From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth Amidst Nippon Steel’s US Acquisition Approval: Plant Activity Shows Positive Trends

Asia’s steel market exhibits a very positive sentiment driven by global consolidation and steady regional production. Activity levels at key Asian steel plants show a general uptrend. However, no direct relationships between observed plant activity levels and news articles such as “Trump approves Nippon Steel’s acquisition of USS“, “Trump Approves Nippon Steel’s US$14.9 Billion Purchase of U. S. Steel“, and “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel” can be established.

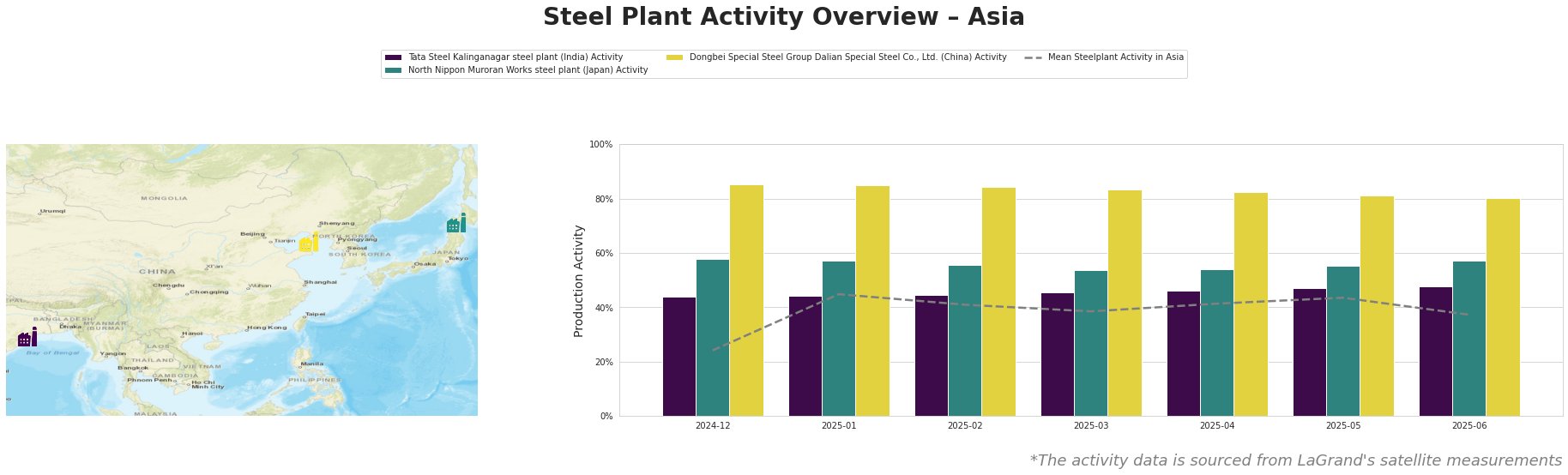

The mean steel plant activity in Asia increased significantly from 24.0% in December 2024 to 45.0% in January 2025, then experienced a decline to 37.0% by June 2025.

Tata Steel’s Kalinganagar plant in India, an integrated BF-BOF facility with a 3 million tonne crude steel capacity mainly serving the automotive sector, showed a consistent increase in activity from 44.0% in December 2024 to 48.0% in June 2025, consistently operating above the Asian average. No direct connection could be established between this trend and the news articles regarding Nippon Steel’s acquisition of US Steel.

The North Nippon Muroran Works in Japan, an integrated BF-BOF-EAF plant with a 2.598 million tonne crude steel capacity producing semi-finished and finished rolled products for the automotive sector, exhibited relatively stable activity levels, fluctuating between 54.0% and 58.0%. It ended June 2025 at 57.0%. Throughout the observed period, its activity remained significantly above the Asian average. No direct connection could be established between this trend and the news articles regarding Nippon Steel’s acquisition of US Steel.

Dongbei Special Steel Group Dalian Special Steel Co., Ltd. in China, an integrated BF-BOF-EAF plant with a 1.54 million tonne crude steel capacity producing finished rolled products including stainless steel and automotive steel, demonstrated the highest activity levels among the observed plants, starting at 85.0% in December 2024 and gradually decreasing to 80.0% by June 2025. The plant’s activity remained significantly above the Asian average throughout the period. No direct connection could be established between this trend and the news articles regarding Nippon Steel’s acquisition of US Steel.

Evaluated Market Implications:

While the news articles “Trump approves Nippon Steel’s acquisition of USS“, “Trump Approves Nippon Steel’s US$14.9 Billion Purchase of U. S. Steel“, and “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel” detail a significant shift in the global steel landscape, and the steady performance of the observed Asian steel plants point toward stable regional output, no explicit connections can be established between those two factors with the data at hand.

Recommended Procurement Actions:

Given the stable activity levels in key Asian plants and the news-driven expectations of increased investment in US steel, procurement professionals should:

- Maintain existing supply relationships within Asia: The consistently high activity at Dongbei Special Steel and the increasing activity at Tata Steel Kalinganagar indicate reliable supply from these sources. Procurement managers should solidify contracts to capitalize on this stability.

- Carefully assess potential cost shifts: Monitor global steel price trends closely, particularly in regions affected by Nippon Steel’s acquisition of US Steel.