From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Poised for Growth: Marcegaglia’s Expansion Drives Optimism Despite Russian Environmental Investments

Europe’s steel market shows strong growth potential driven by new mill projects, with Marcegaglia leading the charge. The construction of new mini-mills is highlighted in “Danieli to Deliver Hot-Rolled Coil Mini-Mill Project for Marcegaglia” and “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill“. While these developments suggest increased future capacity, no direct relationship with current observed activity levels at existing plants could be established from the given data. Conversely, Russia’s MMK investing in environmental transformation, as per “Russia’s MMK to invest over RUB 10 billion in green transformation,” also has no direct connection to the activity data of European plants.

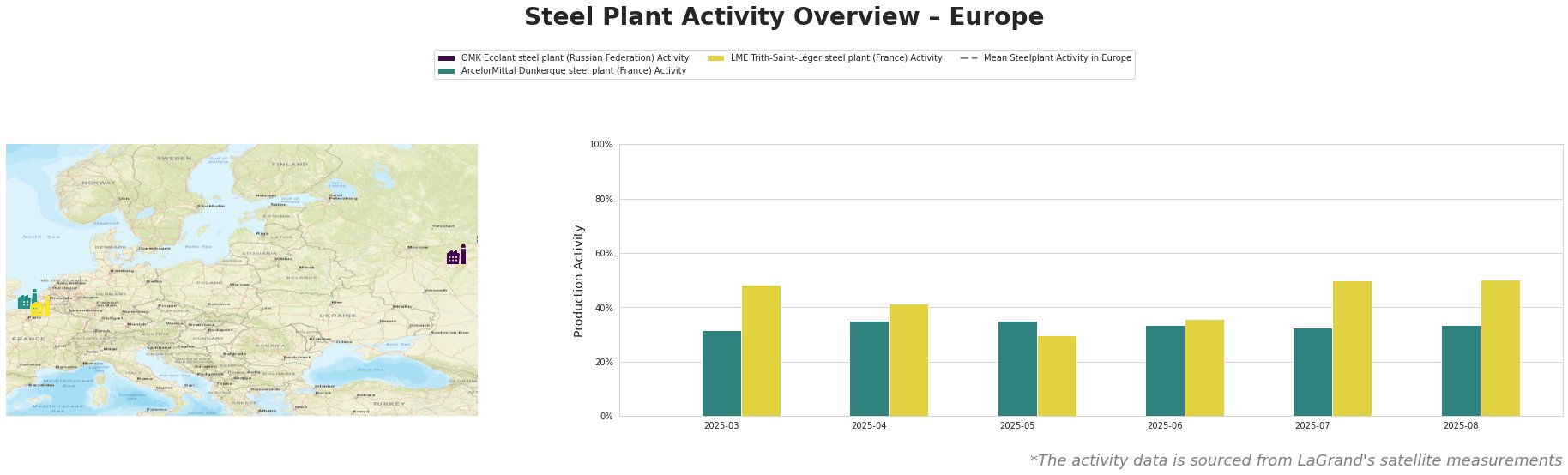

The data reveals no clear or consistent trend in mean activity across European steel plants, and the negative values make comparisons unreliable. The OMK Ecolant steel plant shows consistently low activity levels, which may be due to factors not evident from the news or plant descriptions. ArcelorMittal Dunkerque activity has remained relatively stable, fluctuating between 31% and 35%. LME Trith-Saint-Léger shows a more volatile activity pattern, with a notable drop to 30% in May followed by a significant rebound to 50% in July and August.

OMK Ecolant steel plant is a Russian facility using DRI and EAF technologies with a crude steel capacity of 1.8 million tons. It focuses on semi-finished products like slabs and round billets for building, energy, and transport sectors. The plant consistently shows very low satellite-observed activity levels. No direct relationship could be established between this low activity and the provided news articles.

ArcelorMittal Dunkerque steel plant, located in France, is an integrated BF-BOF plant with a crude steel capacity of 6.75 million tons, producing semi-finished (slabs) and finished rolled (hot rolled products, coil) products. Its activity has remained relatively stable, fluctuating narrowly between 31% and 35% from March to August. This stability occurs while Marcegaglia announces new mills in France, but a direct impact on ArcelorMittal Dunkerque is not clearly supported by the data.

LME Trith-Saint-Léger steel plant, an EAF-based electric steel plant in France, has a crude steel capacity of 850,000 tons, producing slabs and hot rolled coils. The observed activity shows volatility, dipping to 30% in May before rebounding to 50% in July and August. Given Marcegaglia’s investment in new mini-mills, a temporary slow-down may have led to a rebound in activity in July and August, but a definitive causal link cannot be confirmed from the provided data.

The commissioning of Marcegaglia’s new mini-mills in Italy and France by 2028, as announced in “Danieli to Deliver Hot-Rolled Coil Mini-Mill Project for Marcegaglia” and “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill“, will significantly increase HRC supply in the long term. Steel buyers should closely monitor the progress of these projects and consider negotiating long-term supply contracts with Marcegaglia to secure favorable pricing and volumes upon their completion. While the MMK investment in environmental protection, detailed in “Russia’s MMK to invest over RUB 10 billion in green transformation,” is positive, it doesn’t currently appear to impact the European market directly, nor is it connected to any activity-level changes reported here. Given the volatile activity at LME Trith-Saint-Léger, steel buyers should diversify their sourcing strategies to mitigate potential short-term supply disruptions from this plant. This recommendation is based on the activity levels of May to August, but is speculative as no information for the future activity is available.