From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCanada Steel Market Faces Supply Chain Risks Amidst Trump’s Tariff Threats and Fluctuating Plant Activity

The Canadian steel market is bracing for significant challenges due to potential tariffs and uneven production activity. The threats of import tariffs, as highlighted in news articles like “Trump announces 35% tariff on imports from Canada” and “Trump threatens 35pc tariff on Canada by 1 August,” introduce substantial uncertainty. Satellite observations reveal fluctuating plant activity levels, with a potential impact on supply chains.

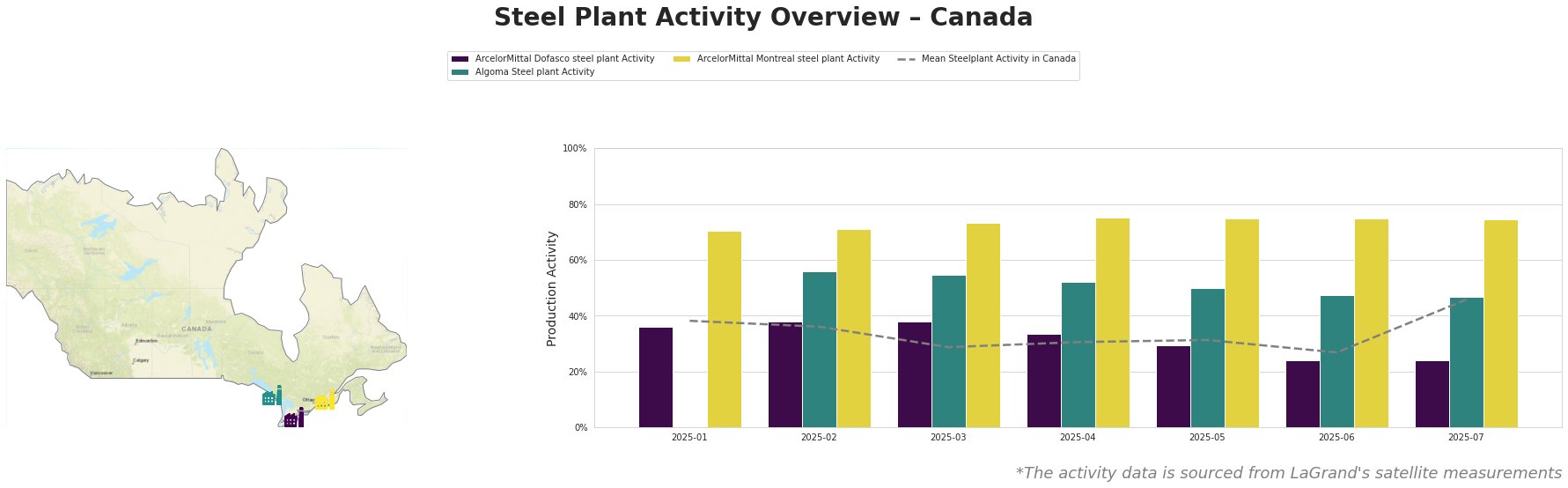

The mean steel plant activity in Canada declined from 38% in January to a low of 27% in June, before rebounding to 46% in July. ArcelorMittal Dofasco’s activity decreased significantly to 24% in July. Algoma Steel shows consistently moderate activity levels, while ArcelorMittal Montreal maintains high activity throughout the period, peaking at 75% from April onwards.

ArcelorMittal Dofasco, an integrated steel plant in Ontario with a crude steel capacity of 4,050 ttpa, primarily utilizes BF and BOF technologies and has EAF capabilities. The observed decline in activity at ArcelorMittal Dofasco to 24% in July, particularly against the backdrop of rising average Canadian steel plant activity, suggests a possible reaction to tariff concerns flagged by “Trump announces 35% tariff on imports from Canada,” leading to a production adjustment.

Algoma Steel plant, another integrated BF/BOF steel plant in Ontario with a crude steel capacity of 2,800 ttpa, shows a decreasing trend from February (56%) to July (47%). Given Algoma Steel’s product focus on plate and sheet, and the lack of direct news mentioning specific impacts on this plant, a direct link between news articles such as “Trump announces 35% tariff on imports from Canada” and observed activity cannot be explicitly established.

ArcelorMittal Montreal, operating with DRI and EAF technologies in Quebec and a crude steel capacity of 2,400 ttpa, maintained relatively high activity from January to July. Since no news articles mention any specific impact on Quebec or this particular plant, a direct correlation between the observed high activity and reported trade tensions or other external factors cannot be explicitly established.

The potential imposition of a 35% tariff on Canadian imports, as announced in “Trump threatens 35pc tariff on Canada by 1 August,” introduces significant risks to the Canadian steel supply chain. The risk is further compounded by activity reduction at ArcelorMittal Dofasco.

Recommended Actions for Steel Buyers and Market Analysts:

- Accelerate Procurement: Given the potential for a 35% tariff on Canadian steel effective August 1st, and the reported tariff threat in the article “Trump threatens 35pc tariff on Canada by 1 August,” steel buyers should expedite near-term procurement to secure supply before the tariff implementation, especially from plants potentially affected like ArcelorMittal Dofasco.

- Assess Supply Chain Vulnerability: Analyze the reliance on ArcelorMittal Dofasco and other potentially affected suppliers. The activity decrease observed at Dofasco calls for assessing alternative sources.

- Monitor Policy Developments: Closely monitor updates related to tariffs and trade negotiations, particularly those stemming from the US, as outlined in “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll.” Understanding potential retaliatory measures is crucial for informed decision-making.

- Evaluate Alternative Sourcing: Given the fluctuations in plant activity and tariff concerns, consider diversifying the supply base by exploring alternative sources of steel.