From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market Braces for Impact as Trump Tariffs Loom, Plant Activity Falters

Japan’s steel market faces increasing uncertainty due to potential US tariffs, prompting concerns about supply disruptions and strategic procurement adjustments. This assessment is informed by articles such as “Trump puts new 25% tariffs on imports from Japan, South Korea” and “Trumps Zoll-Briefe verunsichern. Was bleibt Japan und Südkorea?“. While a direct, immediate correlation between these announcements and specific plant activity can’t be definitively established, the timing of these announcements coincides with a recent decline in overall steel plant activity.

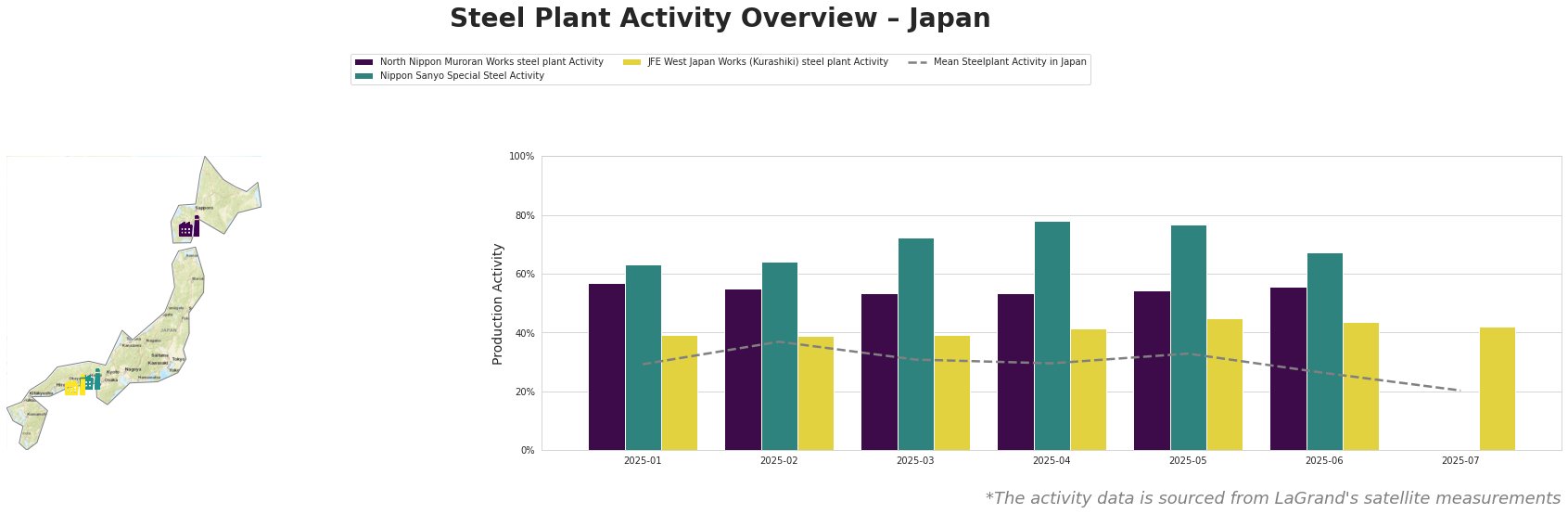

The mean steel plant activity in Japan shows a downward trend, decreasing from 33.0% in May to 20.0% in July. The most significant decrease in activity across all observed plants occurred in July. North Nippon Muroran Works maintained a relatively stable activity level between 54% and 57% until July, where activity was not captured. Nippon Sanyo Special Steel exhibited the highest activity levels, peaking at 78% in April, before dropping to 67% in June, and then missing in July. JFE West Japan Works (Kurashiki) steel plant’s activity rose to 45% in May, before dropping to 42% in July.

North Nippon Muroran Works, located in Hokkaidō, is an integrated steel plant with a crude steel capacity of 2598 ttpa, utilizing both BOF and EAF technologies. It produces semi-finished and finished rolled products, including bars and wires, primarily for the automotive sector. Its activity was stable during the months of the survey. As of July, its activity levels are unknown, preventing any direct connection to news events.

Nippon Sanyo Special Steel, situated in Kansai, operates solely with EAF technology, boasting a crude steel capacity of 1596 ttpa. Its product range includes billets, rolled products, tubes, and bars, serving diverse sectors such as automotive, infrastructure, energy, and transportation. The plant showed strong activity through May, but levels dropped to 67% in June, before activity was not captured in July. There is no directly attributable connection to the recent news articles regarding tariffs.

JFE West Japan Works (Kurashiki) in Chūgoku is an integrated BF-BOF steel plant with a substantial crude steel capacity of 10000 ttpa. Its diverse product portfolio encompasses hot-rolled, cold-rolled, and coated sheets, plates, H-profiles, and pipes, catering to a wide range of industries. The plant’s activity decreased to 42% in July. While this decline coincides with the tariff announcements, no definitive causal link can be established based on the provided information.

The looming tariffs on Japanese steel exports to the US, as reported in “Trump puts new 25% tariffs on imports from Japan, South Korea” and the overall trade policy uncertainty highlighted in “Trumps Zoll-Briefe verunsichern. Was bleibt Japan und Südkorea?“, create a negative outlook for the Japanese steel market. Given the uncertainty and the potential for increased costs, steel buyers should consider the following procurement actions:

* Diversify Sourcing: Reduce reliance on plants primarily exporting to the US, such as those producing automotive-grade steel.

* Negotiate Contracts: Secure price protection clauses in contracts to mitigate the impact of tariffs.

* Monitor Policy Changes: Closely track US trade policy developments and their potential impact on specific steel products.

* Assess Inventory Levels: Carefully evaluate current inventory levels and adjust procurement strategies based on anticipated supply disruptions.