From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Export Surge Despite July Slowdown, Scrap Exports Rise

Ukraine’s steel sector shows mixed signals, with strong export growth in the first seven months of 2025 offset by a July slowdown and surging scrap exports. Increased long and flat rolled product exports contrast with declines in ferroalloy exports. The “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July” and “Ukraine exported 971,700 tons of flat rolled products in January-July” articles highlight this positive trend. However, the impact of these export increases on domestic plant activity levels cannot be directly established based on the provided information.

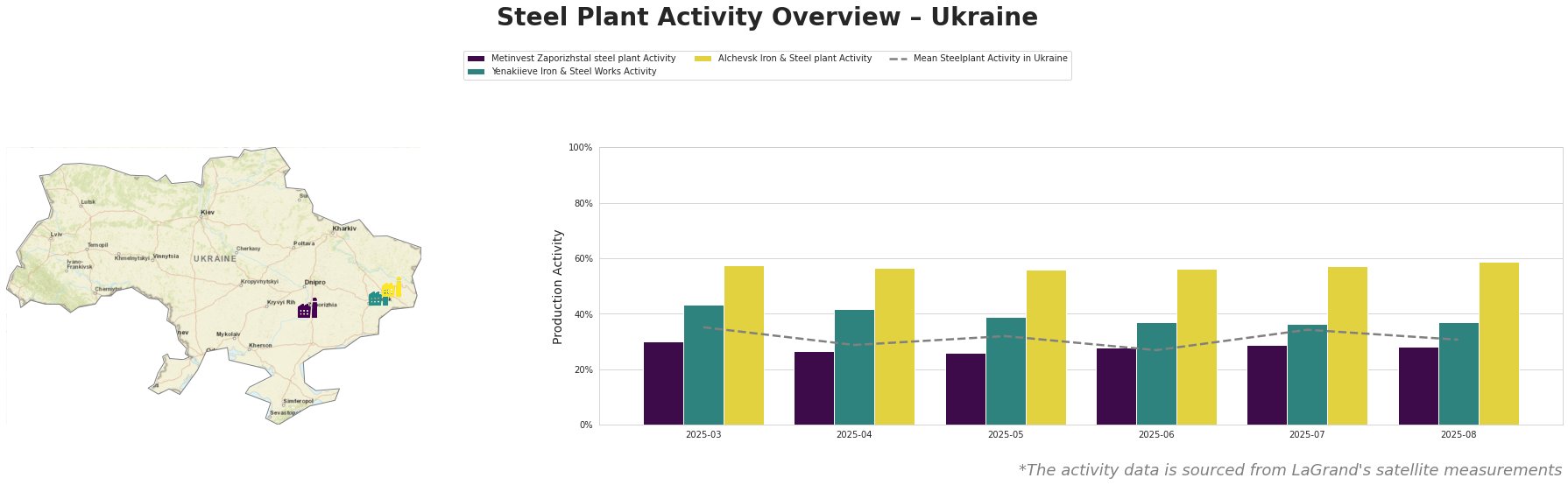

Steel Plant Activity Overview

Overall plant activity has fluctuated, with a low point in June (27%) and a peak in March (35%). Alchevsk Iron & Steel plant consistently operates above the mean. Yenakiieve Iron & Steel Works and Metinvest Zaporizhstal steel plant consistently operate below the mean. The recent rise in activity at Alchevsk Iron & Steel plant to 59% in August does not have a direct connection to the provided news articles, and may reflect regional factors or internal plant decisions.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tons per annum (TTPA), produces finished rolled products like hot-rolled coil and cold-rolled sheets. Its activity level has remained relatively stable and below the Ukrainian average, ranging from 26% to 30% between March and August 2025. The lack of a significant increase in activity, despite increased flat-rolled product exports reported in “Ukraine exported 971,700 tons of flat rolled products in January-July”, suggests that other plants might be contributing more to the export volume.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, another integrated BF-BOF plant with a crude steel capacity of 3.3 million TTPA, focuses on semi-finished and finished rolled products like billets and rebar. Its activity has been consistently below the national average, fluctuating between 36% and 43% from March to August 2025. While “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July” indicates increased long rolled exports, there’s no direct correlation evident in the plant’s activity data.

Alchevsk Iron & Steel plant

Alchevsk Iron & Steel plant, boasting the highest crude steel capacity (5.472 million TTPA) of the three, also uses integrated BF-BOF production. It consistently operated above the Ukrainian average, reaching 59% activity in August 2025. Like the other steel plants, it is difficult to establish whether its higher activity level is a direct consequence of increasing exports, as it is not a main producer of flat or long rolled steel.

Evaluated Market Implications

The “Scrap exports from Ukraine exceeded 44,000 tons in July” article, coupled with overall increased scrap exports in January-July 2025, raises concerns. While the overall steel export picture is positive, the increase in scrap exports could lead to supply constraints and increased prices for domestic steel producers relying on scrap, particularly those employing electric arc furnace (EAF) technology (though the provided steel plants use BF/BOF process), which are not considered here.

Recommended Procurement Actions:

- Monitor scrap prices closely. The surge in scrap exports, as highlighted in “Scrap exports from Ukraine exceeded 44,000 tons in July,” could lead to price volatility. Steel buyers should closely track scrap prices and factor potential increases into their procurement strategies.

- Diversify sourcing for long and flat rolled products. Given the export increases reported in “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July” and “Ukraine exported 971,700 tons of flat rolled products in January-July”, buyers should actively explore and secure alternative supply sources to mitigate potential risks arising from disruptions or prioritization of export orders.