From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Booming: Modernizations Fuel Optimism Amidst Activity Shifts

Asia’s steel market shows strong signs of growth, driven by strategic modernizations across key producers. The upgrades at Jindal Shadeed, as reported in “Oman’s Jindal Shadeed upgrades steel plant for construction market,” aim to meet increased construction demand, although we see no direct link between this upgrade and the observed plant activity levels. Similarly, “Japan’s Godo Steel contracts Danieli for bar mill modernization” indicates long-term investment in enhanced productivity, although no relationship to current activity can be established. In China, “Zhongshou and Primetals Technologies Reach Major Project Milestone” demonstrates rapid progress in advanced steel production, but there is no clear connection to activity levels.

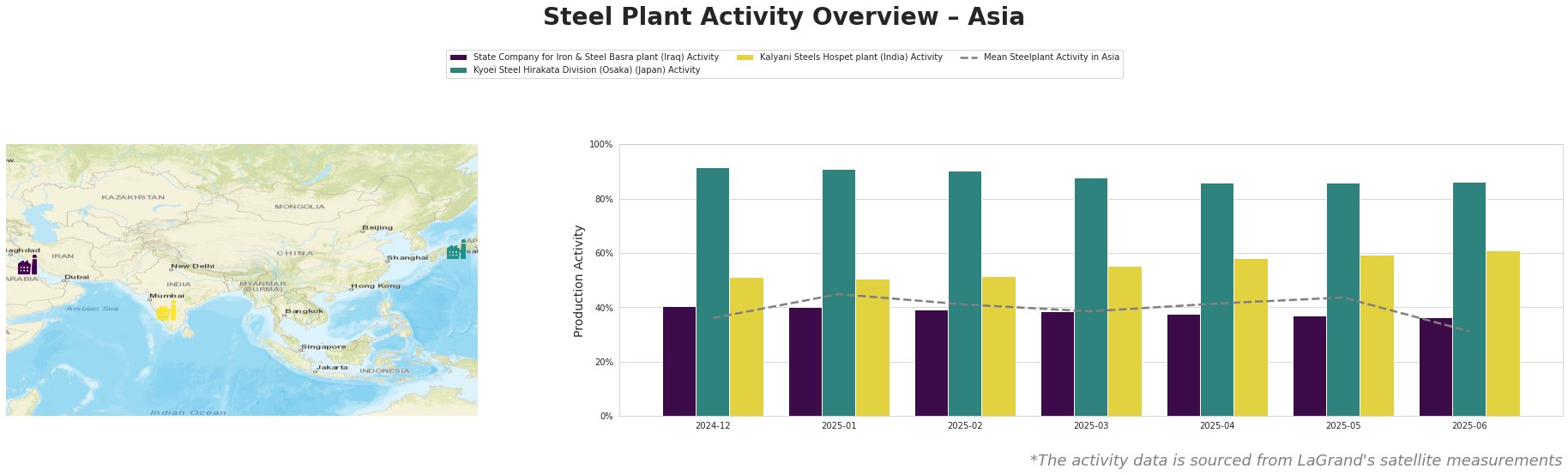

The mean steel plant activity in Asia shows volatility, peaking at 45% in January 2025, before dropping significantly to 31% in June 2025.

State Company for Iron & Steel Basra plant: This Iraqi plant, with a 500,000 TPA EAF-based capacity focused on semi-finished billets, shows relatively stable activity. Starting at 41% in December 2024, it experienced a slight decline to 36% by June 2025. While this plant possesses ResponsibleSteel Certification, recent upgrades at other regional plants, as highlighted in “Oman’s Jindal Shadeed upgrades steel plant for construction market“, may put pressure on its competitiveness.

Kyoei Steel Hirakata Division (Osaka): This Japanese EAF-based plant, producing 805,000 TPA of finished rolled products like deformed bars for the construction sector, consistently operates at high activity levels. Starting at 92% in December 2024, it experienced a minor drop to 86% in June 2025, but it remains substantially above the Asian average. The news that “Japan’s Godo Steel contracts Danieli for bar mill modernization” suggests a broader trend in Japan towards upgrading facilities. Kyoei steel might face increased competition in the future because of these upgrades.

Kalyani Steels Hospet plant: This Indian plant, boasting an integrated BF/DRI operation with 860,000 TPA crude steel capacity, has shown steady growth in activity. Starting at 51% in December 2024, it climbed to 61% by June 2025, indicating increased production of its diverse product range, including rolled bars for the automotive and construction sectors. There is no explicitly named news article about Kalyani Steels to which these activity increases can be directly linked.

Given the planned upgrades across Asia and the overall positive sentiment, steel buyers should secure long-term contracts with diversified suppliers to mitigate potential short-term supply disruptions arising from modernization downtimes, such as the Godo Steel upgrade (“Japan’s Godo Steel contracts Danieli for bar mill modernization“). Steel analysts should monitor closely the execution of Zhongshou’s new Arvedi ESP line (“Zhongshou and Primetals Technologies Reach Major Project Milestone“), as its successful launch could significantly impact the availability of high-strength steel coils, and influence pricing strategy. The potential competition from modernized plants in Oman (see “Oman’s Jindal Shadeed upgrades steel plant for construction market“) should be closely monitored, especially for semi-finished steel products and billets.