From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges Amidst China’s Green Mandates: Activity and Procurement Insights

Asia’s steel market displays very positive sentiment, influenced by China’s aggressive push for renewable energy in industrial sectors. According to the news articles “China expands green energy targets in industrial sectors,” “China has ordered industrial giants to switch to renewable energy,” and “China mandates renewable power use for industry,” steel producers now face mandates to increase renewable energy consumption. While these policy shifts are expected to drive long-term sustainability, their short-term impact on steel production and costs remains to be seen, with no immediate connection to current observed satellite activity levels.

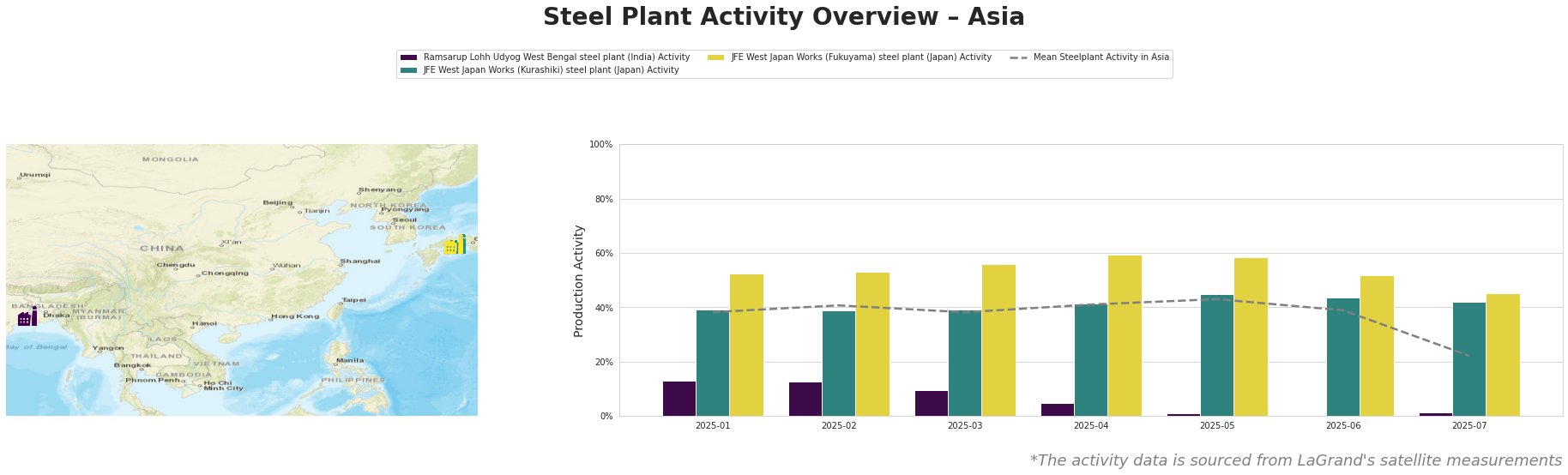

The mean steel plant activity across Asia peaked in May at 43% and sharply decreased to 22% in July. Activity levels at individual plants show diverse trends. Ramsarup Lohh Udyog in West Bengal, India, experienced a continuous decline from 13% in January to 0% in June, with a slight increase to 1% in July. JFE West Japan Works (Kurashiki) in Japan showed a more stable trend, fluctuating between 39% and 45% before dropping to 42% in July. JFE West Japan Works (Fukuyama) also exhibited stability, ranging from 52% to 59% before decreasing to 45% in July. The cause for this drop in average activity at all locations is not directly linked to any of the provided news articles.

Ramsarup Lohh Udyog, a steel plant in West Bengal, India, operates with integrated BF and DRI processes, alongside an EAF, producing semi-finished and finished rolled products for the energy sector. The plant’s activity has plummeted to near zero by June 2025 and remains at only 1% in July, significantly below the Asian average. The dramatic decrease is not directly attributable to the green energy mandates described in “China expands green energy targets in industrial sectors,” “China has ordered industrial giants to switch to renewable energy,” and “China mandates renewable power use for industry“.

JFE West Japan Works (Kurashiki), located in the Chūgoku region of Japan, is an integrated BF steel plant producing a diverse range of flat and long steel products for various sectors, including automotive and infrastructure. The plant’s activity remained relatively stable, between 39% and 45%, during the first half of 2025, ending on a low of 42% in July, indicating consistent production levels, albeit also undergoing a drop in July. There is no established connection between this stable trend and the news articles on China’s green energy policy.

JFE West Japan Works (Fukuyama), also in the Chūgoku region of Japan, operates as an integrated BF steel plant, similar to the Kurashiki plant. Its activity was relatively stable during the first half of 2025, decreasing from 59% to 45% in July, indicating consistent production, with a drop in July similar to other plant activities. The stable trend and slight drop in July do not show a direct relationship to the provided news articles on China’s green energy mandates.

The aggressive renewable energy mandates in China, highlighted in “China expands green energy targets in industrial sectors,” “China has ordered industrial giants to switch to renewable energy,” and “China mandates renewable power use for industry,” are likely to increase demand for green electricity certificates (GECs) and potentially increase production costs for Chinese steelmakers. While there is no direct link between the policy shifts and the satellite observed activity data, steel buyers should monitor price developments closely, especially for steel sourced from regions heavily impacted by these mandates. Specifically, procurement professionals should consider diversifying their sourcing strategies, potentially increasing reliance on Japanese steel producers like JFE, where production levels appear more stable, to mitigate potential supply disruptions caused by the drop in production in July or the increased costs associated with China’s green energy transition. Given the recent significant drop in the overall average steel plant activity in Asia for July, buyers should monitor the supply situation closely and be prepared for potential price increases from all sources.