From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic Amid Indonesian Infrastructure Push and Plant Activity Shifts

Asia’s steel market sentiment remains positive, influenced by Indonesian government initiatives and observed activity changes in key steel plants. Increased power capacity, as reported in “Indonesia to add 69.5GW of power capacity over 2025-34“, signals a likely boost in demand for construction steel. This potentially correlates with general activity levels at the Sansteel Minguang Co., Ltd. Fujian plant which produces construction steel and where activity remains relatively consistent. However, no direct causal relationship can be established.

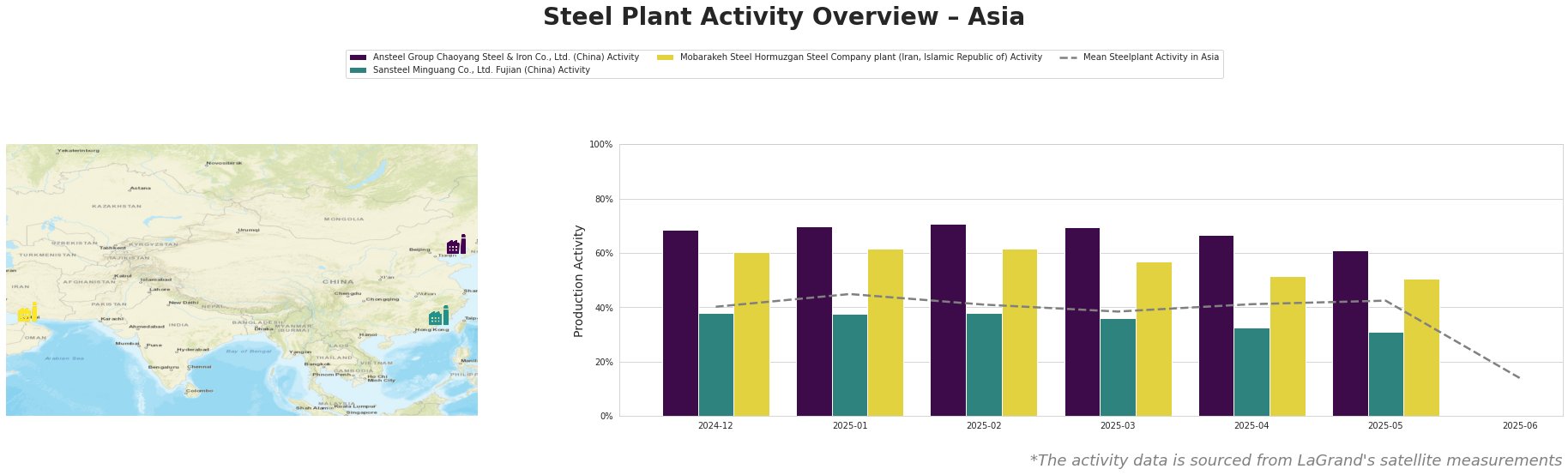

The mean steel plant activity in Asia demonstrates a significant drop in June 2025, falling to 14.0%. Before this sharp decline the mean activity fluctuates between 38.0% and 45.0% from December 2024 to May 2025. Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated above the average, with a high of 71.0% in February 2025, but experienced a notable decrease to 61.0% in May 2025. Sansteel Minguang Co., Ltd. showed a gradual decline from 38.0% to 31.0% over the same period. Mobarakeh Steel Hormuzgan Steel Company plant also showed a downward trend, decreasing from 62.0% in February 2025 to 50.0% in May 2025.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, China, primarily uses Basic Oxygen Furnace (BOF) technology with a crude steel capacity of 2.1 million tonnes per annum (ttpa). Satellite data indicates a decrease in activity from a high of 71.0% in February 2025 to 61.0% in May 2025. The subsequent overall drop in mean activity in Asia in June to just 14% could indicate some coordinated shut-down in the Chinese Steel industry as the overall value is dramatically affected by the lack of activity from this key Asian steel producer. No direct link can be established between this activity drop and the provided news articles.

Sansteel Minguang Co., Ltd., based in Fujian, China, also utilizes integrated BF-BOF process with a crude steel capacity of 6.8 million ttpa, producing mainly steel plates, round bars, and construction steel. The plant’s activity shows a gradual decline from 38.0% at the end of 2024 to 31.0% in May 2025. While “Indonesia to add 69.5GW of power capacity over 2025-34” projects increased demand for construction steel, potentially impacting Sansteel Minguang, current activity levels do not reflect this. No direct connection could be established between this activity decline and the provided news articles, though potential future alignment is foreseeable.

Mobarakeh Steel Hormuzgan Steel Company plant, located in Hormuzgan, Iran, uses DRI and EAF technology to produce 1.5 million ttpa of crude steel, focusing on hot-rolled, cold-rolled, and slabs. The plant’s activity decreased from 62.0% in February 2025 to 50.0% in May 2025. No direct relationship can be established between this change in steel plant activity and any of the recent news articles.

The Indonesian government’s focus on critical minerals, as highlighted in “Fastmarkets partners with Indonesian government to showcase $618 billion critical minerals roadmap to support 2040 vision for global leadership in EV batteries, steel, & solar“, suggests a long-term investment in steel production, though immediate impacts on observed plant activity are not evident. The Indonesian government drive to secure the supply chain of raw materials as noted in “Indonesian government pushes for US fuel imports“, indicates that there will be future demand for construction steel and finished steel.

Evaluated Market Implications:

The sharp drop in overall Asian steel plant activity in June 2025, coupled with the observed declines in activity at Ansteel Group Chaoyang Steel & Iron Co., Ltd., Sansteel Minguang Co., Ltd., and Mobarakeh Steel Hormuzgan Steel Company plant and the general increased future demand, could indicate a potential supply disruption in the near term.

Recommended Procurement Actions:

- Steel buyers focusing on Chinese steel plate and pipe should closely monitor Ansteel Group Chaoyang Steel & Iron Co., Ltd. production levels and consider diversifying suppliers to mitigate potential short-term supply risks if June’s activity of 14% is sustained.

- Given Indonesia’s ambitious infrastructure plans as outlined in “Indonesia to add 69.5GW of power capacity over 2025-34“, buyers should anticipate increased demand for construction steel from Sansteel Minguang Co., Ltd. in the medium to long term. Proactive procurement strategies and securing contracts might be beneficial.

- Buyers should monitor the impact of “Indonesian government pushes for US fuel imports” on infrastructure developments, which could further stimulate steel demand, especially for construction and energy-related projects.