From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Coking Coal Cost Drop Boosts Production Despite Price Dip – Guangdong Activity Surges

China’s steel sector shows signs of resilience amidst fluctuating prices and raw material costs. The Chinese Ministry of Commerce reported in “MOC: Average steel prices in China down slightly in June 23-29” that average steel prices saw a slight decrease in late June. Concurrently, steelmakers benefited from lower input costs as highlighted in “CISA: Coking coal purchase costs in China down 32.26% in Jan-May” which states that coking coal purchase costs decreased by 32.26% between January and May, according to the China Iron and Steel Association (CISA). While “Asian coking coal prices fell in June amid weak demand” suggests overall coking coal demand was soft, the decline in costs appears to have spurred production activity in specific regions. Satellite data indicates increased activity at Guangdong Yuebei United Steel, correlating with these cost reductions.

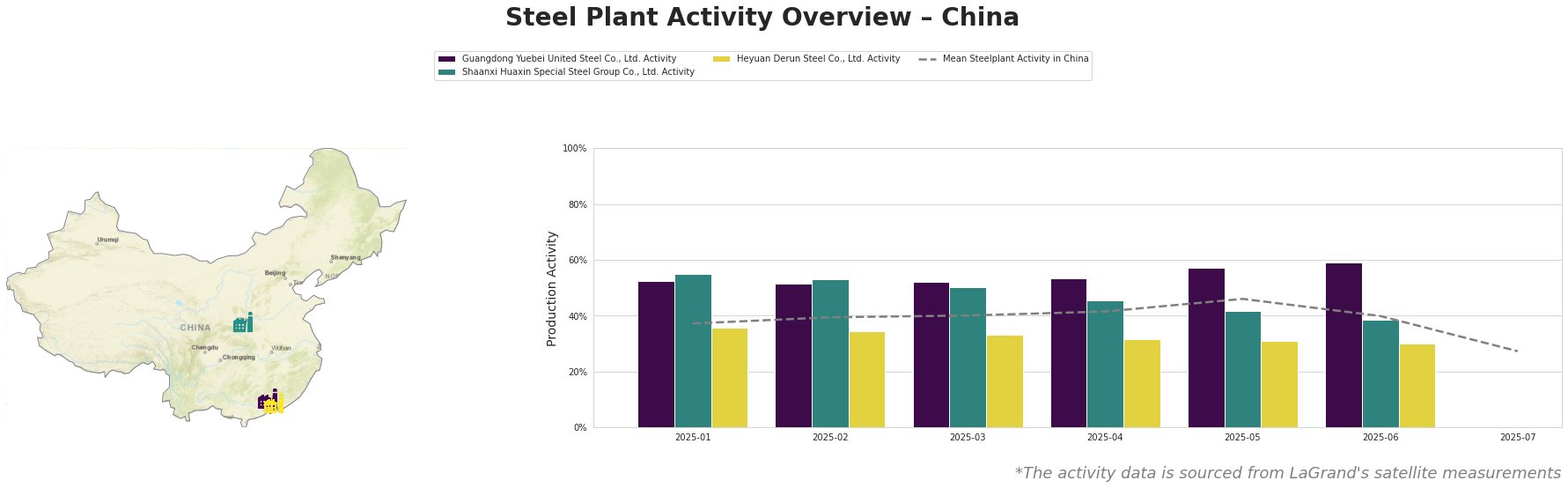

Mean steel plant activity in China increased steadily from January (37.0%) to May (46.0%) before dropping significantly in June (40.0%) and July (27.0%). Guangdong Yuebei United Steel Co., Ltd. consistently operated above the national average, reaching 59.0% in June. Shaanxi Huaxin Special Steel Group Co., Ltd. Activity started at 55.0% in January and gradually declined to 39.0% by June. Heyuan Derun Steel Co., Ltd. Activity experienced a consistent decrease from 36.0% in January to 30.0% in June. The July data is incomplete, with activity data only available for the mean.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2000 ttpa, focuses on finished rolled products like rebar for the building and infrastructure sectors. Its activity consistently surpassed the national average, reaching 59.0% in June. This surge might be partially attributed to the decrease in coking coal costs reported by CISA in “CISA: Coking coal purchase costs in China down 32.26% in Jan-May“, although no direct confirmation exists.

Shaanxi Huaxin Special Steel Group Co., Ltd., an EAF-based steel plant with a 1200 ttpa crude steel capacity, produces rolled round steel plate and hot-rolled ribbed rebar. The plant’s activity decreased steadily from 55.0% in January to 39.0% in June. No direct connection to any of the provided news articles can be established.

Heyuan Derun Steel Co., Ltd., an EAF-based steel plant in Guangdong with a 1200 ttpa crude steel capacity, produces hot-rolled rebar and billet. Its activity decreased consistently from 36.0% in January to 30.0% in June. No direct connection to any of the provided news articles can be established.

Evaluated Market Implications:

The surge in activity at Guangdong Yuebei United Steel Co., Ltd., coinciding with reported coking coal cost reductions, suggests increased rebar production in the Guangdong region. The news article “MOC: Average steel prices in China down slightly in June 23-29” reports a 0.6% price drop for rebar; however, buyers may face upward pressure on rebar prices originating from Guangdong due to increased plant activity. Procurement Action: Steel buyers focused on rebar should monitor Guangdong-sourced material closely, anticipating potential price adjustments influenced by the plant’s increased activity. Consider diversifying suppliers to mitigate regional price volatility.