From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCanada’s Steel Tariffs Drive Mixed Signals: Activity Shifts Amidst Import Protection

Canada’s steel market faces shifts due to recently introduced trade measures. These measures, as reported in “Canada introduces new tariffs, investment plan to support steel industry,” “Canada announces new tariff measures on imported steel to protect domestic industry,” and “Canada strengthens the system of tariff quotas for steel imports,” aim to bolster domestic production. While the ArcelorMittal Montreal steel plant shows consistent activity levels, the Liberty Steel Georgetown plant exhibits a significant decline, and a clear relationship between those drops and recent news developments cannot be established.

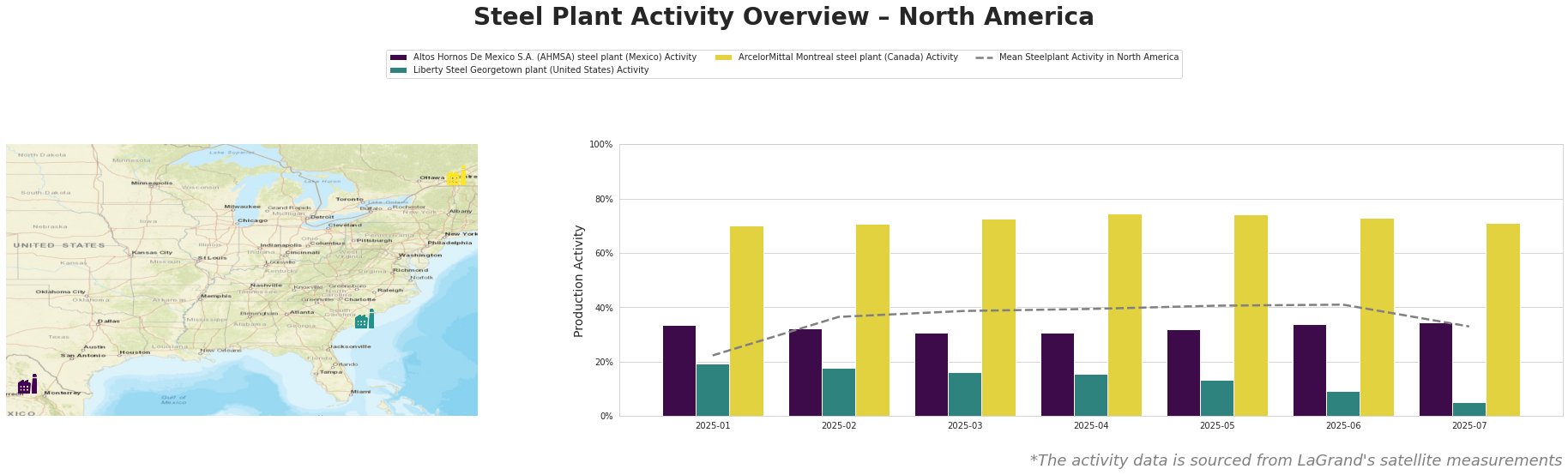

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

From January to June 2025, the Mean Steelplant Activity in North America increased from 22% to 41%. However, it decreased to 33% in July. Altos Hornos De Mexico S.A. shows a relatively stable activity between 31% and 35%. Liberty Steel Georgetown plant activity dropped significantly, falling from 19% in January to only 5% in July. In contrast, ArcelorMittal Montreal steel plant has been operating at consistently high levels, fluctuating only slightly between 70% and 74%.

Altos Hornos De Mexico S.A. (AHMSA), an integrated steel plant in Coahuila, Mexico, relies on BF/BOF and EAF processes for its 5.5 million tonnes per annum (ttpa) crude steel production. While satellite data indicates a stable activity trend, the news articles regarding Canada’s tariffs and investment plans do not directly address the Mexican steel industry, so no direct connection can be established.

Liberty Steel Georgetown, an EAF-based plant in South Carolina, has a crude steel capacity of 908 ttpa, primarily producing semi-finished and finished rolled products. Its activity has declined significantly, dropping from 19% in January 2025 to 5% by July 2025. This decline contrasts with the overall positive market sentiment driven by Canadian trade actions, and no direct relationship between this decline and the Canadian steel market could be established based on the provided news articles.

ArcelorMittal Montreal is an integrated DRI-EAF steel plant located in Quebec, Canada, with a crude steel capacity of 2.4 million tonnes per annum, producing special quality bars, reinforcing bars, and wire rod. The plant’s high and consistent activity levels, consistently above 70% throughout the observed period, likely reflect Canada’s efforts to protect its domestic industry, as highlighted in the news articles “Canada introduces new tariffs, investment plan to support steel industry,” “Canada announces new tariff measures on imported steel to protect domestic industry,” “Canada strengthens the system of tariff quotas for steel imports“, and “Canada announces new measures to protect steel industry“. The plant’s output will likely be favored in Canadian procurement efforts.

Evaluated Market Implications:

The measures described in “Canada strengthens the system of tariff quotas for steel imports” are designed to limit import volumes and incentivize the use of domestic steel. Given the consistent high activity observed at ArcelorMittal Montreal, Canadian steel buyers should consider securing supply agreements with this plant and other Canadian producers to mitigate potential disruptions caused by import restrictions. The decline in activity at Liberty Steel Georgetown could indicate localized challenges unrelated to the Canadian market intervention; steel buyers relying on this plant should evaluate alternative suppliers to ensure continuity.