From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals as EV Growth Impacts Regional Plant Activity

Asia’s steel market presents a mixed picture, influenced by global shifts in the automotive industry and regional economic conditions. While overall activity experienced fluctuations, individual plants show distinct trends. Direct connections between observed steel plant activity and specific news articles are limited. However, the reported sales figures for major automotive brands in “Porsche verkauft im ersten Halbjahr weniger Autos“ and “Volkswagen verkauft fast 50 Prozent mehr E-Autos“ provide context for potential shifts in steel demand, though no direct relationship to observed activity levels could be established.

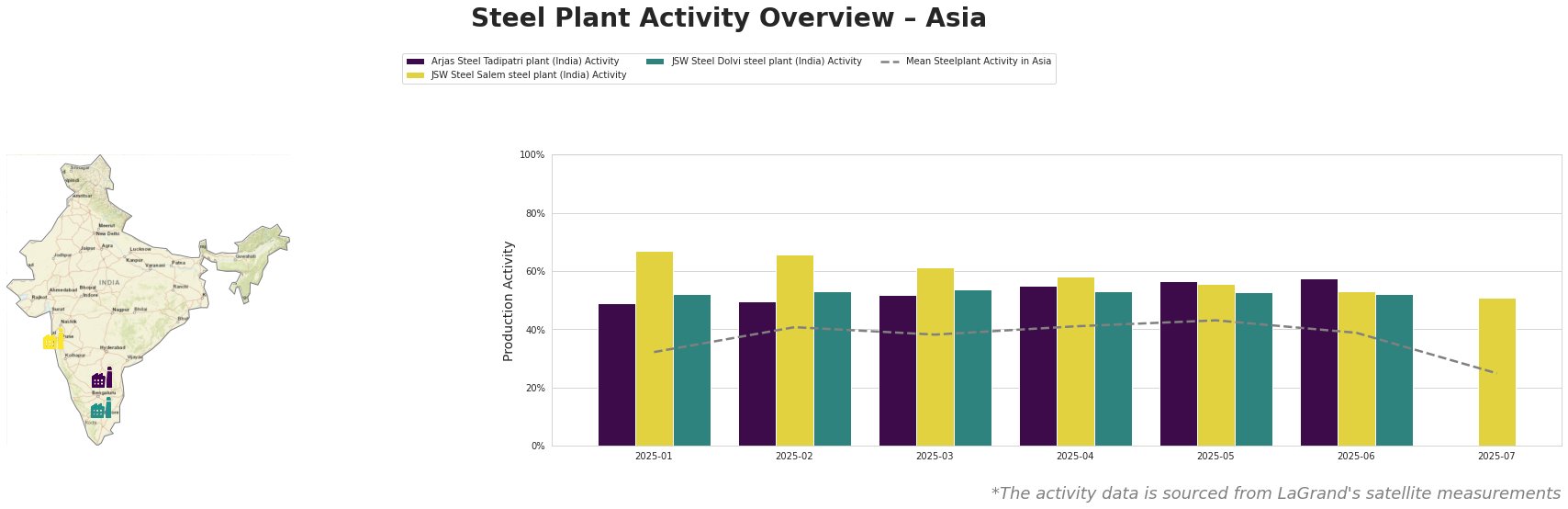

The mean steel plant activity in Asia shows a fluctuating trend from January to June 2025, peaking in May at 43.0% and subsequently dropping sharply to 25.0% in July. Arjas Steel Tadipatri plant consistently operated above the mean, with a slight increase from January to June, remaining at 57.0%. JSW Steel Salem plant initially showed high activity, peaking at 67.0% in January, then declined steadily to 51.0% in July. JSW Steel Dolvi plant maintained a relatively stable activity level around 52-54% from January to June.

Arjas Steel Tadipatri plant, located in Andhra Pradesh, India, is an integrated steel plant with a 325ktpa BOF capacity. The plant’s activity increased slightly from 49.0% in January to 57.0% in June, consistently exceeding the Asian mean. No immediate relationship between the constant production and the provided news articles could be established.

JSW Steel Salem plant in Tamil Nadu, India, operates an integrated BF-based steel plant with a crude steel capacity of 1030ktpa. Activity at the Salem plant started high at 67.0% in January, but decreased steadily to 51.0% in July. Despite its high capacity, the observed decrease in activity could not be explicitly linked to the automotive sales data reported in “Porsche verkauft im ersten Halbjahr weniger Autos” or “Volkswagen verkauft fast 50 Prozent mehr E-Autos”, although automotive is listed as a key EndUserSector.

JSW Steel Dolvi plant in Maharashtra, India, has a 5000ktpa crude steel capacity, utilizing both BF and DRI-based production routes. This plant demonstrated a relatively stable activity level, fluctuating between 52.0% and 54.0% from January to June. The relatively stable activity trend at JSW Steel Dolvi cannot be directly related to the trends highlighted in the provided news articles.

Given the sharp drop in mean activity in July and the mixed performance of individual plants, procurement professionals should prioritize close monitoring of regional steel prices and inventory levels. While increased EV sales reported in “Volkswagen verkauft fast 50 Prozent mehr E-Autos” might suggest increased demand for certain steel grades, the simultaneous sales decline for Porsche as detailed in “Porsche verkauft im ersten Halbjahr weniger Autos” introduces uncertainty. Buyers should diversify their sources and negotiate flexible contracts to mitigate potential supply chain disruptions or price volatility. Monitor closely the impact of the US market described in “Daimler Truck: CFO schlägt Alarm – „extrem“ niedrige Aufträge in den USA“, since this could impact steel exports to Asia.