From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Under Pressure: US Tariff Uncertainty and Chinese Plant Slowdowns

In Asia, steel market sentiment is negative amid ongoing uncertainty surrounding US tariffs and a significant drop in Chinese steel plant activity in June. The legal battles over US tariffs, detailed in news articles like “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?” and “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?,” create trade uncertainty, potentially impacting Asian steel exports. While a direct link between these trade policy developments and steel plant activity can not be established from the given data, the coincident timing suggests a possible influence.

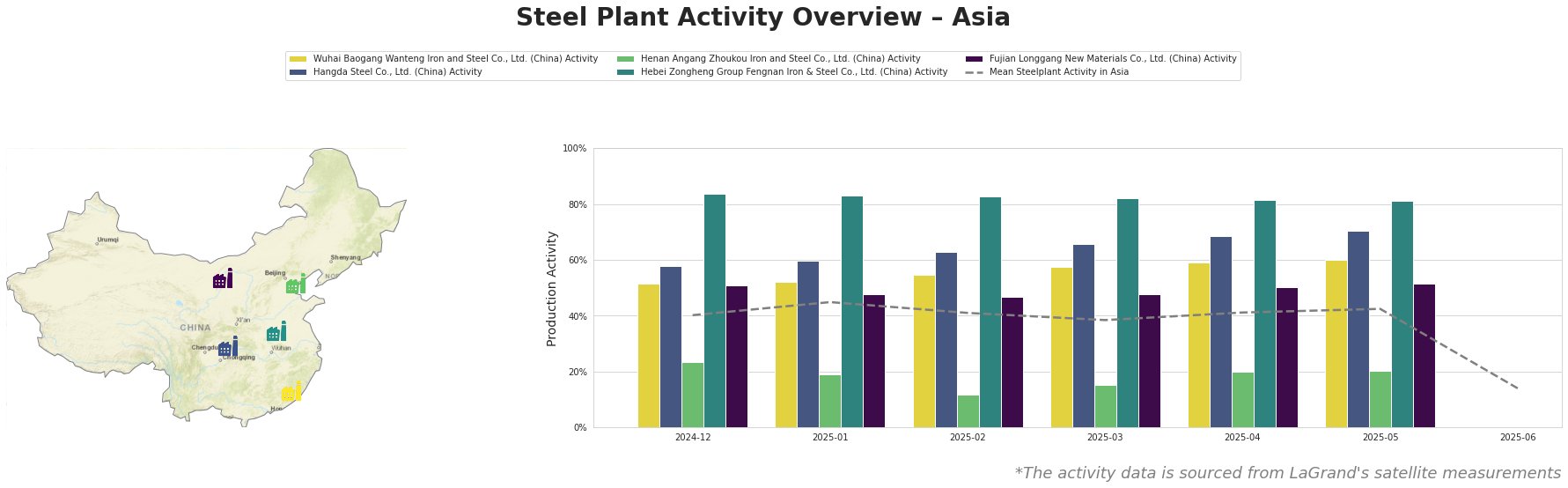

The average steel plant activity in Asia remained relatively stable between December 2024 and May 2025, fluctuating between 38% and 45%. However, there was a sharp decline in June 2025, dropping to 14%. This significant downturn suggests a widespread reduction in steel production across the region.

Plant Information:

Wuhai Baogang Wanteng Iron and Steel Co., Ltd. (Inner Mongolia), an integrated steel plant utilizing BF and BOF technologies with a crude steel capacity of 2000 ttpa, showed consistent activity growth from 52% in December 2024 to 60% in May 2025. No activity data is available for June 2025. While the plant has ResponsibleSteel Certification, there is no direct link to the trade-related news articles.

Hangda Steel Co., Ltd. (Sichuan), an electric steel plant with a 1000 ttpa crude steel capacity utilizing EAF technology, exhibited a continuous increase in activity from 58% in December 2024 to 70% in May 2025. No activity data is available for June 2025. Like Wuhai Baogang Wanteng, Hangda Steel also has ResponsibleSteel Certification, but its activity does not directly correlate to the US tariff news.

Henan Angang Zhoukou Iron and Steel Co., Ltd. (Henan), an integrated BF/BOF steel plant with a crude steel capacity of 1750 ttpa, experienced fluctuating activity levels, ranging from a low of 12% in February 2025 to a high of 24% in December 2024. In May 2025, the activity level was at 20%. No activity data is available for June 2025. The plant holds ResponsibleSteel Certification. There is no established connection between the observed activity trends and the cited news regarding US tariffs.

Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd. (Hebei), a major integrated steel producer with a crude steel capacity of 7700 ttpa using BF and BOF, displayed a consistently high activity level, hovering around 81-84% between December 2024 and May 2025. Activity slightly declined to 81% in May. No activity data is available for June 2025. The plant also has ResponsibleSteel Certification. There is no clear connection between this plant’s high and stable activity and the discussed US tariff situation.

Fujian Longgang New Materials Co., Ltd. (Fujian), an integrated steel plant employing BF/BOF technology with a crude steel capacity of 1210 ttpa, showed a steady increase in activity from 51% in December 2024 to 52% in May 2025. No activity data is available for June 2025. The plant is ResponsibleSteel Certified, but no direct relationship to the tariff news can be established.

Evaluated Market Implications:

The sharp drop in the average steel plant activity in Asia in June 2025, combined with the trade uncertainty stemming from the US tariff legal battles (described in articles such as “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik“), suggests potential supply disruptions in the short term. While individual plant activity before June did not reflect the impact of the tariff news, the overall downturn implies a potential market response to the ongoing situation.

Recommended Procurement Actions:

Given the uncertainty and the observed drop in production:

* Steel buyers should closely monitor the legal developments surrounding US tariffs, particularly the potential for reimposition of tariffs as discussed in “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?“.

* Buyers relying on steel from the broader Asian market should diversify their sourcing and consider securing supply from plants with demonstrated stable activity levels (e.g. Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd before June).

* Market analysts should prioritize gathering more granular regional production data to assess the specific impact of the US tariff situation on different Asian steel-producing regions.** The lack of June data for individual plants limits deeper conclusions.