From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Divergence Amidst Global Price Pressures

Asia’s steel market presents a mixed picture, with diverging production activity observed across key plants despite global price pressures and import dynamics impacting Europe, as highlighted in “Prices for Brazilian slabs fell by 5% in June” and “EU HRC imports rise in May“. While European dynamics have an influence on broader trends, no direct connection to Asia could be established based on provided data.

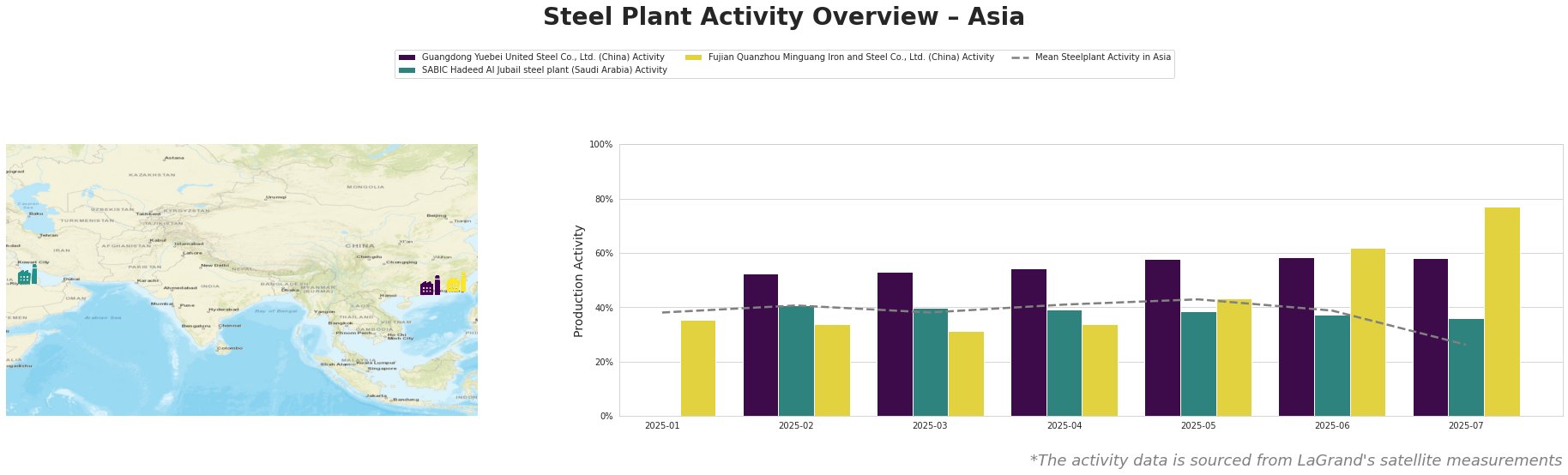

Recent activity levels, observed via satellite, are as follows:

The mean steel plant activity in Asia has shown a significant drop in July, falling to 26% after hovering between 38% and 43% in the preceding months. Guangdong Yuebei United Steel Co., Ltd. maintained a consistently high activity level around 50%, peaking at 58% since May. SABIC Hadeed Al Jubail steel plant has seen a gradual decline, reaching 36% in July. In contrast, Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a notable increase, surging to 77% in July.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based plant with a crude steel capacity of 2000ktpa, has maintained a steady activity level at 58% since May 2025, significantly above the Asian average. The plant focuses on finished rolled products, specifically rebar, for the building and infrastructure sector. No direct connection could be established between this steady activity and the provided news articles.

SABIC Hadeed Al Jubail steel plant, with a crude steel capacity of 6000ktpa and utilizing DRI and EAF technology, has experienced a decline in activity from 41% in February to 36% in July. This plant produces a wide range of products from semi-finished (slab, billet) to finished rolled products, including rebar, HRC, and coated coils. No direct connection can be established between this decline and the provided news articles concerning European market dynamics.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-based plant producing 2550ktpa of crude steel, mainly round bar, coiled rebar and wire rod, has shown a significant increase in activity, reaching 77% in July. This rise contrasts with the overall decline in Asian activity. No direct connection could be established between this increased activity and the provided news articles.

The significant drop in average Asian steel plant activity, coupled with diverging trends at individual plants, warrants careful consideration. While “Prices for Brazilian slabs fell by 5% in June” highlights price pressures, and “EU HRC imports rise in May” discusses import dynamics in Europe, the local production shift in Asia is largely uncorrelated to the provided news. For steel buyers focusing on rebar, maintaining close contact with Fujian Quanzhou Minguang Iron and Steel Co., Ltd. may provide a more secure supply chain than relying on broad Asian averages. However, caution should be exercised regarding broader slab and HRC procurement strategies given general price volatility.