From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Declines Amidst Global Trade Tensions & US Tariffs

Steel production activity in Asia is showing signs of contraction, potentially influenced by global trade tensions, specifically US tariffs impacting various economies. Recent steel plant activity may correlate with the trade tensions highlighted in “Trumps US-Zölle im Liveticker: Frist für neue US-Zölle gegen Indien abgelaufen | FAZ” and “Trumps US-Zölle im Liveticker: DHL schränkt Paketversand in die USA ein |FAZ“. However, it is important to note that no direct relationship between trade-related news and activity trends can be conclusively established based on the provided information alone.

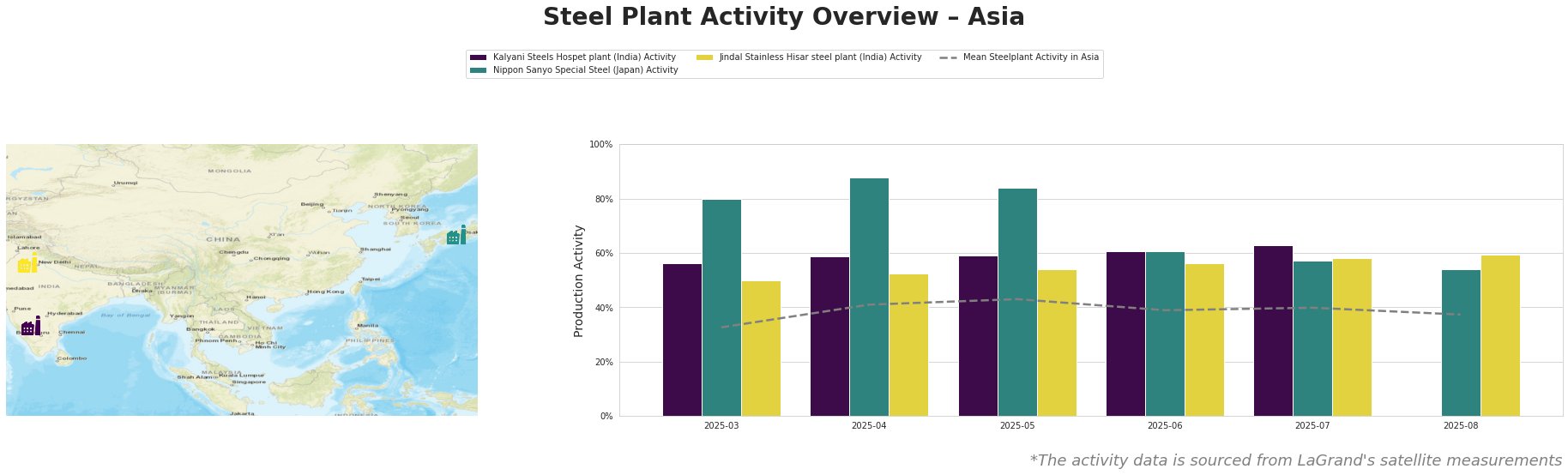

The mean steel plant activity in Asia peaked in May at 43.0% and has since declined to 37.0% by August, representing a notable downward trend. Kalyani Steels Hospet plant activity increased steadily from March (56.0%) to July (63.0%). However, activity data for August is unavailable. Nippon Sanyo Special Steel showed an initial increase from March (80.0%) to April (88.0%), followed by a sharp decline to 54.0% in August, the lowest recorded activity level for this plant in the observed period. The Jindal Stainless Hisar steel plant has shown relatively stable activity levels, ranging from 50.0% in March to 59.0% in August, consistently outperforming the average Asian steel plant activity.

Kalyani Steels Hospet plant, an integrated steel plant with both BF and DRI processes and a crude steel capacity of 860 ttpa, showed increasing activity until July. The absence of August data prevents a full assessment of recent trends. As a producer of semi-finished and finished rolled products for sectors including automotive and construction, it could be impacted by the US tariffs mentioned in “Trumps US-Zölle im Liveticker: DHL schränkt Paketversand in die USA ein |FAZ“, however no specific connection can be directly established from the news data provided.

Nippon Sanyo Special Steel, a Japanese electric arc furnace (EAF) steel plant with a 1596 ttpa crude steel capacity, experienced a sharp decline in activity to 54.0% in August after a peak of 88% in April. This decrease could potentially be related to the concerns raised by German machinery manufacturers mentioned in “Trumps US-Zölle im Liveticker: Frist für neue US-Zölle gegen Indien abgelaufen | FAZ“, although a direct link cannot be confirmed. As a producer of billet, rolled products, and tubes for automotive and other sectors, this decline warrants close monitoring.

Jindal Stainless Hisar steel plant, an EAF-based stainless steel producer with 800 ttpa capacity, maintained relatively stable activity levels, consistently exceeding the regional average. The relative stability might be because of its stainless steel output being less affected, but no specific supporting evidence can be derived from the provided news articles.

Based on the observed activity decline in the Asian steel market, particularly at Nippon Sanyo Special Steel, alongside the backdrop of trade tensions highlighted in “Hohe Zölle für die Schweiz: Mögliche Massnahmen im Überblick” and “Trumps US-Zölle im Liveticker: Frist für neue US-Zölle gegen Indien abgelaufen | FAZ“, steel buyers should:

- Prioritize securing supply from Jindal Stainless Hisar steel plant due to its stable production.

- Actively monitor the production levels of Nippon Sanyo Special Steel. The sharp decline in August warrants careful observation.

- Negotiate contracts that allow for price adjustments based on potential tariff changes, considering the uncertainties highlighted in “Trumps US-Zölle im Liveticker: DHL schränkt Paketversand in die USA ein |FAZ“.