From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rising Chinese Production Offsets Potential EU Export Disruptions Amid US Tariff Concerns

Asia’s steel market presents a mixed outlook. While Chinese steel plant activity shows increasing production, potential disruptions loom for EU exports due to ongoing US tariffs, as highlighted in “EU and US finalize trade deal, agree on protection from global steel production oversupply“, “Eurofer: EU-US trade framework leaves steel exposed“, and “VDMA calls on Commission to secure relief from US Tariffs on Steel and Aluminum“. The observed production trends in specific Chinese and Japanese steel plants show only minor fluctuations, but the impact of the trade framework poses risks that necessitate constant monitoring.

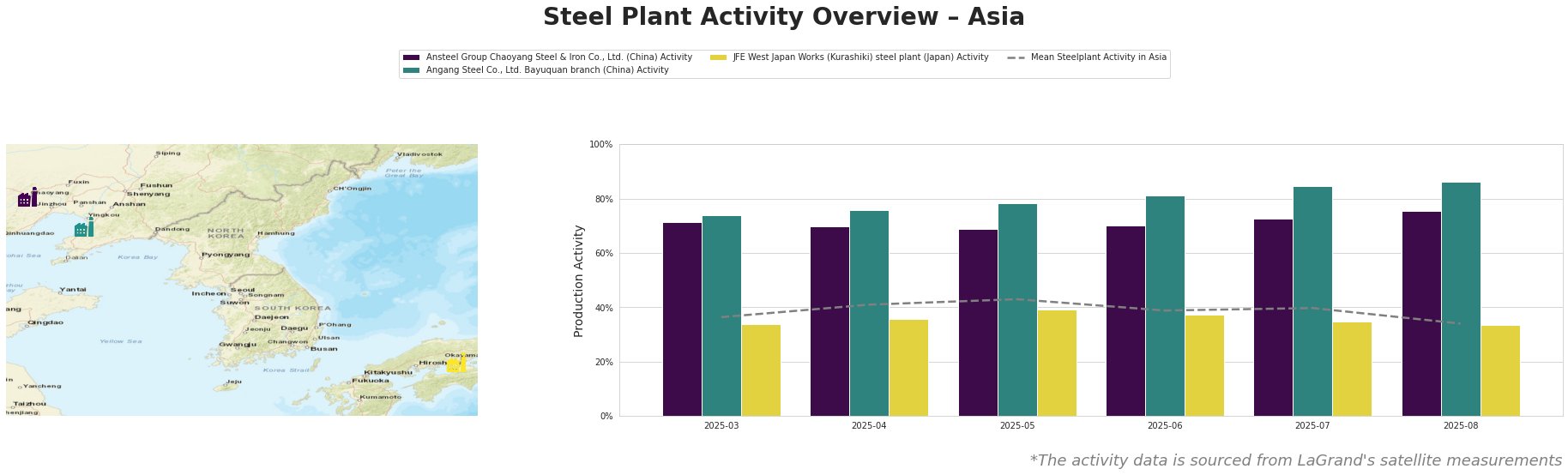

Overall, the mean steel plant activity in Asia decreased to 34% in August, from a high of 43% in May.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., an integrated BF/BOF steel plant in Liaoning, China, shows relatively stable activity, ranging between 69% and 76% from March to August. The peak activity of 76% in August is notably above the mean activity levels across Asia. No direct connection between this sustained high activity and the cited news articles can be established.

Angang Steel Co., Ltd. Bayuquan branch, also located in Liaoning and operating with BF/BOF technology, shows a consistently upward trend in activity, reaching 86% in August, significantly exceeding the Asian average. This represents a substantial increase from 74% in March. As with Ansteel, no direct connection can be established between this production increase and the cited news articles concerning EU-US trade.

JFE West Japan Works (Kurashiki) steel plant, a major integrated steel producer in Japan, exhibits relatively stable activity levels between 33% and 39% throughout the observed period, consistently below the average Asian activity. No connection between this stability and the news concerning EU-US trade could be identified.

The EU-US trade framework, as reported in “EU and US finalize trade deal, agree on protection from global steel production oversupply“, “Eurofer: EU-US trade framework leaves steel exposed“, and “VDMA calls on Commission to secure relief from US Tariffs on Steel and Aluminum“, poses a potential risk to steel supply from Europe, particularly for steel-intensive industries. The Eurofer’s concerns about the 50% US tariff on steel suggest a potential decrease in EU exports. Given the relatively high and stable production observed at Angang Steel and Ansteel, Asian buyers who previously relied on EU steel should explore and secure alternative supply agreements with these Chinese producers to mitigate risks associated with potential EU export disruptions caused by the US tariffs. Buyers should also closely monitor any policy responses from Eurofer in September. This shift is supported by the satellite-observed high activity at these plants, indicating their capacity to potentially meet increased demand. Furthermore, given the end-user sectors like the automotive, construction and other sectors serviced by JFE Steel (Kurashiki), any tariff volatility could impact future steel buying decisions from this source.