From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Surges: Turkish Imports Soar Amidst Fluctuating Plant Activity

The Asian steel market demonstrates positive sentiment, influenced by strong import activity in Turkey. “Turkey’s billet imports up 59.2 percent in H1 2025” and “Turkey’s CRC imports up 33.5 percent in H1 2025” highlight increased demand for steel products. While increased Turkish imports could imply increased activity at exporter steelplants, based on satellite data, such correlation to selected Chinese steel plants’ activity cannot be directly established based on the provided data, requiring further investigation.

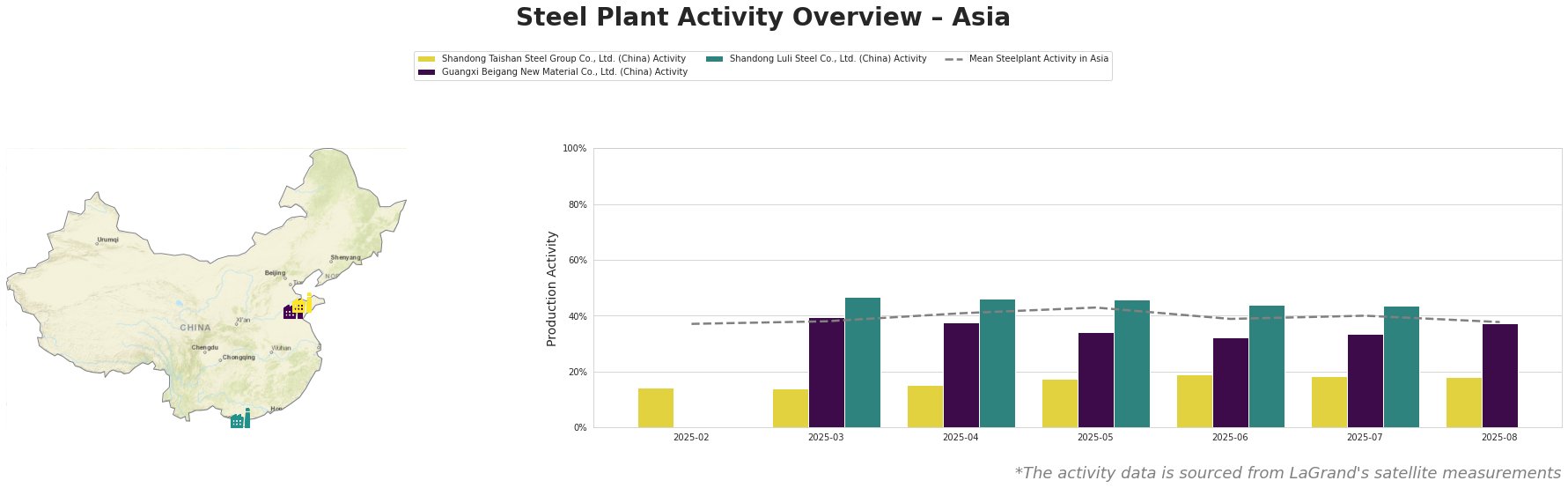

The mean steel plant activity in Asia fluctuated, peaking at 43.0% in May 2025 and settling at 38.0% in August 2025. Shandong Taishan Steel Group Co., Ltd. exhibited a slow but steady increase from 14.0% in February and March to 19.0% in June before declining slightly to 18.0% in July and August. Guangxi Beigang New Material Co., Ltd. saw a peak of 39.0% in March, followed by a decline to 32.0% in June, recovering slightly to 37.0% in August. Shandong Luli Steel Co., Ltd. showed a consistent activity level, fluctuating between 47.0% and 44.0%. While Shandong Luli Steel Co., Ltd. is well above the mean, Shandong Taishan Steel Group Co., Ltd. and Guangxi Beigang New Material Co., Ltd. are significantly underperforming compared to other observed plants.

Shandong Taishan Steel Group Co., Ltd., an integrated BF producer with a 5,000 TPA crude steel capacity, saw a gradual increase in activity from February to June 2025, reaching 19% before declining slightly. While the company produces CRC, matching the increased imports reported in “Turkey’s CRC imports up 33.5 percent in H1 2025,” no direct correlation can be made between the observed activity levels and the news article given that the plant’s CRC production is only a portion of it´s total product portfolio..

Guangxi Beigang New Material Co., Ltd., an integrated BF and EAF producer with 3,400 TPA crude steel capacity including ferronickel, experienced fluctuating activity levels. The plant’s activity decreased from March to June 2025, potentially indicating production adjustments. No direct link can be established between its activity and the provided news articles.

Shandong Luli Steel Co., Ltd., an integrated BF producer focused on semi-finished and finished rolled products with a 1,400 TPA crude steel capacity, maintained relatively consistent activity. This stability suggests consistent demand for its products. However, no specific connection can be established to the provided news articles due to the limited scope of information about specific market segments.

The increased billet and CRC imports in Turkey, as highlighted in “Turkey’s billet imports up 59.2 percent in H1 2025” and “Turkey’s CRC imports up 33.5 percent in H1 2025”, respectively, suggest a strong demand. Steel buyers should monitor the availability of billets and CRC from Malaysia, Russia and China, which were major suppliers to Turkey in H1 2025. Given the increased Turkish demand, analysts should closely monitor US scrap exports, following the trend reported in “US iron and steel scrap exports down 19.1 percent in June 2025“, as it may influence steel production costs, particularly at EAF-based mills. Steel buyers focusing on CRC should diversify their suppliers.