From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Output Dips: Production Cuts & Plant Activity Analysis – August 2025

China’s steel sector faces headwinds as evidenced by declining output. According to “China’s Crude Steel Output Falls Below 80 Million mt in July, down 3.1% in Jan-July” and “China reduces steel output for the third month in a row“, crude steel production has fallen significantly. While satellite data reveals activity changes at key plants, direct links to the overall output decline aren’t always apparent.

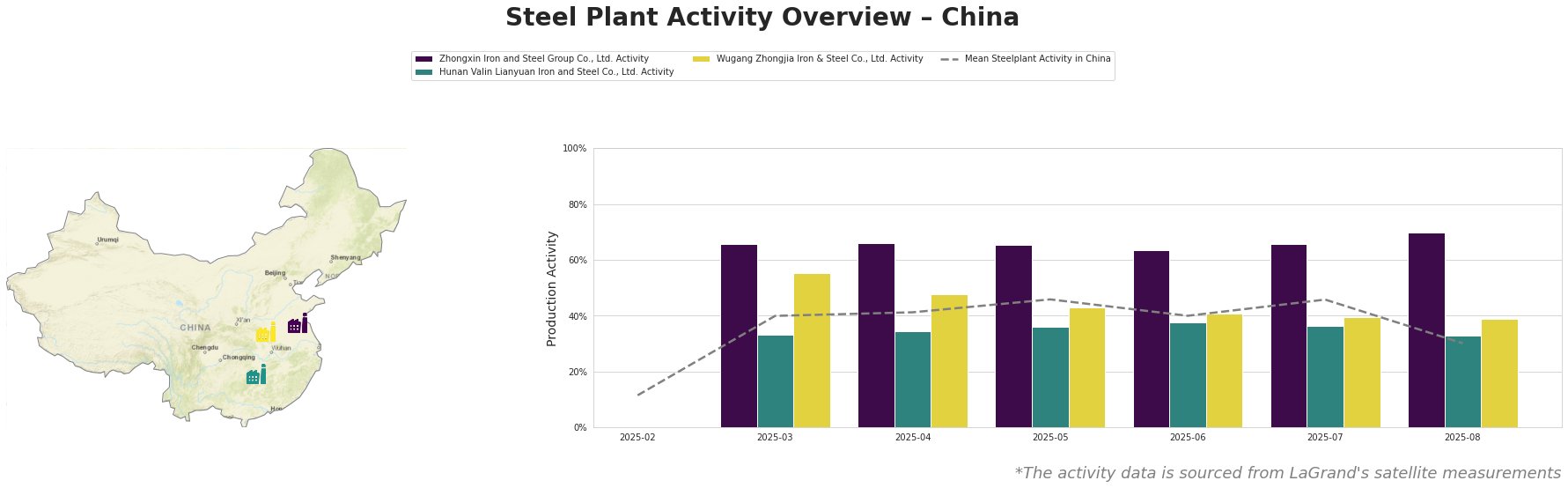

The average steel plant activity in China showed a fluctuating trend from February to August 2025, peaking in May and July at 46% and dropping significantly to 30% in August. This sharp decrease in August’s mean activity may reflect the production cuts mentioned in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July“.

Zhongxin Iron and Steel Group, a Jiangsu-based integrated steel plant with a 5.7 million tonne BOF capacity, showed consistently higher activity than the national average, ranging from 64% to 70% over the observed period. August saw the highest level (70%), a contrast to the national downward trend, and no direct connection could be established with the provided news articles.

Hunan Valin Lianyuan Iron and Steel, a Hunan-based integrated steel plant with a 9 million tonne BOF capacity, displayed activity levels below the national average, peaking at 38% in June, then dropping to 33% in August. There is no direct evidence to link this plant’s activity to the reported production cuts.

Wugang Zhongjia Iron & Steel, a Henan-based ironmaking plant with a 1.22 million tonne BF capacity, also showed activity above the national average, though declining from 55% in March to 39% in August. The reason for this decline is not mentioned in any of the provided articles.

The article titled “China’s iron ore output down 5.4 percent in January-July 2025” indicates a decrease in domestic iron ore production, yet a surge in July output, along with fluctuating import prices. No direct link to individual plant activity can be derived.

Evaluated Market Implications:

The news article “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” explicitly mentions production cuts planned for mid-August in the Beijing-Tianjin-Hebei region. While we cannot directly confirm decreased production at plants, the reduced overall steel production in China, coupled with a sharp dip of steel plant activity in August, suggests potential supply constraints.

Recommended Procurement Actions:

Given the announced production cuts in the Beijing-Tianjin-Hebei region and the decreased average plant activity in August, steel buyers should:

- Prioritize securing supply: Buyers sourcing from the Beijing-Tianjin-Hebei region should proactively engage with suppliers to confirm order fulfillment and delivery timelines.

- Assess inventory levels: Review current inventory levels and consider increasing stock of critical steel products, especially those sourced from potentially affected regions.

- Monitor price trends: Closely monitor steel prices for upward pressure, particularly for products produced in regions subject to production cuts.

- Evaluate alternative suppliers: Identify and qualify alternative steel suppliers outside the Beijing-Tianjin-Hebei region to mitigate potential supply disruptions.