From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Remains Strong Amidst UK-US Trade Tensions: Plant Activity Varies

Asia’s steel market demonstrates continued strength amidst UK-US trade negotiations impacting global steel dynamics. The news articles “Tata Steel plant complicates UK-US steel talks – The Guardian,” “Trump lowered some duties for Britain, but not on steel imports-BBC,” and “British steel exports may lose the American market” highlight ongoing concerns regarding steel tariffs and their potential effects on international trade flows; however, no direct correlation to observed activity changes in Asian steel plants can be explicitly established based on the provided data.

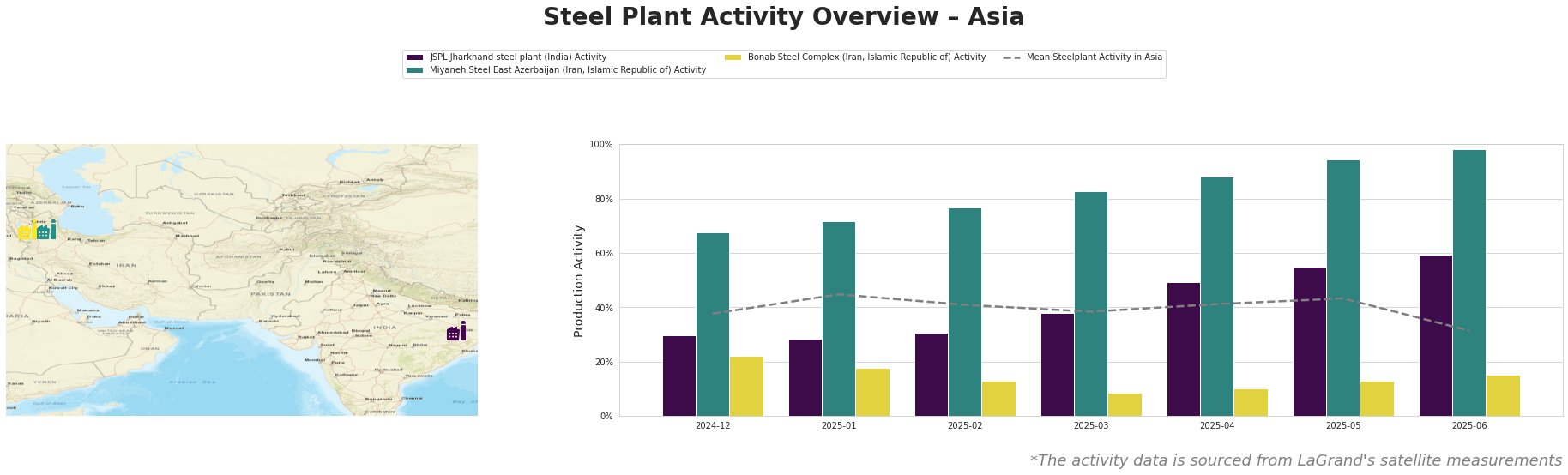

The Mean Steelplant Activity in Asia fluctuated between 38% and 45% from December 2024 to May 2025, ending at 31% in June 2025. JSPL Jharkhand saw a steady increase in activity from 30% in December 2024 to 59% in June 2025. Miyaneh Steel East Azerbaijan showed consistently high activity, increasing from 68% in December 2024 to 98% in June 2025. Bonab Steel Complex exhibited lower activity levels, generally below the Asian mean, fluctuating between 9% and 22% during the observed period, ending the period at 15%. No direct connection could be established between the news articles regarding UK-US steel trade and the observed steel plant activity levels based on the provided information.

JSPL Jharkhand, located in Jharkhand, India, is an EAF-based steel plant with a crude steel capacity of 1.6 million tonnes, specializing in semi-finished products like wire rod and bars. The plant’s activity has steadily increased, rising from 30% in December 2024 to 59% in June 2025, surpassing the mean activity in Asia. This upward trend indicates a potential for increased production capacity and availability of JSPL’s specific product lines, independent of the news surrounding UK/US trade policy.

Miyaneh Steel East Azerbaijan, located in Iran, is an integrated DRI-EAF steel plant with a crude steel capacity of 800,000 tonnes. Its activity levels have been consistently high and increasing, reaching 98% in June 2025. This suggests a strong operational performance and potentially tightening supply within its specific regional market. The plant utilizes DRI (Direct Reduced Iron) technology, giving it a unique position compared to plants relying solely on EAF or BOF. There is no observable link between the performance of Miyaneh Steel and the UK/US Trade negotiations at this time.

Bonab Steel Complex, also located in East Azerbaijan, Iran, utilizes EAF technology to produce 1.4 million tonnes of crude steel. Activity has remained substantially below average for the period, peaking at 22% in December 2024 and falling to 15% in June 2025. No explicit connection can be established between this lower performance and the named news articles.

The sustained high activity at Miyaneh Steel East Azerbaijan (98% in June 2025) coupled with the drop in mean Asian activity (31% in June 2025) suggests possible supply constraints emerging in specific product categories from the Iranian market. For steel buyers focused on securing materials typically supplied by JSPL Jharkhand, the increased plant activity (59% in June 2025) suggests a potentially stable supply base, making them a reliable option. Buyers should monitor JSPL Jharkhand’s output of wire rod and bar, and consider strengthening relationships to secure supply in the face of broader global trade uncertainties. Given the diverging activity trends, steel buyers should diversify their procurement strategies, avoiding over-reliance on specific plants or regions and monitoring alternative supply options.