From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Surges on Green Initiatives: ArcelorMittal & SSAB Drive Optimism Amidst Stable Plant Activity

Europe’s steel market displays a very positive sentiment, fueled by decarbonization efforts. “Germany’s EMW, SSAB enter partnership for fossil-free steel” and “ArcelorMittal expands support for the LESS green steel standard” signal a strong shift towards low-emission steel. While these initiatives point to increasing demand, no direct correlation with immediate, measurable shifts in the satellite-observed steel plant activity could be established.

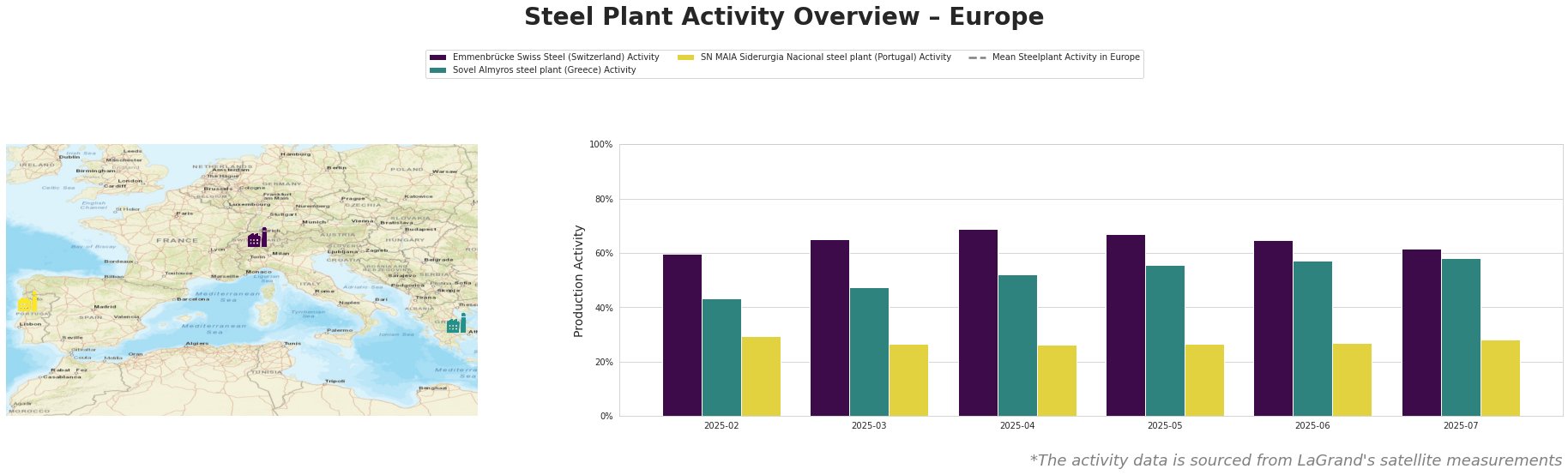

Recent monthly activity trends across selected European steel plants:

Activity at Emmenbrücke Swiss Steel, an EAF-based plant with ResponsibleSteel Certification, fluctuated, peaking at 69% in April before dropping to 62% in July. This slight decrease does not seem directly related to the news of SSAB’s fossil-free steel partnership with EMW (“Germany’s EMW, SSAB enter partnership for fossil-free steel”), as the partnership is focused on future deliveries. The Sovel Almyros steel plant, an EAF-based plant in Greece producing rebar and other finished rolled products, exhibited a steady increase in activity, reaching 58% in July. No direct link can be made between this trend and the provided news articles. Similarly, SN MAIA Siderurgia Nacional, a Portuguese EAF-based rebar producer, showed relatively stable activity levels around 27-29%, without any immediately apparent correlation to the market-wide decarbonization news.

ArcelorMittal’s expanded commitment to the LESS standard, as detailed in “ArcelorMittal expands support for the LESS green steel standard” and “ArcelorMittal expands commitment to low-carbon steel with LESS membership across Europe“, indicates a strategic shift that may affect future supply dynamics, particularly for XCarb® products.

Evaluated Market Implications:

While overall plant activity remains relatively stable, the growing adoption of the LESS standard and partnerships for fossil-free steel suggest a future shift in supply towards low-emission options.

Recommended Procurement Actions:

- Prioritize relationships with suppliers committed to low-emission steel standards. Given ArcelorMittal’s active promotion of the LESS standard (“ArcelorMittal Increases Low Emission Steel Standard Support” and “ArcelorMittal expands support for the LESS green steel standard”) and their increasing XCarb® production, steel buyers should proactively engage with ArcelorMittal to secure future access to these products.

- Monitor policy developments. The EU’s Industrial Decarbonization Accelerator Act, as mentioned in “ArcelorMittal expands commitment to low-carbon steel with LESS membership across Europe”, could significantly impact demand for low-carbon steel. Stay informed about these developments and their potential impact on steel pricing and availability.

- Assess the long-term impact of SSAB’s fossil-free steel partnership with EMW. (“Germany’s EMW, SSAB enter partnership for fossil-free steel”) Although the partnership focuses on future deliveries, it represents a potential disruption to traditional supply chains. Steel buyers should monitor the progress of this partnership and its implications for the availability of fossil-free steel in the automotive industry.