alone, they suggest potential shifts in Chinese steel production strategies or reliance on existing stockpiles.

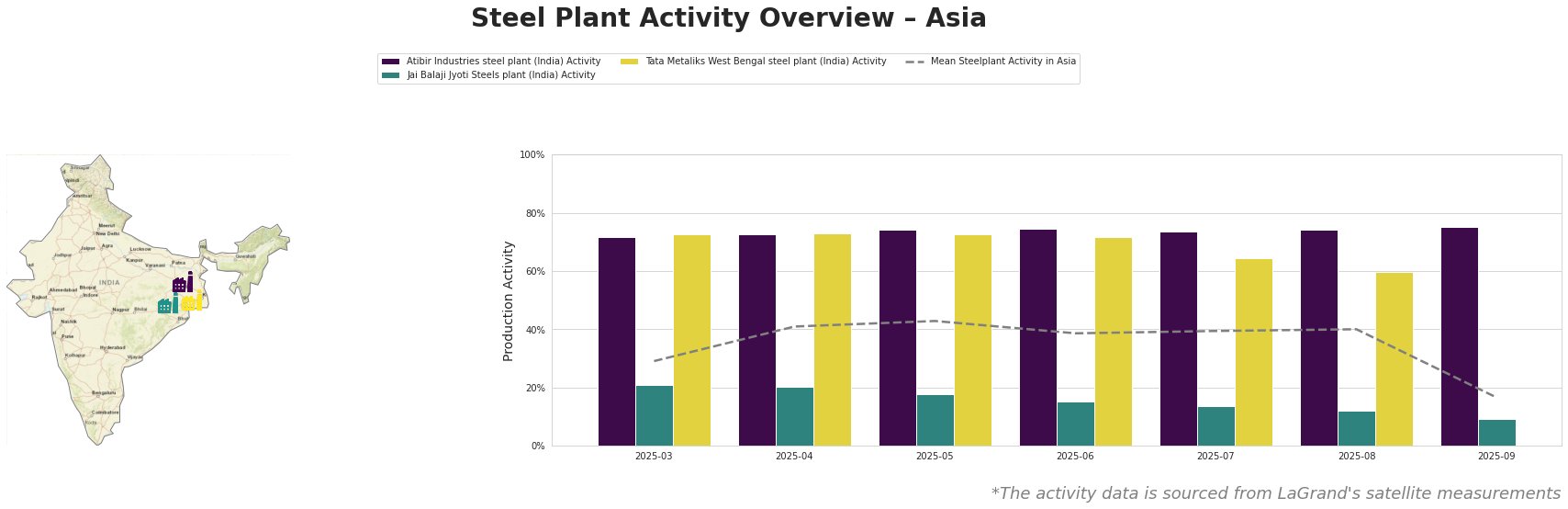

Across Asia, the mean steel plant activity experienced fluctuation between March and August 2025, from 29% to 43%, before sharply dropping to 17% in September. Atibir Industries in India shows consistently high activity, fluctuating between 72% and 75% over the observed period, standing in contrast to the overall Asian trend. Jai Balaji Jyoti Steels shows a steady decline from 21% in March to just 9% in September. Tata Metaliks West Bengal sees stable activity around 73% until July, followed by a decline to 60% by August. The significant drop in overall Asian activity in September is not directly explained by the provided news articles.

Atibir Industries, a plant in Jharkhand, India, utilizing integrated BF/BOF processes with a crude steel capacity of 600 ttpa, has consistently operated at a high activity level (72-75%) between March and September 2025. This stable output, and its high percentage in comparison to the Asian mean activity level of 40%, could be a result of the plant’s focus on pig iron and rolled products. No direct link can be established between Atibir’s activity and the provided news articles regarding Chinese steel exports or raw material imports.

Jai Balaji Jyoti Steels, an Odisha-based plant with a DRI-EAF route and a crude steel capacity of only 92 ttpa, shows a continuous decline in activity from 21% in March to 9% in September. While the plant produces DRI, billets, bars, and wire rods, its activity reduction isn’t directly linked to the observed fluctuations in Chinese iron ore imports discussed in “China’s iron ore imports down 1.6 percent in January-August”. The drop could reflect localized market factors or production constraints not captured in the provided articles.

Tata Metaliks West Bengal, an integrated BF/BOF plant with a crude steel capacity of 255 ttpa, maintained a stable activity level around 73% until July 2025, after which activity decreased to 60% in August, and data is missing for September. Specializing in pig iron and ductile pipes, the plant’s reduced activity doesn’t have an explicitly evident connection to “China increased steel exports by 10% y/y in January-August”, but Chinese export volumes could indirectly impact regional demand and pricing for pig iron, affecting Tata Metaliks’ output.

Evaluated Market Implications:

The increasing steel exports from China, as highlighted in “China increased steel exports by 10% y/y in January-August,” combined with fluctuating raw material import trends, could lead to increased price volatility in the Asian steel market. The decline in coal and iron ore imports in China may eventually constrain Chinese output, potentially creating supply shortages, but the recent surge in exports suggests this is not yet the case. The drastic drop in Asian steel production in September suggests a potential supply issue; however, this observation cannot be explicitly linked to news data.

For steel buyers: Actively monitor Chinese export policies and inventory levels. Consider diversifying your supply base to mitigate risks associated with potential Chinese production adjustments. Given the divergent activity trends among Indian plants, assess the specific product lines and regional market dynamics relevant to each supplier before committing to long-term contracts. Closely monitor the Asian mean steel plant activity as an indicator of overall steel production. Given that September data shows a drastic reduction in activity, steel buyers should engage in proactive supplier communication, ensuring that current or anticipated orders will be fulfilled.