From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market Shows Mixed Signals Amid Climate Policy Uncertainty

South America’s steel market presents a mixed picture. Recent activity levels at key steel plants show some decline, while climate policy debates add uncertainty. The UN climate talks in Bonn, delayed by agenda disagreements as reported in “UN Bonn climate talks delayed by agenda disagreements,” underscore the complexities of balancing economic development with environmental goals, potentially impacting the steel industry through mechanisms like the EU’s CBAM. The Brazilian oil auction, highlighted in “Climate groups on alert for Brazil oil auction,” illustrates the ongoing tension between fossil fuel exploitation and climate commitments, which could indirectly affect steel demand in the energy sector. No direct relationship between these news articles and observed steel plant activity levels can be explicitly established.

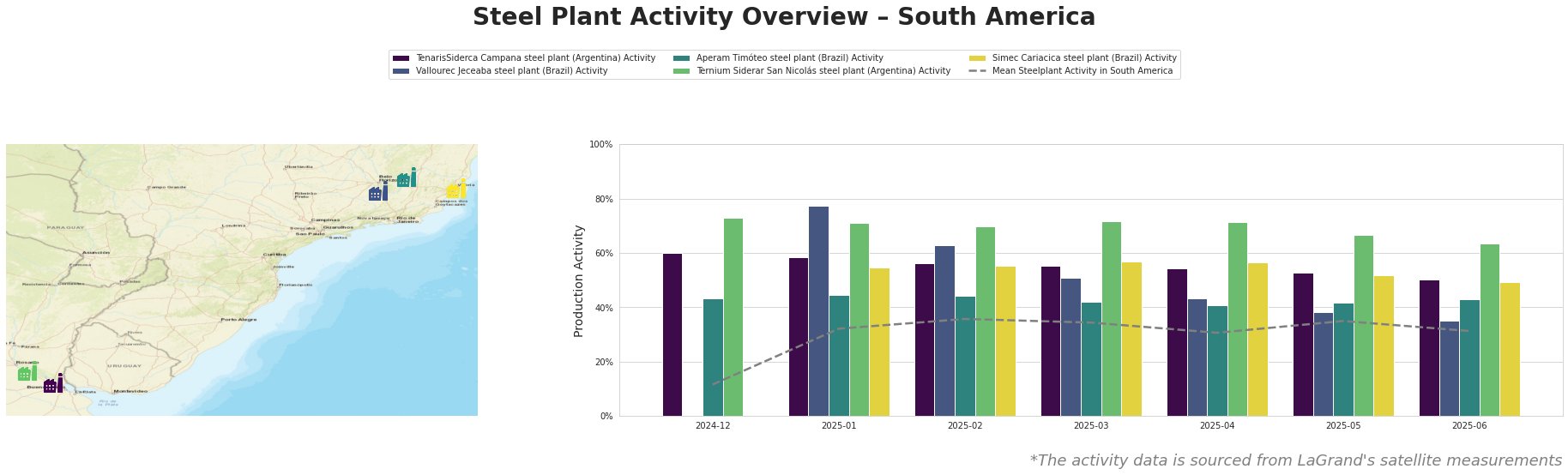

The average steel plant activity in South America was at its highest in February 2025 at 36% and dipped to 31% in June 2025.

TenarisSiderca Campana steel plant (Argentina), a DRI-EAF based plant producing seamless steel pipes primarily for the energy sector, has shown a steady decline in activity from 60% in December 2024 to 50% in June 2025, consistently operating above the South American mean activity level. No direct connection between this decline and the provided news articles can be established.

Vallourec Jeceaba steel plant (Brazil), an integrated BF-EAF plant focusing on seamless steel pipes for the energy sector, experienced a significant decrease in activity from 78% in January 2025 to 35% in June 2025. This plant’s activity dropped significantly below the South American average in June. No direct connection between this decline and the provided news articles can be established.

Aperam Timóteo steel plant (Brazil), an integrated BF-BOF/EAF plant producing stainless and special carbon steels, has maintained a relatively stable activity level, fluctuating between 41% and 44%, slightly above the South American mean. The plant uses charcoal (biomass) as a substitute for coke. No direct connection between its stable activity and the provided news articles can be established.

Ternium Siderar San Nicolás steel plant (Argentina), an integrated BF-BOF plant producing slabs, hot-rolled, and cold-rolled coils, consistently operated well above the South American average. However, its activity decreased from 73% in December 2024 to 63% in June 2025. No direct connection between this decline and the provided news articles can be established.

Simec Cariacica steel plant (Brazil), an EAF-based plant producing rebar and profiles, experienced a decrease in activity from 55% in January/February 2025 to 49% in June 2025, remaining above the South American average. No direct connection between this decline and the provided news articles can be established.

Given the observed decline in activity at Vallourec Jeceaba steel plant and the ongoing debates surrounding climate policy as highlighted in “Climate groups on alert for Brazil oil auction” and “UN Bonn climate talks delayed by agenda disagreements“, steel buyers sourcing seamless pipes from Vallourec should consider:

- Diversifying Suppliers: Explore alternative suppliers of seamless steel pipes, particularly those operating with more stable activity levels, to mitigate potential supply disruptions. Specifically, assess the feasibility of increasing orders from TenarisSiderca and Ternium, given their relatively higher operational levels.

- Monitoring Climate Policy Impacts: Closely monitor the developments related to Brazil’s oil and gas auctions and the implementation of the EU’s CBAM, as these policies could indirectly impact the cost and availability of steel.

- Engaging with Vallourec: Initiate discussions with Vallourec to understand the reasons behind the activity decline and their plans to address it. Request transparency regarding their supply chain and potential disruptions.

- Evaluate inventory levels: Steel buyers should evaluate current inventory levels of seamless pipes and rebar, in the event of additional activity decline.