From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Safeguard Measures Boost Domestic Production; US-UK Trade Tensions Persist

India’s steel sector shows strong domestic growth due to import restrictions, while trade tensions between the US and UK create uncertainty. The news article “India may halve steel imports in 2025 due to safeguard measures” reports on potential import reductions due to protective measures, which appears to correlate with increased activity observed at the JSPL Jharkhand steel plant. However, no direct links could be established between the remaining news articles and plant-level activity data.

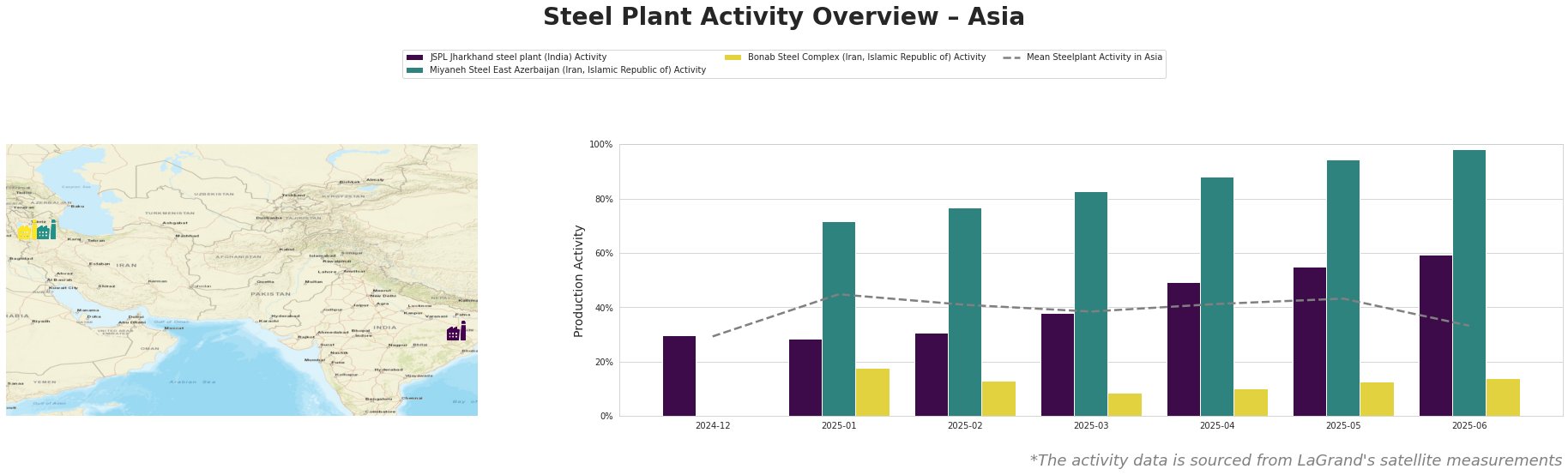

Here’s a summary of measured activity, in percent, with monthly aggregations:

The mean steel plant activity across Asia shows volatility, peaking at 45% in January 2025 and then generally trending downward to 33% in June 2025. JSPL Jharkhand consistently shows activity levels above the Asian mean after February. Conversely, both Miyaneh Steel and Bonab Steel Complex demonstrate activity levels significantly above the mean, particularly in the last few months.

JSPL Jharkhand steel plant, located in Jharkhand, India, possesses a 1600 ttpa capacity for crude steel production using Electric Arc Furnaces (EAF). It mainly produces semi-finished products like wire rods and bars. The plant’s activity increased steadily from 30% in December 2024 to 59% in June 2025. This rise in activity could be correlated with the news “India may halve steel imports in 2025 due to safeguard measures“, as domestic producers like JSPL may be increasing output to meet local demand amid reduced imports.

Miyaneh Steel East Azerbaijan, in Iran, has an 800 ttpa crude steel capacity, utilizing both DRI and EAF technologies in an integrated process. Activity levels are very high, rising from 72% in January 2025 to 98% in June 2025. No direct connection to the provided news articles could be established.

Bonab Steel Complex, also in East Azerbaijan, Iran, has a 1400 ttpa crude steel capacity utilizing EAF technology. Activity is significantly lower than Miyaneh Steel. The complex saw a slight decrease in activity through March 2025, but has slowly climbed back since then. No direct connection to the provided news articles could be established.

Evaluated Market Implications:

The news “India may halve steel imports in 2025 due to safeguard measures“, combined with increased activity at JSPL Jharkhand, suggests a shift towards domestic steel production in India.

- Potential Supply Disruptions: Reduced steel imports into India could lead to supply constraints and potentially higher prices for certain steel products, particularly flat-rolled products subject to safeguard duties.

- Recommended Procurement Actions: Steel buyers sourcing for the Indian market should proactively engage with domestic producers like JSPL to secure supply agreements and mitigate potential import-related disruptions. Closely monitor the DGTR’s investigation into safeguard duties, due in August, as any increase beyond 12% will further impact import costs.

The ongoing US-UK trade negotiations create uncertainty, especially for British steel exporters. News articles such as “Tata Steel plant complicates UK-US steel talks – The Guardian“, “Trump lowered some duties for Britain, but not on steel imports-BBC“, “British steel exports may lose the American market“, and “US to implement tariff-rate quotas for some UK steel products” highlight the risk of continued tariffs on UK steel. Since there is no plant specific activity data, no actionable recommendations can be made.