From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine’s Steel Exports Surge Amidst European Production Fluctuations: A Bullish Outlook for H2 2025

Europe’s steel market presents a mixed picture, with Ukrainian exports rising while activity levels at key European plants fluctuate. The recent surge in Ukrainian steel exports, as highlighted in “Ukraine increased exports of long rolled products by 43% y/y in January-May” and “Ukraine’s flat steel exports up 6.1 percent in Jan-May 2025“, contrasts with observed changes in activity at European steel plants. These shifts could impact regional supply dynamics.

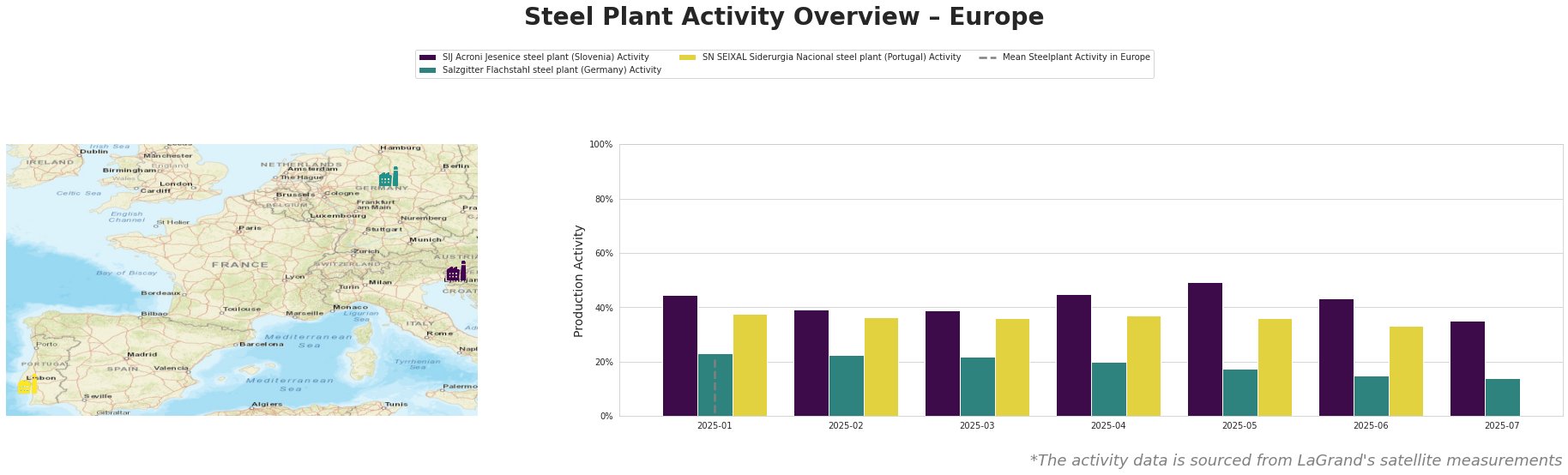

The mean activity level across observed European steel plants shows wild fluctuations. SIJ Acroni Jesenice started relatively strong but saw a drop to 35% by July. Salzgitter Flachstahl experienced a consistent decline, falling from 23% in January to 14% in July. SN SEIXAL Siderurgia Nacional maintained a relatively stable activity level until June, dropping slightly, with no data available for July.

SIJ Acroni Jesenice steel plant: This Slovenian plant, equipped with EAF technology and a crude steel capacity of 726ktpa, focuses on semi-finished and finished rolled products. Its activity level peaked at 49% in May 2025, followed by a decline to 35% in July. There is no direct connection to be established between these shifts and the provided news articles about Ukrainian steel exports or imports.

Salzgitter Flachstahl steel plant: As an integrated BF plant in Germany with a crude steel capacity of 5200ktpa, Salzgitter Flachstahl produces a range of flat-rolled products. The plant’s activity consistently decreased from 23% in January to 14% in July. There is no direct connection to be established between these shifts and the provided news articles about Ukrainian steel exports or imports. The plant’s transition towards hydrogen-based steel production by 2050, as part of its Salcos Green Steel project, is noteworthy but does not explain the recent activity decline.

SN SEIXAL Siderurgia Nacional steel plant: This Portuguese plant, with an EAF-based crude steel capacity of 1100ktpa, produces mesh, wire, hot-rolled coils, and bars. Its activity remained relatively stable around 36-38% until a slight drop to 33% in June. No data is available for July. There is no direct connection to be established between these shifts and the provided news articles about Ukrainian steel exports or imports.

Evaluated Market Implications:

The increase in Ukrainian exports, particularly long rolled products as mentioned in “Ukraine increased exports of long rolled products by 43% y/y in January-May,” suggests a potential shift in supply dynamics, especially for long rolled products in Europe. At the same time, the news articles “Imports of flat rolled products to Ukraine have increased, with Turkey, Poland and Slovakia as supply leaders.“, “Ukraine increased imports of flat rolled steel by 17.2% y/y in January-May“, “Ukraine increased flat rolled products’ exports by 6.1% y/y in January-May” indicate that flat rolled products exports also increased, but imports rose even higher.

- Procurement Action: Given Ukraine’s rising flat steel exports but even faster import rate, and the observed decline in activity at Salzgitter Flachstahl (a major flat steel producer), steel buyers should proactively diversify their flat steel supply sources, particularly for hot-rolled and coated products. Buyers should negotiate contracts now to secure supply from alternative sources, such as Turkey, Poland and Slovakia to mitigate risks associated with possible supply reduction coming from Europe.