From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Signals Positive Outlook Amid US Policy Shifts and Varying Plant Activity

Asia’s steel market presents a positive outlook despite uncertainties surrounding US energy and tax policy adjustments. Observed changes in Asian steel plant activity levels, particularly the significant increase at KISCO steel Changwon plant, do not establish direct relationships with news articles such as “US Senate votes to soften clean energy tax cuts: Update” or “US Senate votes to pass tax, energy bill“, which primarily focus on the U.S. domestic policy changes. However, potential shifts in global biofuel mandates, as suggested by the article “Philippines’ ethanol imports to increase: USDA“, could indirectly affect steel demand through infrastructure and transportation projects in the long term.

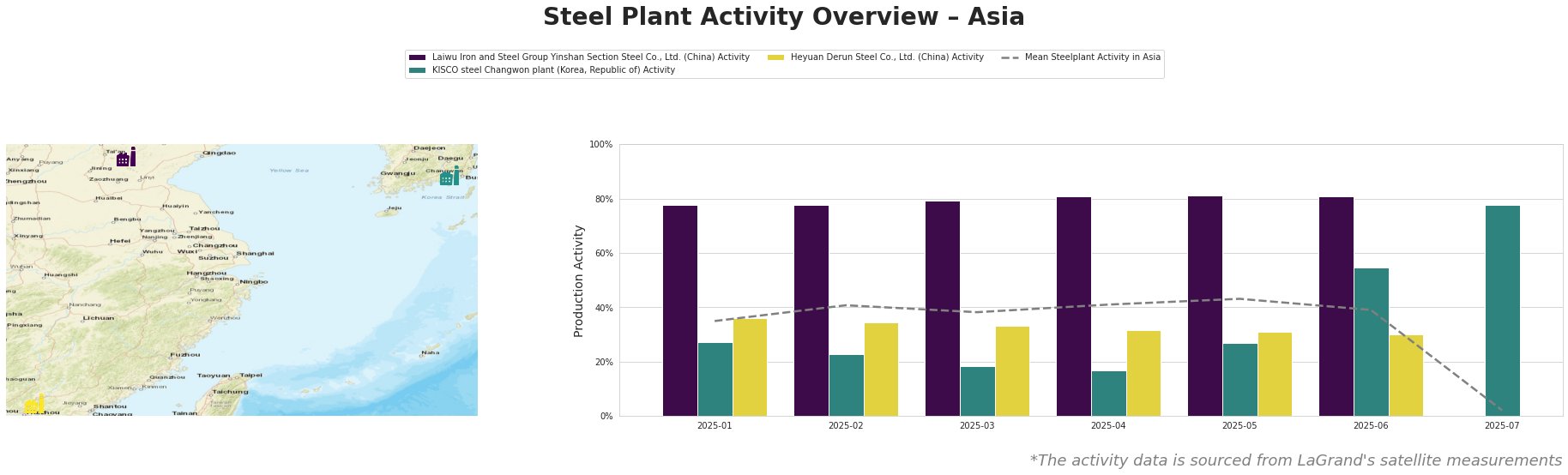

Observed steel plant activity exhibits varying trends. The mean steel plant activity across Asia fluctuated throughout the first half of 2025, peaking in May (43.0%) before a sharp drop in July (2.0%), although missing data may have skewed this figure. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. maintained consistently high activity levels (78%-81%) during the first half of the year. KISCO steel Changwon plant experienced a significant increase in activity from 17% in April to 55% in June, and further to 78% in July. Heyuan Derun Steel Co., Ltd. demonstrated a steady decline in activity from January (36%) to June (30%). The significant increase at KISCO steel Changwon plant in recent months contrasts the overall trend, while Laiwu Iron and Steel maintains a very high, stable level.

Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., a major integrated steel producer in Shandong, China, utilizing BF and BOF technologies with a crude steel capacity of 5.4 million tonnes, has shown consistently high activity levels, maintaining a stable production rate significantly above the Asian mean. This stable performance suggests reliable supply from this specific producer, and no correlation can be established with the provided news articles.

KISCO steel Changwon plant, located in South Korea, is an EAF-based steelmaker producing rebar, forging, and billet with a crude steel capacity of 3 million tonnes. Its activity has significantly increased, reaching 78% in July, contrasting earlier months. This boost does not directly correlate with the provided news about US policy shifts, and may signal increased regional demand or operational changes specific to the plant.

Heyuan Derun Steel Co., Ltd., an EAF-based steel producer in Guangdong, China, specializing in hot-rolled rebar and billet, with a crude steel capacity of 1.2 million tonnes, shows a decreasing production trend. This steady decline could indicate localized demand shifts or operational adjustments, but lacks direct connections to the provided news articles about US policies.

Evaluated Market Implications:

The consistent activity at Laiwu Iron and Steel suggests stable supply of section steel from this producer. However, the decreasing activity at Heyuan Derun Steel Co., Ltd. may indicate localized supply constraints for rebar in the Guangdong region. The surge in activity at KISCO steel Changwon plant could alleviate regional rebar supply issues.

Recommended Procurement Actions:

- Steel Buyers: Given the high activity at Laiwu Iron and Steel, consider securing contracts for section steel with this supplier to ensure stable supply.

- Market Analysts: Monitor regional rebar prices in Guangdong due to the decreasing activity at Heyuan Derun Steel. Assess whether the increased production at KISCO steel Changwon plant adequately offsets this potential supply constraint. Actively monitor how policy adjustments detailed in news articles such as “US Senate votes to soften clean energy tax cuts: Update” may indirectly impact steel demand drivers in the long term, even if immediate connections are not evident.