From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Commercial Vehicle Surge Offsets Potential Dolvi Slowdown, Creating Selective Opportunities

Asia’s steel market presents a mixed outlook. While China’s commercial vehicle sector demonstrates strength, potential production adjustments at key Indian plants warrant careful monitoring. The positive trend in China is reflected in the article “Commercial vehicle sales in China up 2.6 percent in H1 2025,” indicating healthy domestic demand for steel-intensive vehicles. However, no direct connection between this article and specific plant activity levels could be established. No news article directly explains the large drop in the overall activity average.

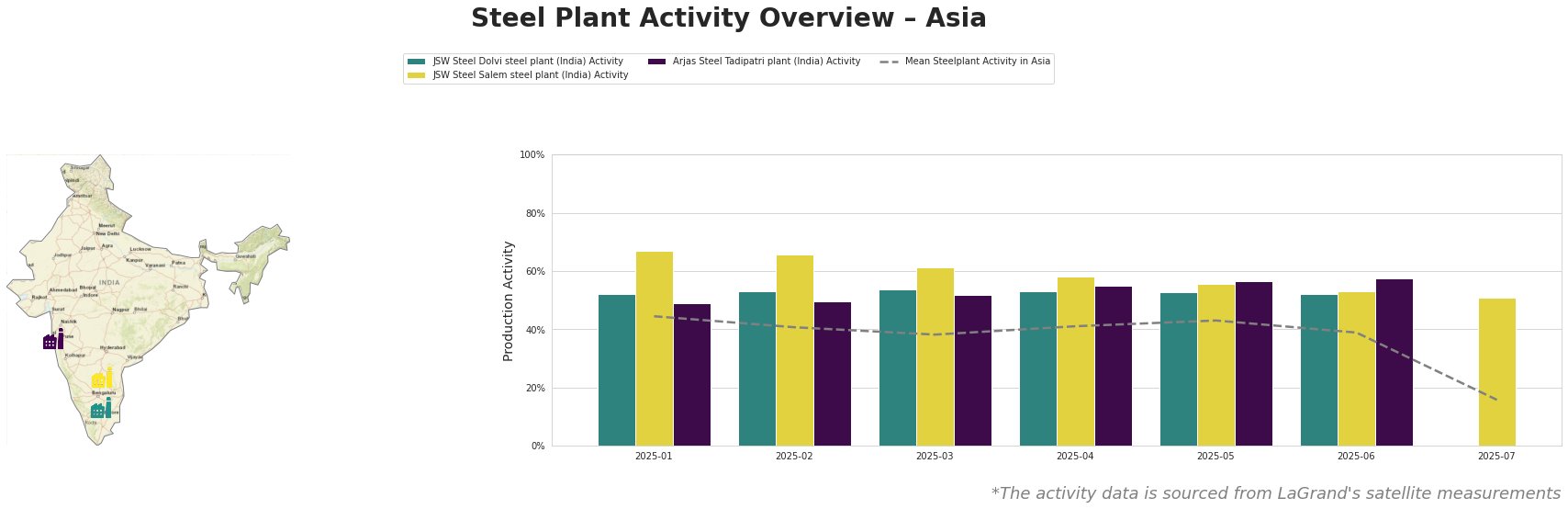

Observed activity levels reveal nuanced trends. The mean steel plant activity in Asia shows a concerning drop to 16% in July, a significant decline from the 39% recorded in June. JSW Steel Dolvi consistently operated above the Asian mean until July, where no value was reported. JSW Steel Salem plant activity is initially high, but experiences a gradual decline, ending only slightly above the overall Asia mean, while Arjas Steel Tadipatri showed a continuous increase during the observed period. No news article has directly explained the dramatic drop in average plant activity.

JSW Steel’s Dolvi plant in Maharashtra, India, is a major integrated steel producer with both blast furnace (BF) and direct reduced iron (DRI) capabilities, reaching 5 million tonnes per annum of crude steel. Its product range spans finished and semi-finished goods, targeting sectors from energy to automotive. Satellite data indicates that activity data is missing for July 2025, raising concerns about potential disruptions. Without explicit information about why activity data is missing, the cause of this drop is unknown.

JSW Steel’s Salem plant in Tamil Nadu, India, focuses on hot-rolled products, including bars and flats, serving similar end-user sectors as Dolvi. The plant has a 1.03 million tonnes crude steel capacity and relies on integrated BF processes. The plant’s activity decreased steadily from 67% in January to 51% in July. This decrease may indicate production adjustments or could correlate with broader market trends, however, without additional information, no definitive cause can be established, nor is there a clear link to the provided news articles.

Arjas Steel’s Tadipatri plant in Andhra Pradesh, India, produces finished and semi-finished long products like bars and profiles using an integrated BF/BOF process route, with a crude steel capacity of 325,000 tonnes per year. Activity increased steadily from 49% in January to 57% in June. No data is available for July. There is no explicit news to directly explain the plant’s performance.

Evaluated Market Implications:

The most recent data indicates a large drop of steel plant activity across the region.

Given the lack of July activity data for JSW Steel Dolvi, steel buyers should:

- Contact JSW Steel directly to ascertain the cause for missing data for July. Explicitly inquire about potential production slowdowns or disruptions at the Dolvi plant.

- Assess alternative supply sources for products typically sourced from JSW Steel Dolvi, particularly wire rod, cold rolled, and hot rolled steel. Consider suppliers in China, given the positive outlook for their commercial vehicle sector, as highlighted in “Commercial vehicle sales in China up 2.6 percent in H1 2025.”

- Closely monitor future satellite activity data for JSW Steel Dolvi and JSW Steel Salem to identify any sustained reduction in activity, which could signal prolonged supply constraints.