From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: Quota Adjustments & Activity Surge Signal Price Increases for Category 17 Steels

In Europe, recent adjustments to EU steel import safeguard measures, as highlighted in “EU adjusts safeguard measures for certain categories of steel” and “EU plans adjustments to safeguard measures on angles, shapes and sections,” are poised to reshape supply dynamics for category 17 steel products (angles, shapes, and sections). These policy shifts may be compounded by observed changes in plant activity levels. A direct connection between the news articles and the satellite observed activity for the Dillinger steel plant could not be established.

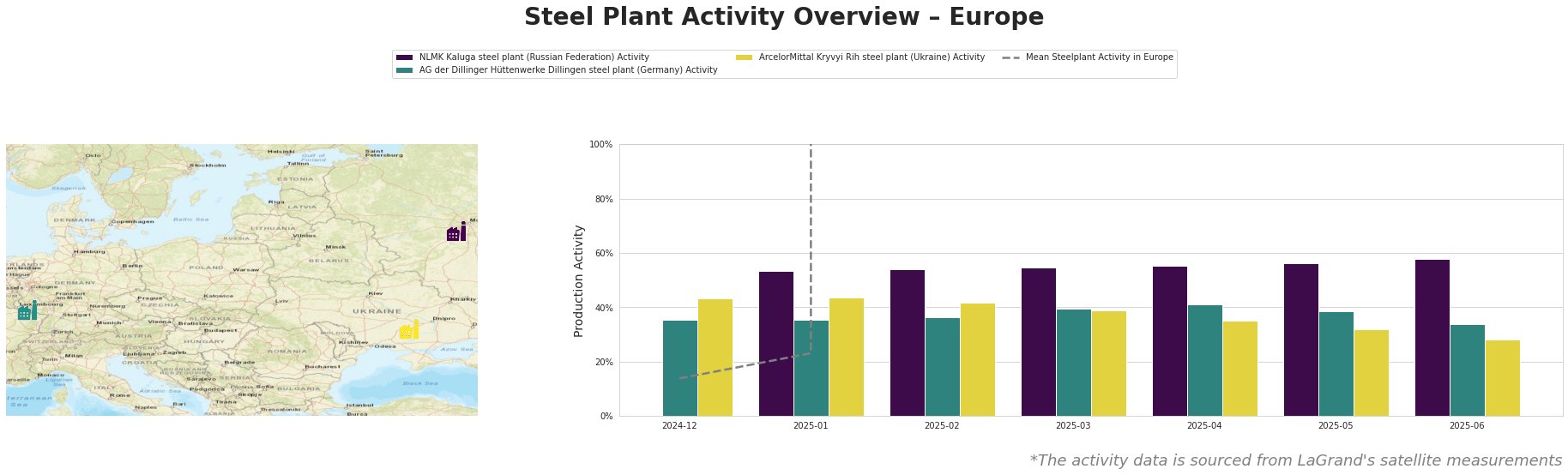

The mean steel plant activity in Europe has fluctuated significantly in early 2025, demonstrating a continuous growth trend until May-2025 and then a clear drop in June-2025.

NLMK Kaluga, a Russian EAF steel plant with 1.5 million tonnes crude steel capacity producing billets, rebar, channels and angles, has exhibited a steady increase in activity, rising from 53% in January 2025 to 58% in June 2025. No direct link between the news articles and the activity levels of the NLMK steel plant could be established.

AG der Dillinger Hüttenwerke, a German integrated steel plant with 2.76 million tonnes crude steel capacity, mainly based on BOF, primarily producing heavy-plate products, showed relative stability followed by a decline, with activity decreasing from 41% in April 2025 to 34% in June 2025.

ArcelorMittal Kryvyi Rih, a Ukrainian integrated steel plant with 8 million tonnes crude steel capacity, producing billets, rebar, and sections, experienced a consistent decline in activity, dropping from 44% in January 2025 to 28% in June 2025. No direct link between the news articles and the activity levels of the ArcelorMittal steel plant could be established.

Evaluated Market Implications

The EU’s reintroduction of country-specific quotas for category 17 steel from Turkey, the UK, and Korea, as detailed in “The EU plans to re-introduce country quotas for certain types of steel products“, coupled with the observed activity drop at ArcelorMittal Kryvyi Rih, indicates potential supply constraints and price increases for these products. Although the Dillinger activity also decreased and no direct link between the news and the activity levels for this plant was established, it is still a strong signal to be even more cautious.

Recommended Procurement Actions:

Given the impending changes to import quotas effective July 1, 2025, steel buyers should:

- Secure category 17 steel volumes: Immediately assess Q3 and Q4 2025 needs for angles, shapes, and sections. Given the quota restrictions for Turkey, the UK, and Korea, secure orders with these suppliers now to maximize access to their allocated quotas.

- Diversify sourcing: Actively explore alternative suppliers outside of the quota-restricted countries, particularly if relying heavily on Turkish, UK, or Korean sources for category 17 products.

- Monitor closely: Track the actual import volumes from the UK, Turkey, and Korea against their respective quotas to anticipate potential supply shortfalls and adjust procurement strategies accordingly.

These measures are designed to help steel buyers and analysts navigate the evolving European steel market landscape and mitigate potential risks associated with policy changes and observed production trends.