From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Headwinds: Weak Demand and Potential Supply Adjustments

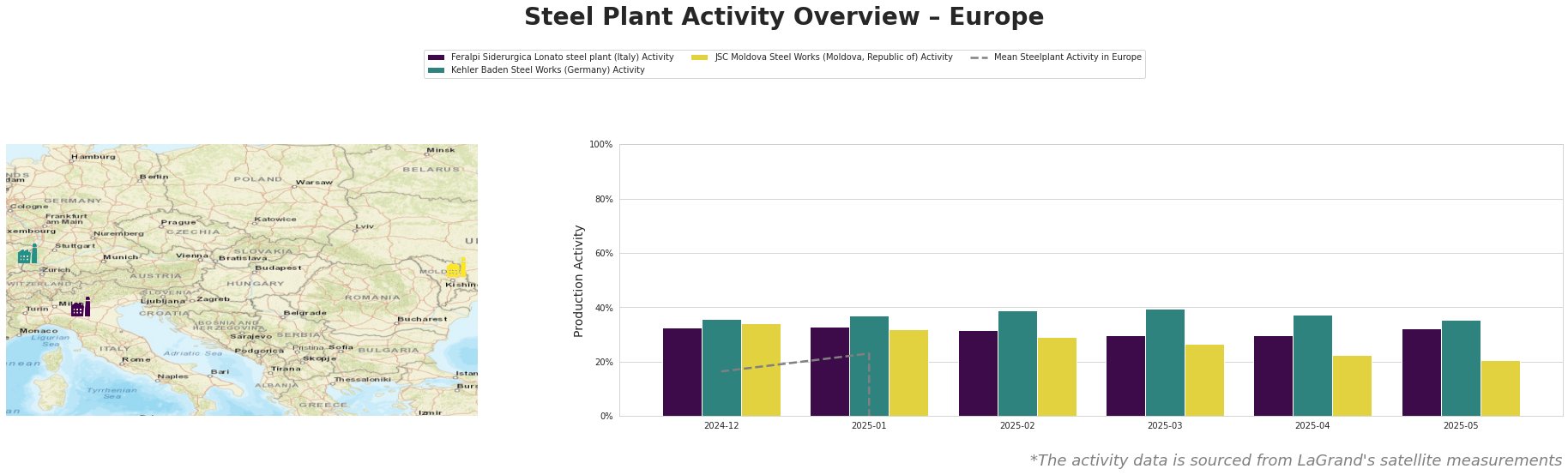

Europe’s steel market is facing downward pressure due to weak demand across multiple regions, coupled with concerns about import quotas, as highlighted in “European long steel market steady amid weak demand, quota caution“. Satellite data reveals fluctuating activity levels at key steel plants, suggesting potential supply adjustments.

Observed activity changes at specific steel plants, as well as broader market trends, are possibly related, but no direct connections can be established based on the news articles provided.

The Mean Steelplant Activity in Europe show an abnormality and cannot be used for market analysis.

The Feralpi Siderurgica Lonato steel plant (Italy), an EAF-based producer of 1.1 million tonnes of crude steel annually, primarily focused on rebar and wire rod, demonstrated a relatively stable activity level between 30% and 33% throughout the observed period. This stability does not directly correlate with the downward trend in Italian rebar prices reported in “European longs markets continue to follow diverse trends,” as that article focuses on price pressures and scrap costs, not plant output.

Kehler Baden Steel Works (Germany), with a 2.5 million tonne EAF capacity, producing wire rod and rebar, showed a decline in activity from 40% in March to 35% in May. This decrease coincides with reports of stagnant HRC prices and buyer hesitation in “European HRC mills reduce offers, but buyers hold back,” although this article focuses on HRC rather than the long steel products produced by Kehler Baden Steel Works; thus, any direct connection to plant activity is speculative.

JSC Moldova Steel Works, an EAF-based plant with a 1 million tonne capacity producing wire rod and rebar, exhibited a more pronounced activity decline, dropping from 34% in December to 21% in May. While the overall European long steel market faces weak demand as stated in “European long steel market steady amid weak demand, quota caution,” no specific news directly explains this decline in Moldova Steel Works’ activity.

The overall market sentiment is negative, exacerbated by quota concerns and weak demand. “European long steel market steady amid weak demand, quota caution” highlights that rebar prices remained steady at Eur650-660/mt delivered Germany and around Eur625-630/mt delivered Belgium.

Given the reported price drops in Poland, as mentioned in “Polish rebar price drops on slow demand; wire rod values stable on lower supply“, and potentially reduced output at Kehler Baden Steel Works and JSC Moldova Steel Works, steel buyers should:

- Carefully monitor wire rod supply dynamics: The “Polish rebar price drops on slow demand; wire rod values stable on lower supply” article indicates wire rod price stability due to reduced supply. Procurement managers should explore diversified supply options, particularly from regions unaffected by plant-specific activity declines, to mitigate potential price increases.

- Closely scrutinize import quotas: The “European long steel market steady amid weak demand, quota caution” article suggests that import volumes are low due to stricter quota allocations. Buyers should verify quota availability before committing to import orders to avoid unexpected costs or delays.