From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Braces for Disruption as Iran Conflict Looms; Plant Activity Mixed

Asia’s steel market faces growing uncertainty due to escalating tensions in the Middle East, particularly between Israel and Iran. The news articles “LPG prices jump as Israel-Iran conflict risks trade“, “Trump wants Iran’s ‘unconditional surrender’: Update“, “Market risks grow as Trump threatens Iran: Update“, “Trump talk of Iran attacks spreads market risks“, “Flaring Iran nuclear crisis provides first major test for pivotal Trump trio“, “Trump sets two-week deadline for US attack on Iran” and “Israel to undermine Iran regime after hospital hit” highlight the potential for supply chain disruptions and increased costs. While these articles suggest a broad impact, a direct connection between these geopolitical events and immediate changes in steel plant activity levels cannot be explicitly established from the provided data at this time.

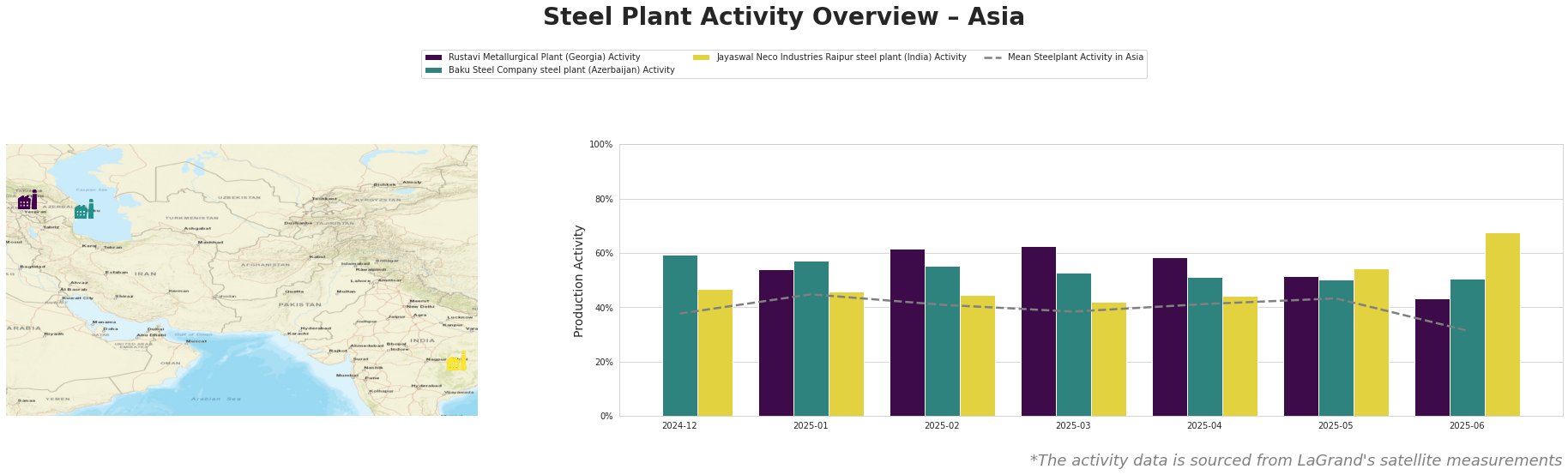

Across Asia, the mean steel plant activity has shown a declining trend in June, dropping significantly to 31.0% after a period of relative stability.

The Rustavi Metallurgical Plant, an integrated (BF) steel plant in Georgia with a crude steel capacity of 120 ttpa, experienced a notable decrease in activity, from 52% in May to 43% in June. This decline occurred during a period of heightened geopolitical risk as outlined in the news articles. Although the plant is geographically distant from the immediate conflict zone, the “LPG prices jump as Israel-Iran conflict risks trade” article suggests potential disruption to energy supplies, which may indirectly impact production at energy-intensive facilities like Rustavi, which operates a captive power plant.

The Baku Steel Company, an electric arc furnace (EAF) steel plant in Azerbaijan with a crude steel capacity of 1000 ttpa, maintained a steady activity level of 50% in June. Its activity level closely aligns with the regional mean. While the plant’s location in the Caucasus region places it geographically closer to the Middle East tensions than other monitored facilities, its reliance on EAF technology and scrap may buffer it from immediate energy market volatility described in the news articles; however, no explicit connection to the news articles can be confirmed from the data.

Jayaswal Neco Industries Raipur steel plant, an integrated (BF and DRI) steel plant in India with a crude steel capacity of 1200 ttpa, saw a significant increase in activity, rising from 54% in May to 68% in June. This is in contrast to the overall negative trend in the region. Given India’s geographic distance from the immediate conflict and its diversified supply chains, the plant’s activity surge may reflect a strategic move to capitalize on potential supply disruptions elsewhere. However, with the available information, it is impossible to establish a direct connection between this observed rise in activity and the named news articles.

Given the current geopolitical climate and observed activity shifts, the following procurement actions are recommended:

- For steel buyers relying on Rustavi Metallurgical Plant: Diversify your supply base to mitigate potential production shortfalls due to energy market instability, as suggested by the declining activity levels and broader market uncertainty detailed in the news articles. Secure alternative sources promptly.

- For market analysts: Closely monitor freight rates and insurance costs related to steel shipments from the Middle East and surrounding regions. The news articles “Market risks grow as Trump threatens Iran: Update” and “Trump talk of Iran attacks spreads market risks” highlight the potential for increased shipping costs, which could impact the overall cost of steel.

- For buyers in Asia: Monitor Indian steel production and export levels. The increased activity at Jayaswal Neco Industries Raipur steel plant could indicate a growing role for Indian steel in the region, especially if other supply sources are disrupted.

These recommendations are based on explicitly observed activity data and the potential implications outlined in the provided news articles. Ongoing monitoring of the situation is crucial for informed decision-making.