From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Faces Production Dips Amidst Climate Policy Concerns: Monitor Riva Hennigsdorf

In Europe, steel production faces potential challenges due to growing concerns about climate policy impacts and shifting political landscapes. Plant activity data aligns with concerns raised in news articles. Specifically, the union warning of industrial losses due to climate policy, as detailed in “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe” raises concerns that might be reflected in observed plant activity changes, especially in Germany. The ongoing debate about the transition to electric vehicles, as discussed in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert,” can lead to uncertainty in demand from the automotive sector, impacting steel production. However, no direct link between these news articles and specific plant activity levels can be explicitly established from the provided data.

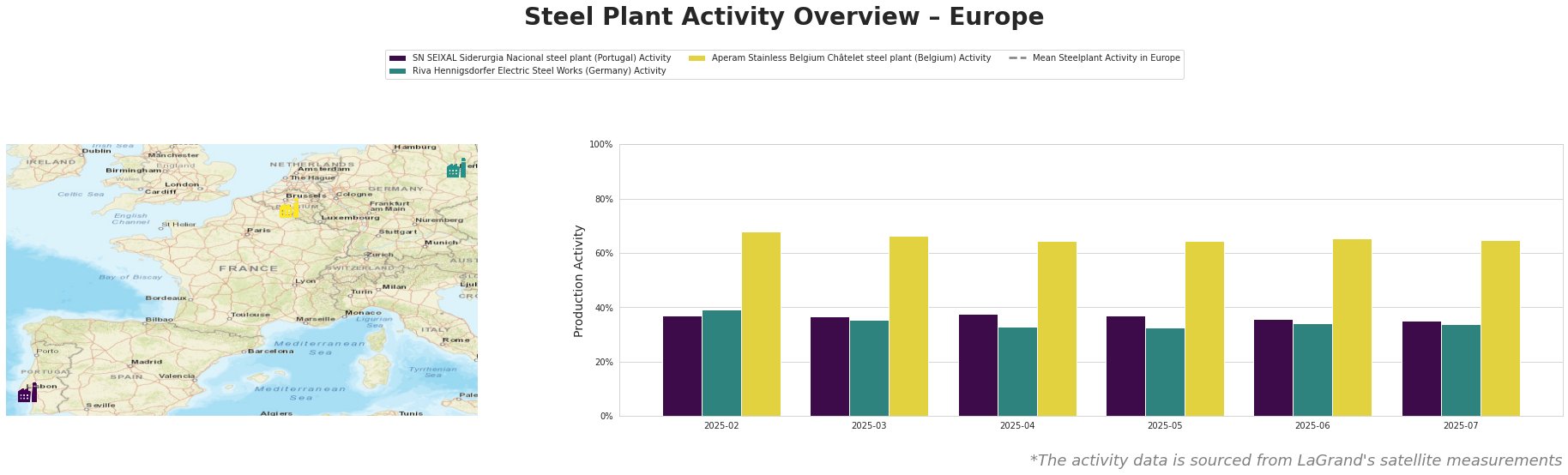

The provided data shows fluctuating, and primarily declining plant activity levels across the observed steel plants. No consistent upward trends are observed. From February to July 2025, SN SEIXAL Siderurgia Nacional steel plant in Portugal experienced a slight overall decrease, from 37% to 35%. Riva Hennigsdorfer Electric Steel Works in Germany saw a decrease from 39% in February to 34% in July. Aperam Stainless Belgium Châtelet steel plant showed a decrease from 68% in February to 65% in July. The mean steelplant activity in Europe is negative and fluctuating wildly across the provided data set, however, it is unclear what the negative values represent or how they should be interpreted.

SN SEIXAL Siderurgia Nacional, a Portuguese steel plant with a 1.1 million tonne EAF capacity, produces semi-finished and finished rolled products like mesh, wire, and hot-rolled coils. Its activity decreased slightly from 37% in February to 35% in July. There is no direct correlation that can be drawn between this activity and the named news articles.

Riva Hennigsdorfer Electric Steel Works, a German EAF-based plant with a 1 million tonne capacity, produces steel billets, rebar, and round steel, with a focus on the automotive sector. Its activity decreased from 39% in February to 34% in July. Given the plant’s focus on the automotive sector and the concerns raised in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert,” about the future of combustion engines, the activity reduction might reflect uncertainty in future demand. However, it is important to note that no direct connection can be explicitly established with the provided data.

Aperam Stainless Belgium Châtelet, a Belgian EAF-based stainless steel producer with a 1 million tonne capacity, produces slabs and cold-rolled products. The plant’s activity decreased from 68% in February to 65% in July. No direct connection can be established between this activity and the named news articles.

Given the activity decrease at Riva Hennigsdorfer Electric Steel Works and the uncertainty surrounding the automotive industry due to the planned combustion engine ban as outlined in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert“, steel buyers should monitor Riva Hennigsdorf closely for potential supply disruptions. Consider diversifying rebar and round steel supply sources, especially those serving the automotive sector, to mitigate potential risks associated with production cuts. Closely monitor further announcements of EU policy and German national reaction, as discussed in “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe“.