From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Faces Headwinds: Falling Prices and Uncertain Production

The Italian steel market is experiencing a downturn due to weak demand and import pressures, as highlighted in “Negative sentiment persists in the European HRC steel market” and “European HRC prices keep falling“. While “Sale of thick-rolled products in Europe: prices decrease due to weak demand” indicates a broader European trend, its direct impact on specific Italian plants’ activity isn’t immediately evident from satellite data. Declining HRC prices reported in these articles are likely contributing to the observed fluctuations in steel plant activity across Italy.

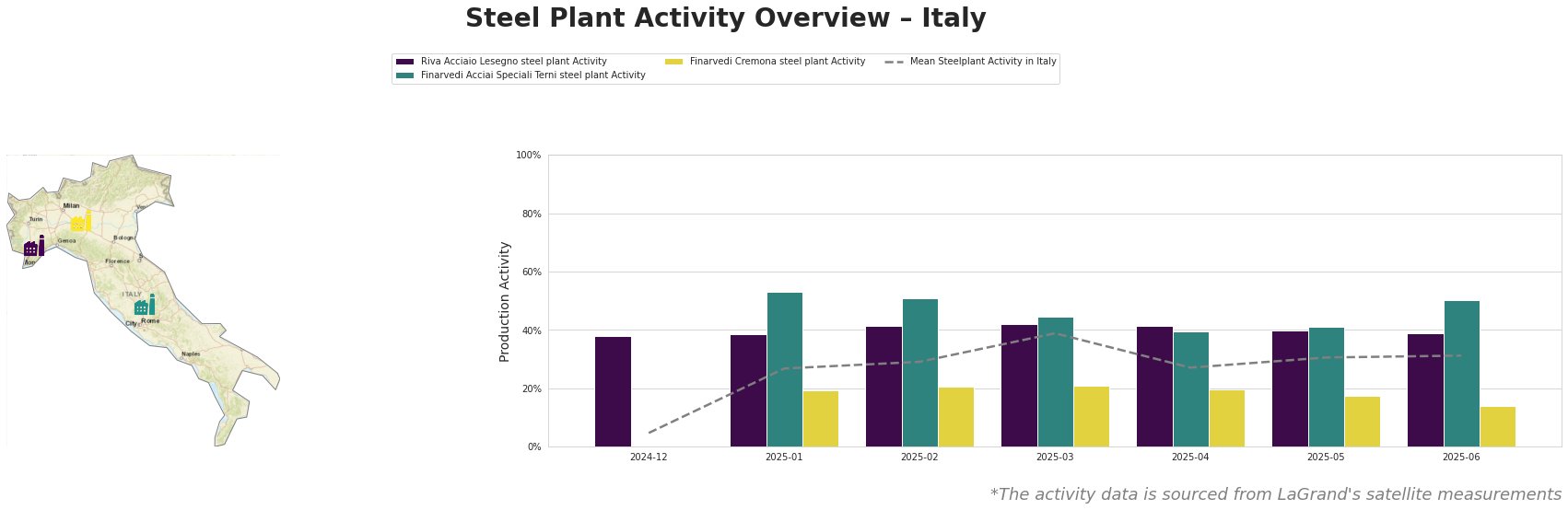

Here’s an overview of recent monthly activity trends in the Italian steel market:

The mean steel plant activity in Italy saw a rise from December 2024 (5%) to March 2025 (39%) before fluctuating downwards to 31% until June 2025.

Riva Acciaio Lesegno steel plant: This plant, an EAF-based producer of billets, rods, and rolled products, shows a relatively stable activity level. Activity decreased only slightly from 38% in December 2024 to 39% in June 2025. The stable activity might indicate fulfillment of existing orders despite the broader market pessimism reported in “Negative sentiment persists in the European HRC steel market”, but a direct causal link cannot be established.

Finarvedi Acciai Speciali Terni steel plant: This plant, a major EAF-based producer of stainless steels and other finished rolled products, has activity levels consistently above the Italian mean. Its activity rose significantly from January (53%) to June (50%), peaking at 45% in March 2025. There is no explicitly evident connection between this plant’s activity fluctuations and the price declines detailed in “Sale of thick-rolled products in Europe: prices decrease due to weak demand” or “European HRC prices keep falling.”

Finarvedi Cremona steel plant: Specializing in hot rolled coil and galvanized products using EAF technology, this plant experienced a considerable activity decrease from January (19%) to June (14%). This decline could potentially align with the reports of weakened demand and falling HRC prices reported in “European HRC prices keep falling”, however, there is no way to explicitly establish a connection.

Evaluated Market Implications:

The news articles coupled with the satellite observed plant data indicate downward pressure on prices and varying responses from Italian steel producers. Specifically, the report “European HRC prices keep falling” highlights competition from Indonesian HRC imports offered at €470-480 per tonne.

- Potential Supply Disruptions: The activity decrease at Finarvedi Cremona steel plant, in conjunction with overall market pessimism, raises concerns about potential supply adjustments in hot-rolled coil and galvanized products.

- Recommended Procurement Actions: Given the import pressure from Indonesian HRC, as reported in “Negative sentiment persists in the European HRC steel market” and “European HRC prices keep falling”, steel buyers should:

- Negotiate aggressively with domestic suppliers, leveraging the availability of cheaper imports to drive down prices, particularly with suppliers of hot-rolled coil.

- Consider diversifying suppliers to include Indonesian sources, carefully evaluating quality and logistics costs, to mitigate potential supply disruptions from domestic producers adjusting to lower prices and weakened demand.

- Closely monitor the activity levels of Finarvedi Cremona steel plant, as further declines in activity could indicate production cuts and impact supply availability.