From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Capacity Expansions Signal Robust Growth Amidst Stable Plant Activity

Asia’s steel market is poised for growth driven by capacity expansions, particularly in high-value steel segments, according to recent industry announcements. New plant investments and upgrades, as reported in “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” and “Shandong Zhongxin Taps Primetals Technologies for Coupled Pickling Line, Tandem Cold Mill” are anticipated to increase regional steel production. While these developments signal future capacity increases, current plant activity levels, as observed via satellite data, have remained relatively stable. The satellite data does not yet reflect the impact of these capacity investments as they are forward looking.

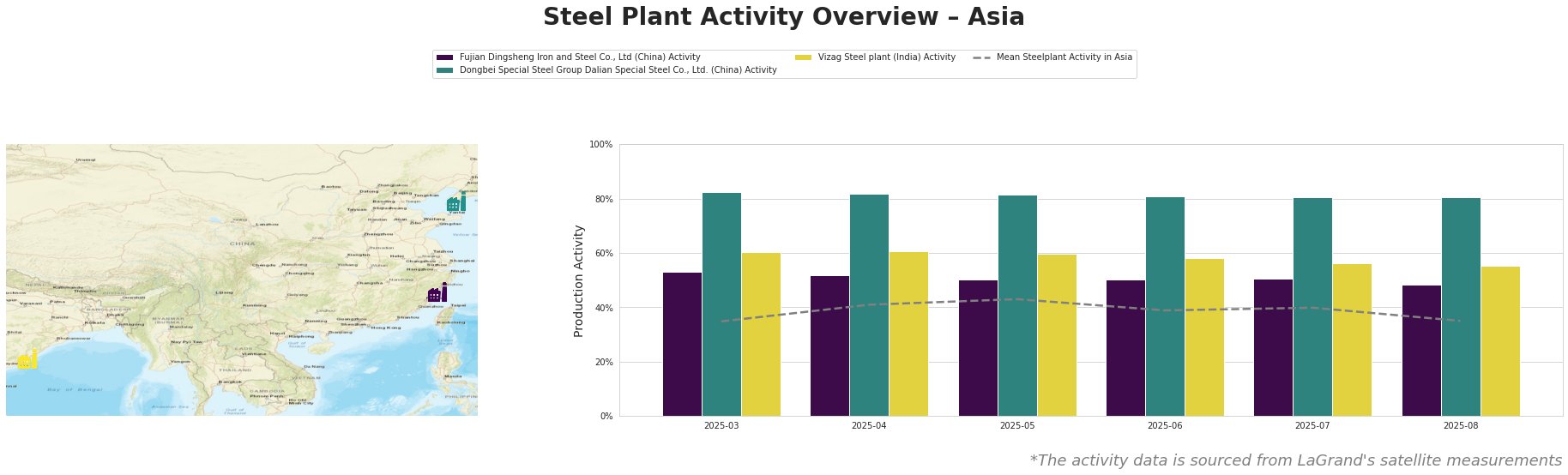

Observed steel plant activity across Asia over the past six months is detailed below:

The mean steel plant activity in Asia fluctuated between 35% and 43% over the observed period. Dongbei Special Steel Group Dalian Special Steel Co., Ltd. consistently operated at significantly higher activity levels, ranging from 81% to 83%, well above the Asian average. Fujian Dingsheng Iron and Steel Co., Ltd. showed a slight decrease from 53% to 48% over the period, while Vizag Steel plant experienced a moderate decline from 60% to 55%. No direct relationship between observed activity levels and the named news articles can be established at this time.

Steel Plant Overviews:

Fujian Dingsheng Iron and Steel Co., Ltd, located in Fujian, China, boasts a crude steel capacity of 1.725 million tonnes per annum (TTPA), all produced via BOF. The plant, known for responsible steel certification, specializes in finished rolled products, including high-quality hot-rolled steel coils, wheel-drawn steel, and medium-thick and wide plates for the automotive and machinery sectors. The satellite observed activity shows a slight decline from 53% in March 2025 to 48% in August 2025. No direct connection between this observed activity and the provided news articles can be established.

Dongbei Special Steel Group Dalian Special Steel Co., Ltd. Situated in Liaoning, China, this integrated steel plant has a crude steel capacity of 1.54 million tonnes and an iron capacity of 1.244 million tonnes via BF. Certified with ISO14001 and ResponsibleSteel, it utilizes BF, BOF, and EAF processes to produce stainless steel bars and wires, as well as automotive steel. Throughout the period of observation, the activity has been stable around 81%-83%. No direct connection between this observed activity and the provided news articles can be established.

Vizag Steel plant, located in Andhra Pradesh, India, is an integrated BF-BOF steel plant with a substantial crude steel capacity of 7.3 million tonnes and an iron capacity of 7.5 million tonnes. While also holding ResponsibleSteel certification, it manufactures semi-finished and finished rolled products like rebar, rounds, wire rod, billets, bar, and specialty steel primarily for the building and infrastructure sectors. Activity declined moderately from 60% to 55% between March and August 2025. No direct connection between this observed activity and the provided news articles can be established.

Evaluated Market Implications and Procurement Actions:

The news articles “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” and “Shandong Zhongxin Taps Primetals Technologies for Coupled Pickling Line, Tandem Cold Mill” indicate a future increase in capacity for high-quality steel products, particularly silicon steel for electric vehicles and high-value-added steel for home appliances and automotive applications. However, these capacity expansions are not yet reflected in current activity levels.

Procurement Actions:

- Silicon Steel Buyers: Given the upcoming capacity for silicon steel production as described in “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group“, steel buyers should proactively engage with ArcelorMittal/China Oriental Group to secure supply agreements ahead of the 2027 projected startup.

- High-Quality Steel Buyers: Considering the investments in pickling and cold rolling mill capacity by Shandong Zhongxin, as detailed in “Shandong Zhongxin Taps Primetals Technologies for Coupled Pickling Line, Tandem Cold Mill“, buyers seeking high-quality steel for home appliances and automotive sectors in eastern China should explore potential partnerships with Shandong Zhongxin to ensure access to future supply.