From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Imports Surge Amid Scrap Export Growth – Activity Stable

Ukraine’s steel market presents a mixed picture, characterized by increasing import pressure and robust scrap exports, while plant activity remains relatively stable. The rise in imports, as highlighted in “Ukraine increased imports of long rolled products by 63% y/y in January-June” and “In January-June, Ukraine increased imports of long rolled products by 63%,” could pose challenges for domestic producers. Concurrently, the surge in scrap exports, detailed in “Scrap exports from Ukraine reached 47.7 thousand tons in June” and “Scrap exports from Ukraine have increased by 63.4% since the beginning of the year.%,” raises questions about resource allocation. Direct linkages between plant activity and these news articles are not immediately apparent from the satellite data.

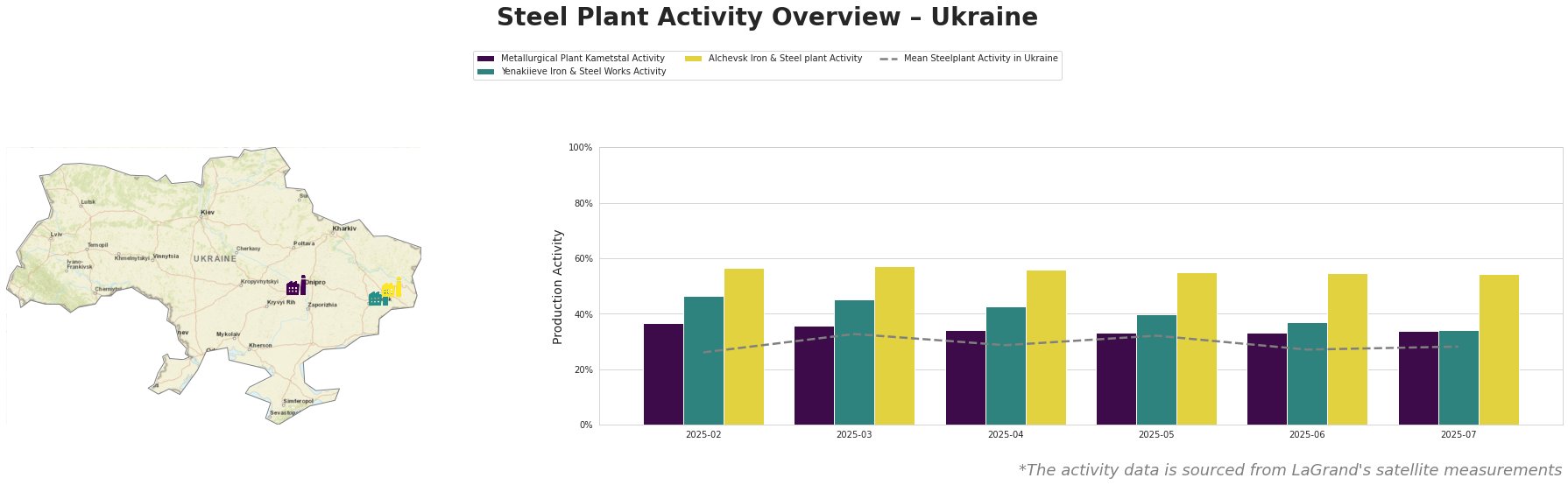

Here’s a summary of measured plant activity:

The average steel plant activity in Ukraine fluctuated between 26% and 33% from February to July 2025, showing a relatively stable trend. Metallurgical Plant Kametstal generally operated above the average, while Yenakiieve Iron & Steel Works and Alchevsk Iron & Steel plant also maintained levels above the average. Yenakiieve Iron & Steel Works saw a notable drop in activity from 46% in February to 34% in July. No direct connection between this drop and the named news articles can be explicitly established.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, possesses a crude steel capacity of 4.2 million tonnes per annum (TPA) using basic oxygen furnace (BOF) technology. Its main products include semi-finished and finished rolled steel, serving the energy and transport sectors. Activity at Kametstal remained relatively stable, ranging from 33% to 37%. No explicit link can be made between this observed stability and recent news articles.

Yenakiieve Iron & Steel Works, situated in Donetsk, has a crude steel capacity of 3.3 million TPA, also relying on BOF technology. It produces semi-finished and finished rolled products, including rebar and structural shapes. The observed activity decrease from 46% in February to 34% in July may warrant further investigation but cannot be directly linked to the provided news articles concerning imports or scrap exports.

Alchevsk Iron & Steel plant, located in Luhansk, boasts a larger crude steel capacity of 5.472 million TPA, utilizing BOF technology. Its product range includes slabs, square billets, and structural shapes. Activity at Alchevsk Iron & Steel plant consistently remained the highest among the observed plants, fluctuating narrowly between 57% and 54%. No direct connection between this relatively high level of activity and the content of the provided news articles can be established.

Given the rising import pressure documented in “Ukraine increased imports of long rolled products by 63% y/y in January-June” and “In January-June, Ukraine increased imports of long rolled products by 63%,” steel buyers should closely monitor price trends, particularly from Turkish and Chinese suppliers of long rolled products. Procurement professionals sourcing angles, shaped profiles, and carbon steel bars should proactively explore import options to leverage potentially lower prices. Based on the news articles “Scrap exports from Ukraine reached 47.7 thousand tons in June” and “Scrap exports from Ukraine have increased by 63.4% since the beginning of the year.%“, keep close watch on the potential implementation of export restrictions/licensing on Scrap, which could have a knock-on effect on domestic prices.