From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals Amidst US Tariff Concerns and Varying Plant Activity

The Asian steel market shows a neutral outlook, with activity levels fluctuating amidst global trade uncertainties. The provided FAZ news articles concerning “Trumps US-Zölle im Liveticker” highlight ongoing concerns about US tariffs and their potential impact on global trade, particularly for European and potentially Chinese economies. However, a direct correlation between these specific tariff concerns and the satellite-observed activity changes in the selected Asian steel plants cannot be explicitly established from the available data.

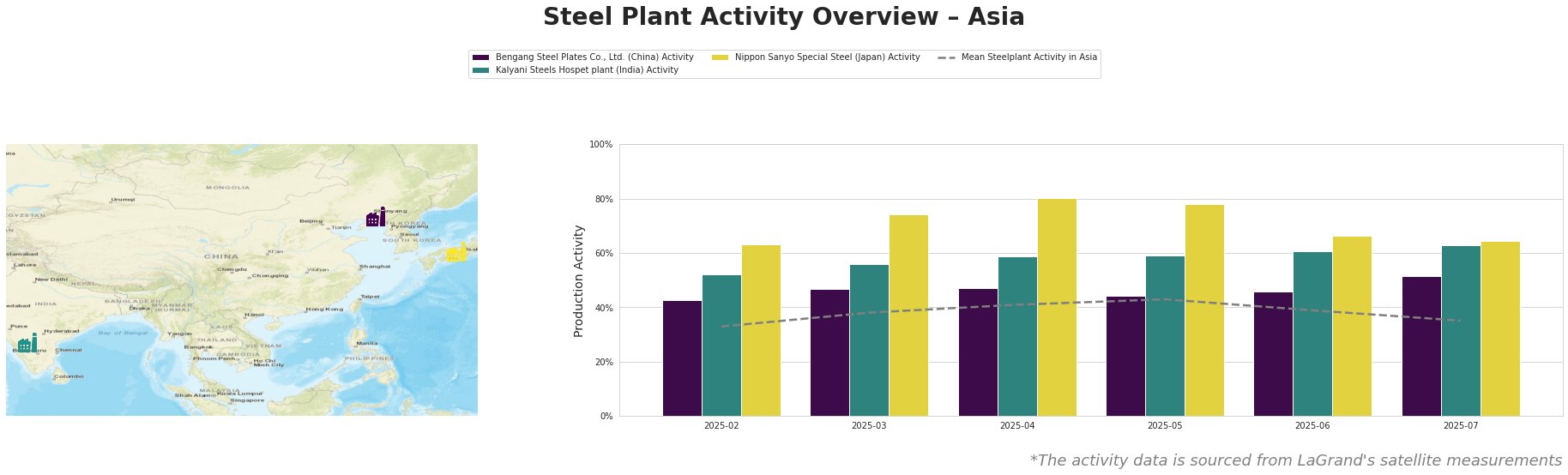

The mean steel plant activity in Asia peaked in May 2025 at 43% before declining to 35% in July 2025. This overall decrease may reflect broader market uncertainty, but cannot be directly attributed to the news articles provided on US tariffs.

Bengang Steel Plates Co., Ltd., a major integrated steel producer in Liaoning, China, with a crude steel capacity of 12.8 million tonnes, showed a fluctuating activity pattern. Activity dipped to 44% in May 2025 before increasing to 51% in July. This rise occurs during the same period that the FAZ articles report on potential impacts to the German economy based on US tariffs and ongoing negotiations with China. Although Bengang Steel Plates focuses on automotive plates, appliance plates, and pipeline steel, it is difficult to directly relate this isolated activity increase to the US tariff news alone, as China is repeatedly mentioned.

Kalyani Steels Hospet plant, an integrated steel plant in Karnataka, India, with both BF and DRI based production, experienced a consistent increase in activity. Its activity rose from 52% in February 2025 to 63% in July 2025, consistently outperforming the Asian average. This indicates a strong local demand or successful export strategy, however, no direct link can be established with the FAZ news articles related to US tariffs.

Nippon Sanyo Special Steel, a Japanese electric arc furnace (EAF) based special steel producer, exhibited the highest activity levels among the observed plants. Activity peaked at 80% in April 2025 and then slightly decreased to 64% in July 2025. This decline coincides with growing fears over global trade and potentially related damage to Germany described in “Trumps US-Zölle im Liveticker: | FAZ: Merz: Deutsche Wirtschaft wird erheblichen Schaden nehmen durch Zölle“. As Nippon Sanyo supplies the automotive industry, its activity may be affected.

Given the mixed signals and the potential for indirect impacts from US tariff policies as described in the FAZ news articles, steel buyers should:

- Monitor Price Volatility: Closely track price fluctuations, particularly for automotive and appliance-grade steel, considering the Bengang Steel Plates’ activity and the concerns raised in the FAZ articles concerning US tariffs’ effects on the automotive sector.

- Evaluate Inventory Strategy: Given the uncertainty, buyers relying on Nippon Sanyo Special Steel should explore flexible inventory strategies to mitigate risks associated with potential further activity decreases, acknowledging their exposure to automotive and machinery sectors that may be indirectly impacted by global trade tensions.