From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rebar Exports Surge Amidst Crude Steel Output Decline

Asia’s steel market presents a mixed outlook, with rising rebar exports from China contrasted by a general decline in crude steel output. As reported in “China’s Rebar Exports Rise 52.4% in January–July 2025,” Chinese rebar exports have seen a substantial increase. This trend is occurring alongside an overall decrease in Asian crude steel output, as highlighted in “World crude steel output down 1.3 percent in July 2025,” where Asia’s output fell by 1.9%. The satellite data does not directly reflect the increase of Chinese rebar exports because it focuses on a selection of Steel Plants in specific countries.

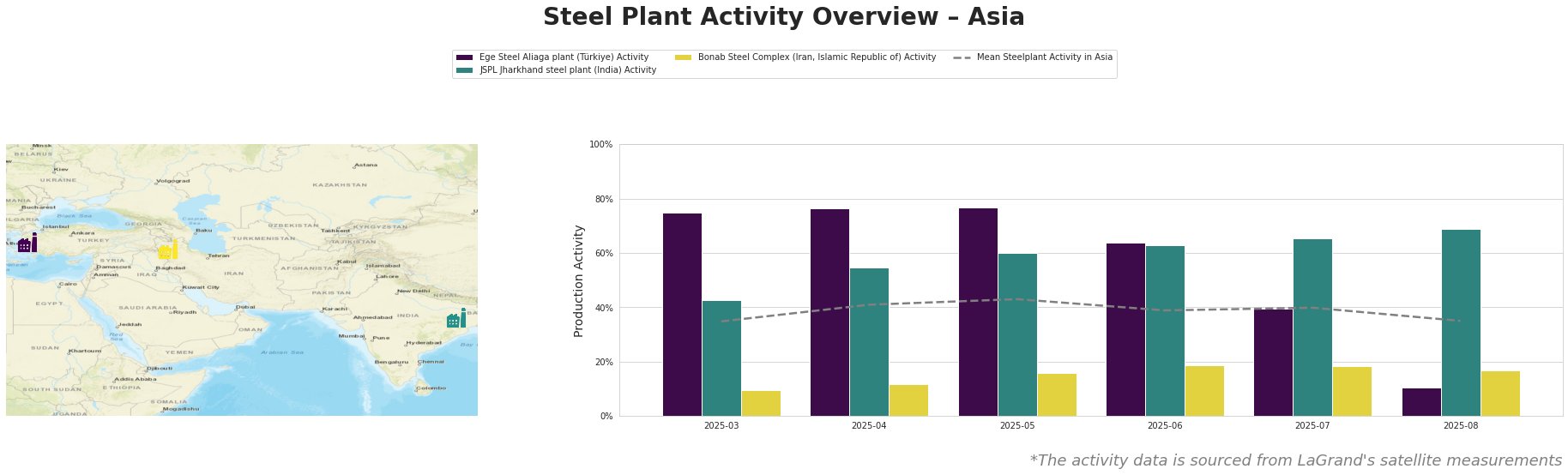

Measured Activity Overview

The mean steel plant activity in Asia shows a fluctuating trend, peaking in May at 43% and declining to 35% by August. JSPL Jharkhand steel plant consistently outperformed the Asian average and increased activity from 43% in March to 69% in August. Ege Steel Aliaga plant started high but then experienced a significant activity drop from 77% in May to just 11% in August. The activity at Bonab Steel Complex remained consistently low, showing only minor changes.

Ege Steel Aliaga plant

Ege Steel Aliaga, located in İzmir, Türkiye, is an electric arc furnace (EAF) based plant with a crude steel capacity of 2,000 ttpa, producing mainly rebar and wire rod. The plant holds a Responsible Steel Certification. The activity levels observed via satellite show a sharp decline in activity, dropping from 77% in May to a mere 11% in August. While there is no specific news article explaining this dramatic drop, the overall trend of decreased steel production in some regions, as indicated in “World crude steel output down 1.3 percent in July 2025“, could potentially be a contributing factor. The article “German monthly steel output continues to fall“, which states that German crude steel production in July 2025 decreased by 13.7%, could potentially be indicative of a similar trend affecting the Turkish steel industry, although no direct link can be established based on the provided news.

JSPL Jharkhand steel plant

The JSPL Jharkhand steel plant in India, an EAF-based facility with a 1,600 ttpa crude steel capacity focused on semi-finished products like wire rod and bar, has consistently increased its activity levels. Starting at 43% in March, the plant reached 69% activity by August, significantly outperforming the average observed activity across Asian steel plants. This rise could be related to the 14% increase in steel output in India, mentioned in “World crude steel output down 1.3 percent in July 2025“.

Bonab Steel Complex

The Bonab Steel Complex in East Azerbaijan, Iran, is an EAF-based plant with a crude steel capacity of 1,400 ttpa. Its activity levels remained consistently low throughout the observed period, fluctuating between 10% and 19%. No direct link can be established between this steady but low activity and any of the provided news articles.

Evaluated Market Implications

The surge in Chinese rebar exports, as reported in “China’s Rebar Exports Rise 52.4% in January–July 2025,” suggests a potential oversupply in the Chinese domestic market. This, combined with the overall decline in crude steel output in Asia, as indicated in “World crude steel output down 1.3 percent in July 2025,” paints a picture of potential regional imbalances.

Recommended Procurement Actions:

- Steel Buyers: Given the rise in Chinese rebar exports, buyers in regions importing rebar from China should evaluate the potential for negotiating more favorable pricing.

- Market Analysts: Closely monitor the activity levels of Ege Steel Aliaga, given the significant recent decline. Investigate potential factors contributing to this decrease, as it could indicate localized supply chain disruptions for rebar and wire rod, potentially creating opportunities for other suppliers in Europe and Asia, specifically the JSPL Jharkhand plant.