From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Resilient Despite EU Trade Tensions: Izmir Plant Hits Peak Output, Vizag Slowdown Observed

Asia’s steel market exhibits resilience amidst potential trade disruptions stemming from EU safeguard measures. Increased activity in the Kardemir Celik Sanayi Izmir steel plant coincides with heightened protectionist sentiment in Europe, as highlighted in “EUROMETAL 75th Anniversary: EU steel producers seek early safeguard replacement” and other Eurofer announcements, although a direct link between these events cannot be explicitly established. However, a decline in activity at Vizag Steel plant may presage shifting market dynamics.

Measured Activity Overview

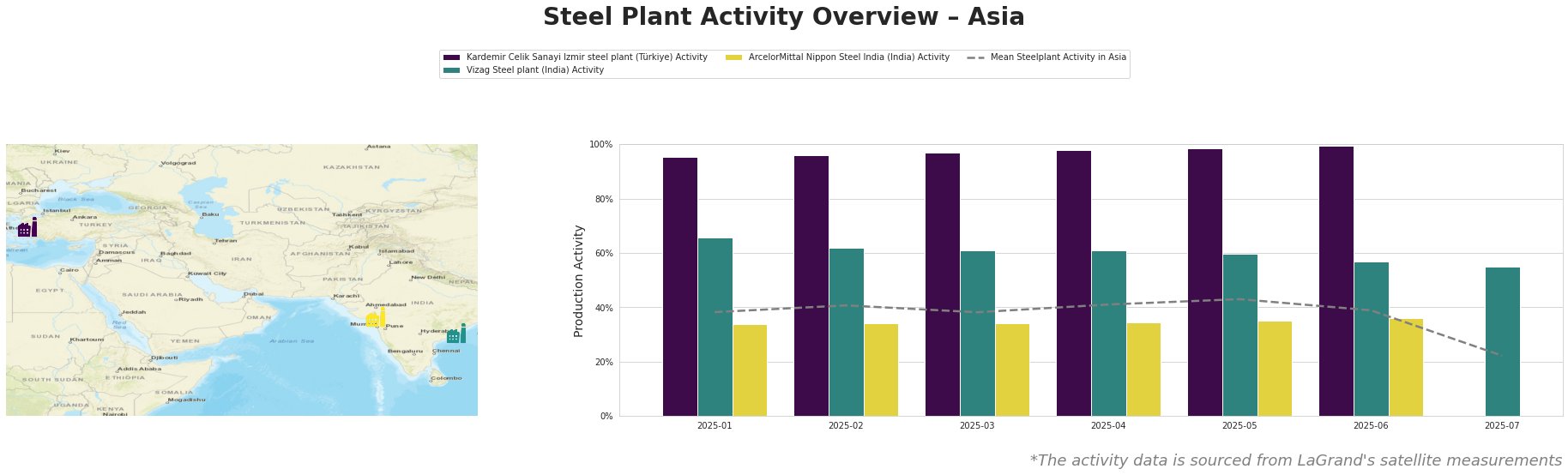

The mean steel plant activity in Asia has shown a general trend upwards from January (38.0%) to May (43.0%), before decreasing in June (39.0%) and sharply dropping in July to 22.0%. The Kardemir Celik Sanayi Izmir steel plant consistently operated at very high levels, steadily climbing to reach peak activity in June (100%) which is markedly above the Asian mean. Vizag Steel plant activity has consistently decreased from January (66.0%) to July (55.0%), whilst remaining above the Asian average. ArcelorMittal Nippon Steel India activity remained relatively stable from January (34.0%) to June (36.0%), consistently below the Asian mean.

Steel Plant Analysis

Kardemir Celik Sanayi Izmir steel plant, located in İzmir, Türkiye, is a significant producer of finished rolled steel products, primarily utilizing electric arc furnace (EAF) technology with a crude steel capacity of 1.25 million tonnes per annum (MTPA). Its activity levels steadily climbed to a peak in June 2025 (100%), significantly exceeding the Asian average and indicating robust production. This surge might be indirectly related to the concerns voiced by European steelmakers in “EUROMETAL 75th Anniversary: EU steel producers seek early safeguard replacement” regarding competitive pressure from exporters, but a direct link cannot be established based on available information.

Vizag Steel plant, situated in Andhra Pradesh, India, operates as an integrated steel plant with a blast furnace (BF) route, boasting a crude steel capacity of 7.3 MTPA. The plant produces semi-finished and finished rolled products like rebar and wire rod. The plant’s activity has shown a consistent decline from January (66.0%) to July (55.0%). Although remaining above the Asian average, a direct connection to the EU steel market’s dynamics, as detailed in articles like “Europe needs effective protective measures for steel in light of US tariffs – EUROFER,” cannot be explicitly established from the available data.

ArcelorMittal Nippon Steel India, located in Gujarat, operates with both BF and DRI routes and a crude steel capacity of 9.6 MTPA. Its activity levels remained relatively stable from January (34.0%) to June (36.0%). This stability, despite broader market fluctuations, might suggest a focus on specific product segments or regional demand dynamics, but no direct connection with the EU market concerns or plant performance can be explicitly established from the given information.

Evaluated Market Implications

The high activity at Kardemir Celik Sanayi Izmir steel plant, while not directly linked to the Eurofer news, suggests potential for increased exports from Turkey. Conversely, the decline in activity at Vizag Steel plant could indicate a softening of domestic demand or shifts in export strategies, meriting close monitoring.

Recommended Procurement Actions:

-

Steel Buyers: Given the potential for increased exports from Turkish steel producers like Kardemir Celik Sanayi Izmir steel plant, procurement professionals should explore opportunities to diversify their supply base and negotiate favorable terms with Turkish suppliers. The peak production observed at this plant from January to June suggests it may be well positioned to fulfill additional orders.

-

Market Analysts: The consistent decline in Vizag Steel plant activity warrants closer scrutiny. Analysts should investigate potential factors contributing to this trend, such as shifts in domestic demand, changes in raw material costs, or adjustments to export strategies. This could provide valuable insights into regional market dynamics and potential supply chain vulnerabilities. Consider also the impact of the “Europe needs effective protective measures for steel in light of US tariffs – EUROFER” and EUROFER’s concerns as this may further affect steel imports and the production of this plant.