From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineLuxembourg Steel Market Strong Amidst EU Collaboration and Stable Plant Activity

Luxembourg’s steel market demonstrates strength, supported by collaborative efforts within the European steel industry. The “75 Jahre EUROMETAL: Zukunft gestalten durch systemischen Wandel,” “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione,” and “EUROMETAL: Future of European steel depends on collaboration“ articles all highlight the importance of industry collaboration to address challenges like CBAM and decarbonization. Direct connections between these collaborative discussions and specific plant activity levels cannot be definitively established from the provided data.

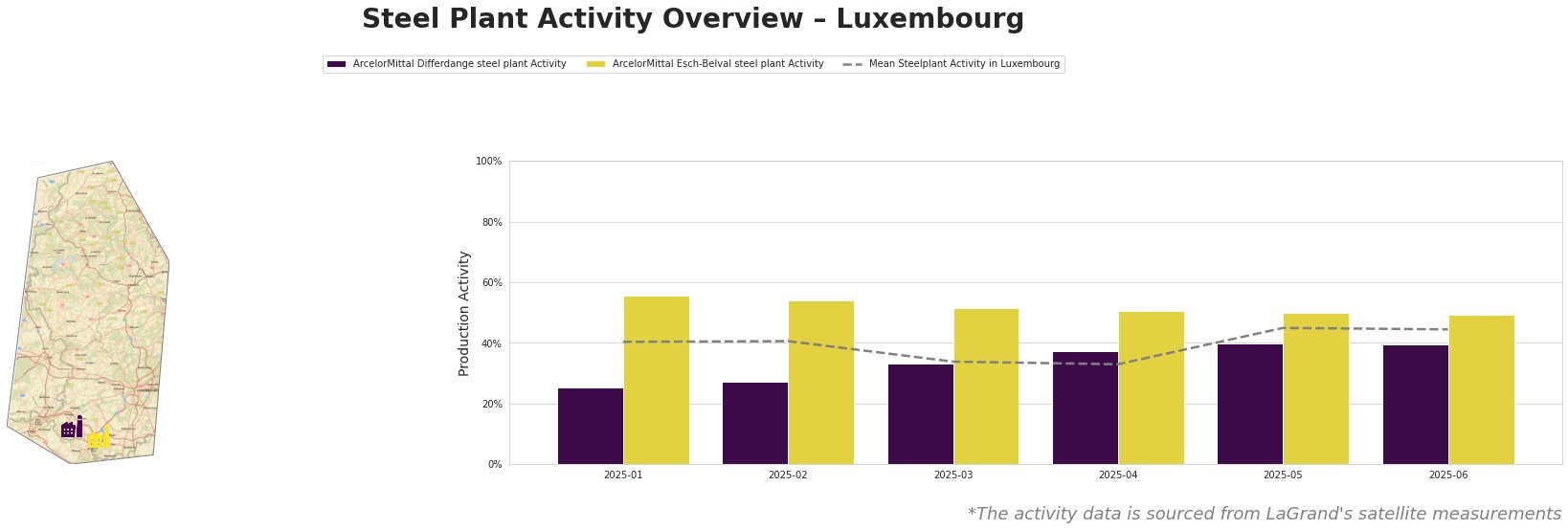

Overall, the mean steel plant activity in Luxembourg shows relative stability with a recent increase from 33% in April 2025 to 44% in June 2025. ArcelorMittal Differdange steel plant shows increasing activity over the observed period, from 25% in January 2025 to 40% in June 2025, consistently below the national mean before equalling it in June. ArcelorMittal Esch-Belval steel plant shows more stable activity, ranging from 55% in January 2025 to 49% in June 2025, consistently above the national average. The news articles do not directly explain these specific plant-level fluctuations.

ArcelorMittal Differdange, an EAF-based steel plant with a crude steel capacity of 2000 ttpa, focuses on sections, sheet piles, and rails for the building and infrastructure sectors. It is ISO14001, ISO50001, and ResponsibleSteel certified. The plant’s increasing activity to 40% by June 2025, after a low of 25% in January 2025, suggests increased demand for its products. While the EUROMETAL articles discuss broader industry trends, a direct link to the Differdange plant’s specific activity changes cannot be definitively established.

ArcelorMittal Esch-Belval, also an EAF-based steel plant, has a crude steel capacity of 1000 ttpa and produces similar products: sections, sheet piles, and rails. Its activity, hovering around 50%, indicates steady production. It also possesses ISO14001, ISO50001, and ResponsibleSteel certifications. The discussions in the “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione,” regarding green steel and decarbonization could be relevant, given Esch-Belval’s EAF-based production; however, the data does not provide explicit evidence of this connection.

Given the overall positive market sentiment expressed in the news articles and the stable to increasing activity levels in Luxembourg steel plants, no immediate supply disruptions are anticipated. However, steel buyers should closely monitor the implementation and impacts of the Carbon Border Adjustment Mechanism (CBAM), as discussed in “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione,” and prepare for potential cost adjustments related to carbon emissions. Procurement strategies should prioritize suppliers with transparent emissions data and consider longer-term contracts to mitigate potential price volatility linked to decarbonization efforts. Buyers focusing on infrastructure projects should leverage the increasing activity at ArcelorMittal Differdange steel plant to secure favorable pricing for sections, sheet piles, and rails.