From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSSAB’s Green Transformation in Luleå Fuels Optimism in European Steel Market

Europe’s steel market shows positive sentiment, driven by investments in green steel technology. Recent activity at SSAB Luleå is closely watched following announcements such as “SSAB raises €430 million in financing for Luleå green transformation” and “SSAB has raised 430 million euros to finance the Luleå Green Transformation project,” as these projects promise to reshape the competitive landscape. The SSAB transformation project explicitly aims to lower costs and shorten delivery times, impacting future procurement strategies.

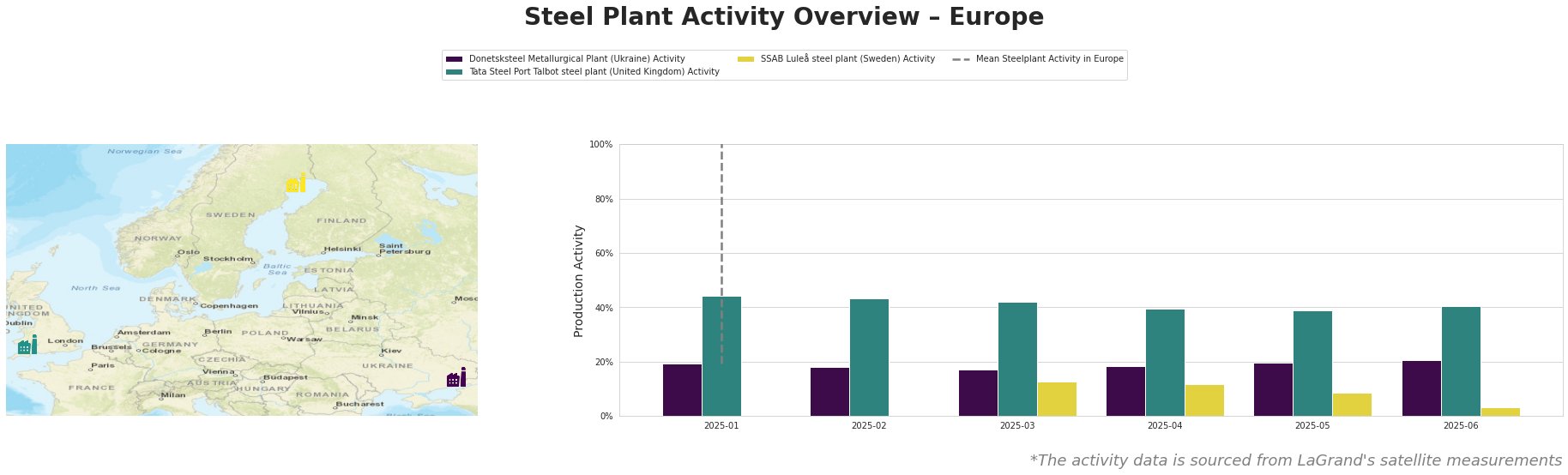

The mean steel plant activity in Europe displays significant fluctuations across the observed months, though these likely represent data recording anomalies. The Donetsksteel Metallurgical Plant shows a slight upward trend in activity, increasing from 19% in January to 21% in June. Tata Steel Port Talbot experienced a gradual decrease from 44% in January to 39% in May, followed by a slight recovery to 41% in June. SSAB Luleå recorded activity levels dropping from 13% in March to 3% in June.

Donetsksteel Metallurgical Plant, based in Ukraine and primarily focused on pig iron production via integrated BF/EAF processes, saw a slight increase in activity over the observed period. The plant is responsible for iron production using blast furnaces and has some EAF capacity, though the EAF is mothballed. This slight uptick does not correlate with any specific news events provided.

Tata Steel’s Port Talbot plant in Wales, a major integrated steel producer with a 5 million mt crude steel capacity relying on BF/BOF technology, experienced a gradual activity decline. This plant produces slabs and finished rolled products, including hot-rolled, cold-rolled, and galvanized coil. No direct connection to the provided news articles can be established regarding this decline.

SSAB’s Luleå plant, with a 2.3 million mt crude steel capacity using BF/BOF technology, is undergoing a significant transformation. Its observed activity dropped significantly, from 13% in March to 3% in June. This decline may be related to the planned construction and upgrades announced in “SSAB raises €430 million in financing for Luleå green transformation” and “SSAB has raised 430 million euros to finance the Luleå Green Transformation project“. The financing secured is explicitly earmarked for building a new mini-mill using electric arc furnaces and modern metallurgy, which might involve temporarily reduced output during the construction phase.

The developments at SSAB Luleå, specifically the investment in green steel production, have implications for steel buyers. The SSAB transformation project, as outlined in the news articles, promises lower production costs and faster lead times upon completion of the new mini-mill.

Procurement Action: Steel buyers should closely monitor the progress of SSAB’s Luleå transformation. Specifically, explore opportunities for forward contracts with SSAB, leveraging their future lower-cost, faster-delivery capabilities, as directly justified by the “SSAB raises €430 million in financing for Luleå green transformation” article.

Analyst Action: Market analysts should factor in the potential for short-term supply fluctuations from SSAB Luleå due to the ongoing construction, offset by increased long-term competitiveness. Analysts should also monitor potential ripple effects on other European steel producers as they adapt to SSAB’s enhanced capabilities, as the “SSAB has raised 430 million euros to finance the Luleå Green Transformation project” article highlights SSAB’s intent to become a premium steel producer.