From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Booming: Automotive and Electrical Steel Production Surge Amidst New Plant Investments

China’s steel market demonstrates strong growth, particularly in automotive and electrical steel sectors, driven by new plant investments and upgrades. Activity level insights at select plants are mixed, with Jianglong Acheng Iron & Steel showing strong performance, while other plants show dips in July 2025 that don’t explicitly correlate with the provided news articles. New plant investments at Ansteel Group described in “ANDRITZ receives final acceptance for cold rolling mill from Ansteel Group, China” and “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group” are geared towards high-strength automotive steel and titanium alloy strips, indicating increased capacity and modernization. Similarly, the ArcelorMittal/China Oriental Group joint venture’s investment in a silicon steel processing plant detailed in “ArcelorMittal/China Oriental Group JV orders high-end silicon steel processing plant from ANDRITZ” and “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” aims to meet the growing demand for electrical steel in electric vehicles and transformers, supporting China’s shift to sustainable production.

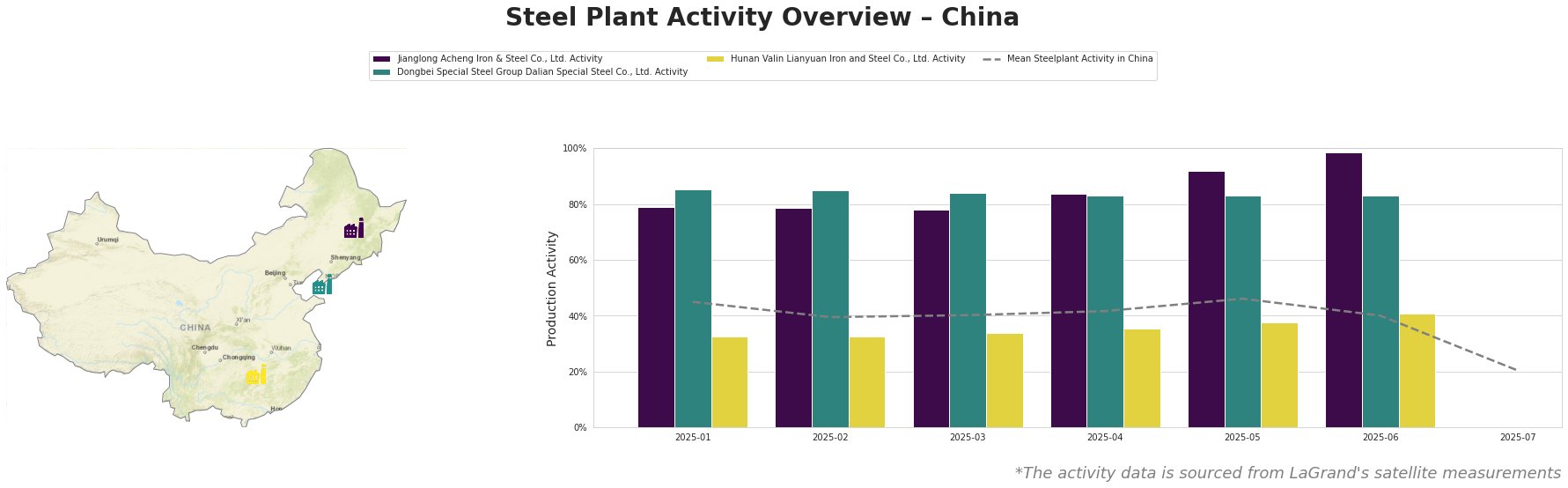

From January to June 2025, the mean steel plant activity in China fluctuated, peaking at 46% in May and dropping to 40% in June before experiencing a sharp decrease to 20% in July. Jianglong Acheng Iron & Steel consistently operated well above the mean, reaching a high of 99% activity in June, though July data is unavailable. Dongbei Special Steel Group Dalian Special Steel maintained a consistently high activity level, between 83% and 85%, across the observed period. Hunan Valin Lianyuan Iron and Steel operated below the mean, with activity gradually increasing from 32% in January to 41% in June, with no data available for July. The significant drop in overall mean activity in July cannot be directly linked to the provided news articles, as they primarily concern capacity expansions and new plant construction.

Jianglong Acheng Iron & Steel Co., Ltd., an integrated steel plant in Heilongjiang with a capacity of 1.1 million tonnes of crude steel and 1 million tonnes of iron produced via BOF and BF technologies, respectively, maintained exceptionally high activity levels throughout the first half of 2025, peaking at 99% in June. This level of activity points to robust demand for its hot-rolled and coated steel products, primarily serving the automotive, energy, and machinery sectors. Given the absence of reported disruptions and the consistent high activity, no immediate supply concerns related to this plant are apparent based on the provided information.

Dongbei Special Steel Group Dalian Special Steel Co., Ltd., located in Liaoning, is another integrated steel plant that produces 1.54 million tonnes of crude steel and 1.244 million tonnes of iron using BF, BOF, and EAF technologies. The plant maintained a stable and high activity level throughout the observed period, ranging from 83% to 85%, highlighting steady production of stainless steel bars and wires, and automotive steel. Like Jianglong Acheng Iron & Steel, the absence of any reported disruptions and steady activity suggests no immediate supply concerns from this plant.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a large integrated steel plant in Hunan with a capacity of 9 million tonnes of crude steel and 7.3 million tonnes of iron, showed increasing activity from January to June, reaching 41% in June. The plant is a key producer of electric steel and automotive steel, including hot-rolled, cold-rolled, and coated products, along with specialized steels for shipbuilding, bridges, and pipelines. The plant’s gradual increase in activity may indicate a recovery in demand or improved operational efficiency. The absence of July data limits further conclusions about potential disruptions.

The significant investments in new silicon steel production capacity by ArcelorMittal/China Oriental Group suggest a potential shift in the competitive landscape for electrical steel, particularly for the electric vehicle (EV) market. Procurement professionals should closely monitor the commissioning and ramp-up of the new plant, as described in “ArcelorMittal/China Oriental Group JV orders high-end silicon steel processing plant from ANDRITZ” and “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group“, scheduled for the end of 2025. Consider diversifying suppliers to include this new capacity once it becomes operational, to secure a supply of high-efficiency electrical steel for EV motor applications. Given Ansteel’s expansion into high-strength automotive steel as per “ANDRITZ receives final acceptance for cold rolling mill from Ansteel Group, China” and “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group“, buyers should investigate potential cost-effective sourcing options for high-strength steel grades tailored for automotive applications. The July 2025 data drop may warrant a careful assessment of supply chain risks and alternative supplier evaluation.