From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Faces Green Transition Hurdles Despite Overall Activity

ArcelorMittal’s decision to halt DRI-EAF projects in Bremen and Eisenhuttenstadt, as reported in “ArcelorMittal halts DRI-EAF projects in the EU” and “Keine Umstellung: Arcelor Mittal streicht Pläne für grünen Stahl zusammen,” raises concerns about Germany’s green steel transition. While overall steel plant activity in Germany shows a positive trend, the cancellation of these projects casts a shadow on decarbonization efforts. Satellite-observed activity data does not show an immediate drop across all plants, indicating continued conventional production.

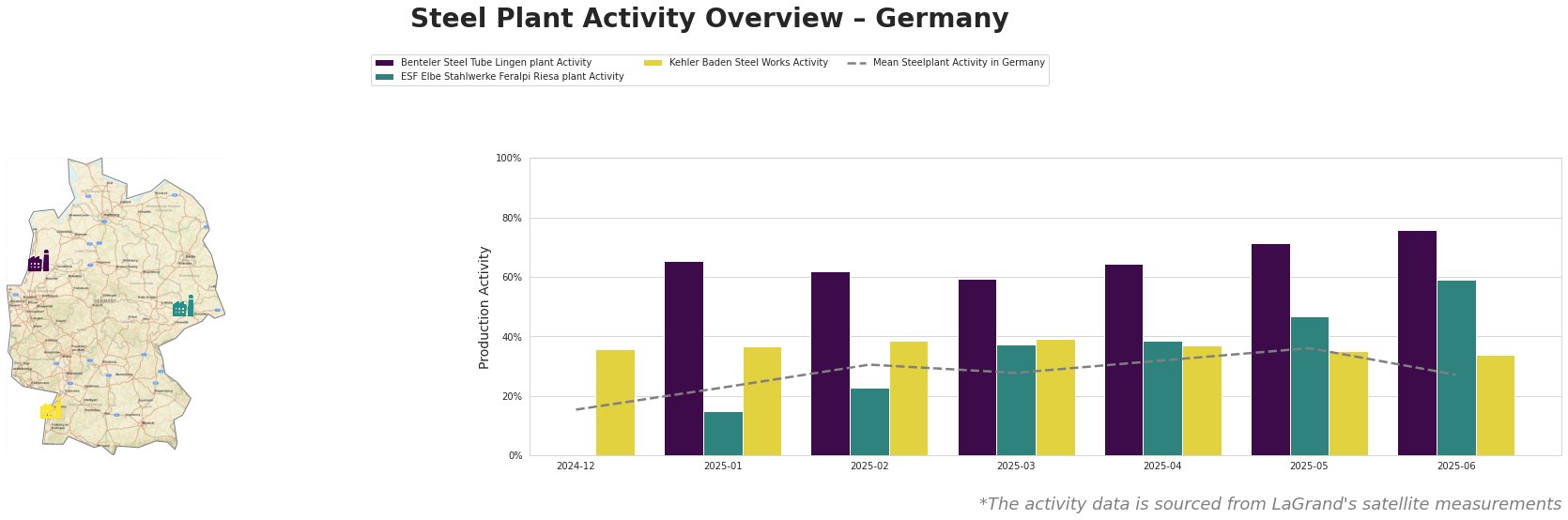

Monthly activity trends for selected steel plants in Germany are as follows:

The mean steel plant activity in Germany increased steadily from 15.0% in December 2024 to 36.0% in May 2025, before dropping to 27.0% in June 2025. Benteler Steel Tube Lingen plant shows activity well above the German mean, starting from 66.0% in January 2025 and climbing to 76.0% in June 2025. The ESF Elbe Stahlwerke Feralpi Riesa plant shows a steady rise from 15.0% in January 2025 to 59.0% in June 2025. Kehler Baden Steel Works activity remained relatively stable in the 34.0%-39.0% range.

Steel Plant Analysis:

Benteler Steel Tube Lingen plant, located in Lower Saxony, primarily uses electric arc furnaces (EAF) for its production of semi-finished and finished rolled products, including tubes, billets, and slabs, targeting the automotive and building & infrastructure sectors. The plant’s activity level has consistently been well above the national average, reaching 76% in June 2025. There is no explicit connection between these increased production levels and the ArcelorMittal news articles.

ESF Elbe Stahlwerke Feralpi Riesa plant, located in Saxony, also relies on EAF technology to produce 1.4 million tons of crude steel annually. The plant’s products range from billets and rods to wire mesh and fencing, serving the automotive and building & infrastructure industries. The plant’s activity has increased steadily, reaching 59.0% in June 2025. This increase occurs even as ArcelorMittal cancels projects, and no direct relationship could be established.

Kehler Baden Steel Works, situated in Baden-Württemberg, utilizes EAFs to produce 2.5 million tons of crude steel per year. Its main products include wire rod, bar, rebar, and billet, predominantly for the building and infrastructure sector. The activity level has remained relatively stable, fluctuating between 34.0% and 39.0%. There is no explicit connection between these stable production levels and the ArcelorMittal news articles.

Market Implications and Recommendations:

The cancellation of ArcelorMittal’s DRI-EAF projects, while not immediately impacting overall production levels, as indicated by the satellite-observed data from other plants, signals a potential delay in the availability of “green steel” in Germany. The articles “ArcelorMittal halts DRI-EAF projects in the EU” and “Keine Umstellung: Arcelor Mittal streicht Pläne für grünen Stahl zusammen” cite unfavorable policy and market conditions, particularly high electricity prices and lack of affordable green hydrogen, as the reasons.

Recommendations for Steel Buyers and Analysts:

- Prioritize supply chain diversification: Given the uncertainty surrounding green steel projects and potential future carbon regulations cited in “ArcelorMittal halts DRI-EAF projects in the EU“, steel buyers should diversify their supply chains to mitigate risks associated with potential supply disruptions or price volatility.

- Monitor energy policy developments: The cited articles highlight the impact of energy prices on the economic viability of green steel production. Steel analysts and buyers should closely monitor German and EU energy policies, especially those related to renewable energy and green hydrogen production, to anticipate future cost implications and the likelihood of further project delays.

- Assess carbon border adjustment mechanism (CBAM) readiness: As ArcelorMittal urges the EU to accelerate carbon border adjustment mechanisms, steel buyers need to prepare for the potential impact of CBAM on import costs, particularly from regions with less stringent environmental regulations. Conduct thorough carbon footprint assessments of your existing supply chains.

- Focus on EAF-based steel: While DRI-EAF projects are delayed, plants using electric arc furnaces such as Benteler Steel Tube Lingen plant, ESF Elbe Stahlwerke Feralpi Riesa plant and Kehler Baden Steel Works are continuing to operate at consistent or higher levels. Procurement efforts towards these plants are recommended, as these are less reliant on hydrogen availability.