From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Amid Trade Jitters: Plant Activity Stable Despite Tariff Concerns

Asia’s steel market demonstrates resilience amidst global trade uncertainties, as indicated by stable plant activity levels. The steel market is currently affected by trade tensions between the US and EU, detailed in articles like “Stock market today: Dow, S&P 500, Nasdaq futures inch higher ahead of tech earnings as tariff deadline looms” and “US stock futures dip with earnings, tariff talks in focus,” impacting broader market sentiment. While no direct link between trade concerns and steel plant activities can be explicitly established from the provided data, it’s important to monitor closely how escalating tariffs might influence future output and demand.

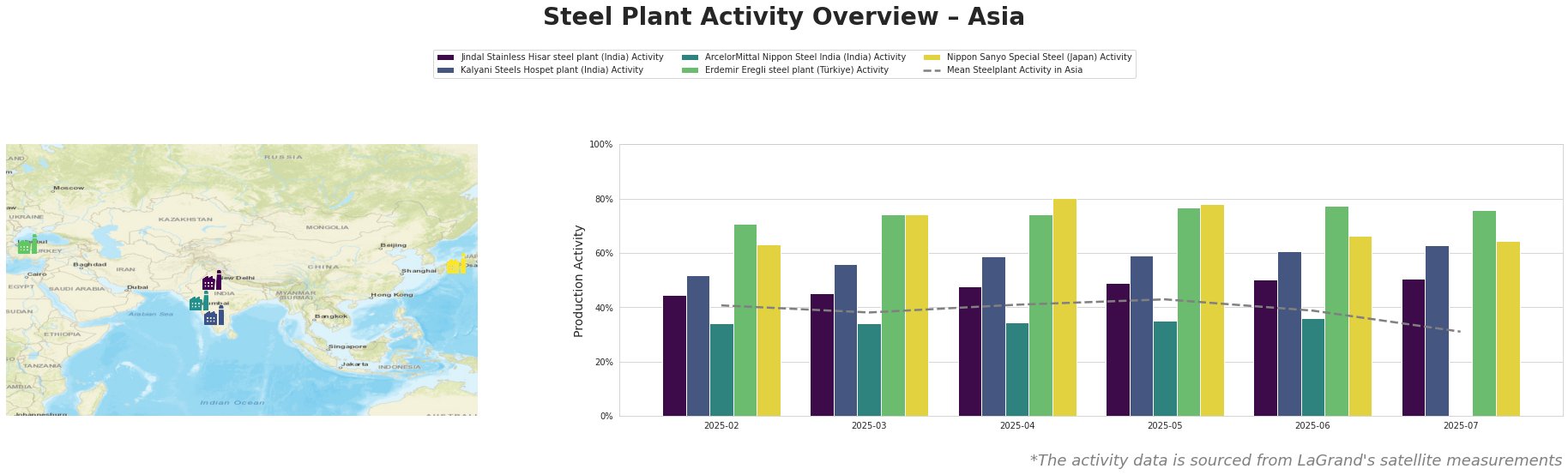

The mean steel plant activity in Asia has fluctuated between 31% and 43% from February to July 2025, with a noticeable dip to 31% in July. This decrease is likely due to various market and economic factors, which are not explicitly specified in the provided news articles.

Jindal Stainless Hisar steel plant (India), an EAF-based plant with an 800 ttpa capacity specializing in stainless steel products, has steadily increased its activity, rising from 45% in February to 51% in July. This increase is above the Asian average, but no direct relationship can be established with any of the provided news articles.

Kalyani Steels Hospet plant (India), an integrated BF and DRI plant with an 860 ttpa crude steel capacity, has shown a consistent increase in activity, reaching 63% in July, significantly above the regional average. This increase, which is not explained in the available articles, might suggest strong domestic demand or efficient operations.

ArcelorMittal Nippon Steel India (India), with a substantial 9600 ttpa crude steel capacity utilizing both BF and DRI, shows a stable activity level around 35% -36% during the reported period. Activity data for July is missing. The Stock market today: Nasdaq, S&P 500 slide amid wave of earnings as tariffs bite GM profit article mentions tariffs impacting General Motors’ profits, demonstrating the potential impact of global trade tensions on industrial output. However, no direct connection can be established between these tariffs and plant activity..

Erdemir Eregli steel plant (Türkiye), a large integrated BF-BOF plant with a 4000 ttpa capacity, maintained high activity, ranging from 71% to 77%. This sustained level indicates strong production, but again, no explicit link to the news articles can be made.

Nippon Sanyo Special Steel (Japan), an EAF-based plant with a 1596 ttpa capacity, experienced fluctuations, peaking at 80% in April but dropping to 64% in July. This plant produces specialty steel and its activity may reflect specific sector demands. However, no direct link to the news articles can be established.

Evaluated Market Implications:

While overall plant activity remains relatively stable, the potential for future supply chain disruptions exists, particularly given that the article “Stock market today: Nasdaq, S&P 500 slide amid wave of earnings as tariffs bite GM profit” highlights the detrimental effects of tariffs on corporate profitability, potentially influencing future production decisions. ArcelorMittal Nippon Steel India activity shows stable activity, but potential trade impacts need monitoring. Given the high and stable activity at Erdemir Eregli (Türkiye), procurement professionals could potentially secure supply from this source, although geopolitical considerations should also factor into this decision. It’s important to note that there is a missing data point for ArcelorMittal Nippon Steel India.

Recommended Procurement Actions: Steel buyers should closely monitor trade negotiations and their potential impact, especially on steel prices and supply chains. Given the upcoming tariff deadlines mentioned in “US stock futures dip with earnings, tariff talks in focus,” consider negotiating flexible contracts with suppliers that allow for adjustments based on tariff changes, especially when sourcing from or through regions involved in trade disputes.